Impactful Takeaways from Far West Round Up

As is Yeske Buie tradition, the Yeske Buie Financial Planning Team once again attended the FPA Far West Roundup in Santa Cruz, California. A relaxed and intimate conference, Far West Roundup facilitates deeper, more personal discussions and allows planners to forge connections with many of the brightest minds in the profession.

Over the long weekend, the team participated in nine class sessions in addition to a powerful opening discussion. Each of the sessions sparked dialogues that continue in the Yeske Buie offices today as they offered deep insights and encouraged us to challenge our assumptions. Below, we share a summary of each discussion and highlight key takeaways from our time at Far West.

Opening Discussion

Far West began with one of our own, Dave Yeske, posing the initial opening discussion question. Asking, “What are the boundaries of our responsibilities to our clients? Is there any? Does our obligation to do what’s best for our clients trump every kind of boundary that’s out there?” The proceeding follow-up questions lead the group to a discussion about the holistic financial planning process, including a debate about the role family should play in disability planning. The consensus on this point was mixed in the room. Typically, children want what is best for their parents, however, sometimes family politics can create ugly situations for all involved. At Yeske Buie we strive to serve as a sounding block as you navigate these difficult decisions.

Breaking down the FIRE Movement: What Financial Planners Need to Know

The opening session featured a dynamic discussion on the FIRE movement and was led by Harry Sit, a financial planner and personal finance blogger. “FIRE” stands for “Financial Independence, Retire Early” and is often highlighted by flashy headlines on sites such as CNBC, MarketWatch, Mr. Money Mustache, and Reddit. Many people have misconceptions about the FIRE movement, often associating the idea with retiring before age 40 and never working another day in their lives. However, our discussion revealed that the true appeal of the FIRE movement comes from the freedom of choice. FIRE is “retirement redefined”: the decision to make a career switch rather than to cease employment entirely.

The origins of the FIRE movement are attributed to Your Money or Your Life, a book written by Vicki Robin and published in 1992. And the true value of FIRE is its ideals; the FIRE movement challenges the traditional assumptions of retirement, encouraging individuals to live purposefully and, most importantly, to have the freedom of choice.

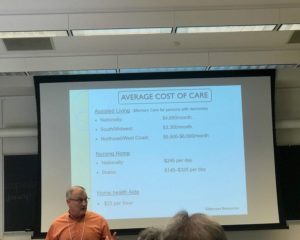

The Silver Tsunami and Diminished Capacity

After the opening night’s discussion lingered on the topic of caring for Clients with diminished capacity, Dr. McCabe’s presentation shed light on the severity of elder abuse. Approximately 50% of seniors are taking 4 or more medications, and approximately 50% of seniors age 85 or older have some form of cognitive defect, so the presence of a caregiver is very common and very much necessary. And if the idea of a trusted caregiver taking advantage of a loved one makes you uncomfortable, then you are not alone. This is a serious issue that Dr. McCabe says families do not address often enough. For this reason, Dr. McCabe urged the planners in the room to start the conversation with their Clients. One planner asked, “When should we talk about these things with Clients?” Dr. McCabe responded, “Right now!” However, Dr. McCabe warned, “If you start this conversation, you’ve got to be able to finish it.” This was a session that our team did not take lightly, as it started a conversation that will continue as long as we continue to serve our Clients.

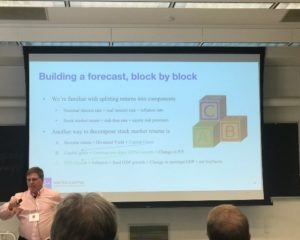

Numbers That Matter: How to Make Better Financial Plan Projections for Your Clients

As financial planners, it comes with the job description to try and “predict” on some level what future returns may be. One of the most common ways this has been done is using historical returns as a form of predictor of future results. In this session, Eric explains why that is not the best solution. He suggests that instead, forecasting should be used to predict portfolio returns. He believes this is best done through large data sets, and it’s important to understand that being “conservative” in multiple aspects of your forecast can have a large overall impact on the final projection.

After the presentation, Zach Bennedsen shared the following thoughts, “It’s interesting that capital markets assumptions are often taken for granted, yet they have a significant influence on the outcome of our planning work. This presentation was a great reminder to be purposeful about the assumptions we’re making when creating projections. That said, this also serves as a reminder on why it’s important to continually revisit the financial plan; real life is always different than the projections, so we can do our best work for Clients if we have the opportunity to course-correct along the way.”

Investing in the Zone: Tax-Advantaged Opportunity Zone Investing

The Tax Cuts and Jobs Act of 2017 brought sweeping tax reforms, simplifying the tax code in many ways while introducing new tax-advantaged strategies for consumers. One of these new strategies, Qualified Opportunity Zones, was explained by a panel consisting of John Bacigalupi and Jeff Hertz of Cantor Fitzgerald, Craig Martin of The Family Wealth Consulting Group, and Rob Keasal, tax director of Peterson Sullivan LLP. The panel introduced Opportunity Zones as an alternative real estate investment whose purpose is “to create a brighter tomorrow for communities that have been left behind.”

The investment allows investors to divert large sums of capital gains into corporations or partnerships within a Qualified Opportunity Zone and, over a period of 7 to 10 years, receive a discount on the tax owed on those realized gains. This is a complicated, high-risk private investment that would seldom be used in practice, but for the risk-seeking investor, this offers another interesting tax-advantaged option.

Utilizing Insurance in a Fee-Only Practice

Fee-only finance planners have differentiated themselves from other industry models through their fiduciary standards and their commitment to fee-only compensation. Why then however, has the insurance industry stayed in a commission only world? The Financial Planning Team learned over the weekend that this was no longer the case. Furthermore, the biggest benefit of this new insurance option is that the benefits are passed directly to the clients. Certain financial products, such as annuities, that have often been high cost are becoming solid financial planning tools through this model. While Yeske Buie does not partake in the insurance industry, this is an interesting new service line to watch in the future.

Around the World in 100 Minutes: International Estate Planning

Ray Sheffield returned to Far West this year to explain the impacts of the US estate tax laws on non-citizens. One important concept introduced by Ray was the notion of domicile. In its simplest form, domicile is where you intend to die. Interestingly, non-US citizens who do not intend to die in the US are only afforded a $60,000 estate tax exemption, as opposed to the $11.4 million afforded to US citizens. This distinction becomes critical when estate attorneys work with multigenerational families who have established roots in the United States. Ray noted that most attorneys will simply say yes when asked to do something: “They will do what the Client wants, not what the Client needs.”

He continued, “Studies show that beneficiaries who receive $500,000 or less will spend it all within 18 months. And if you receive more than that… well, it just takes you longer to spend it.” The most important takeaway from Ray’s presentation was that having the right estate plan in place – one that takes into account all relevant facts and circumstances – is crucial.

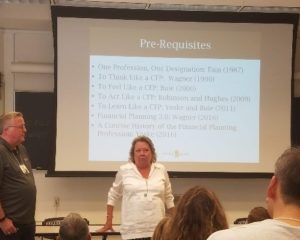

Financial Planning and the Future: Finology and Financial Planning 3.0

Fittingly, Dave and Elissa took the group through a talk on the financial planning profession, highlighting where we came from as a profession, where we are currently, and where we hope to be moving forward into the future. Specifically, they covered the vision, values, ethics, and evidence-based principles that have guided our profession to this day and will continue to do so into the future. Elissa and Dave gave everyone a great quote to ponder when they said that, “financial advice is not transactional, it’s transformational.” Jack Petras shared these thoughts afterwards: “This session really helped me remember why I got into the financial planning profession.

I think it was obvious to see Dave and Elissa’s passion for financial planning on the stage as they spoke, and really motivating to all the planners in the room of where we still have room to grow as a profession moving forward!”

Succession Planning for Fun and Profit

On the whole, financial advisers seem to struggle with relinquishing control of their businesses. According to a 2017 study by the CFP Board, CFPs over the age of 70 outnumbered those under age 30, and more than 20% of CFPs were retiring at the time. This transition leaves Clients in a difficult situation if an effective succession plan is not put in place early on. Lynn Ballou, CFP®, a financial planner who experienced a leadership transition in her own firm, shared some useful tips with the planners at Far West. The most important piece of advice she offered was to start early. “You can never start too early on your succession plan,” Ballou shared, remarking that properly executing a succession plan takes time. With Yeske Buie’s partnership announcement earlier this year, we can be confident that this plan is in place, allowing us to continue to offer our services for generations to come.

Integrating Love and Emotions into Money Discussions

A perfect transition from Dave and Elissa’s financial planning 3.0 topic discussion of how money permeates throughout all aspects of our lives came through Dr. Sonya as she broke down money and is applicability to our success and failure in marriage. Dr. Sonya provided many insightful aspects to the group, including the statistics that only 50% of couples talk about money before marriage and that money is the #1 topic of conflict in marriages today. Understanding the role that money plays in our lives is important to consider in the pursuit of our Live Big goals. Dr. Sonya’s presentation reiterated the point that true financial planning is a transformational process.

Karen Simons, Apprentice Financial Planner on the team, had the following thoughts after the presentation: “The session on Money Talk was insightful! Money talk with your significant other is such an important part of a healthy relationship, although it can be a major source of stress. Our speaker shared that research showed that financially ‘what happens early, predicts later satisfaction.’ The secret was to talk about finances regularly from day one. That way you are always on the same page. Talk about how you are co-mingling and managing your money and how you deal with your finances can help craft your dreams for the future.”

While the team has since returned to their respective offices, the experiences shared and knowledge gained during our weekend in Santa Cruz will remain. The discussions that began in Santa Cruz will certainly continue as we continuously refine the way we serve our Clients.