IRS Ends Paper Checks: What You Need to Know

Do you pay your Federal taxes or receive refunds by check? Soon, that’ll be a thing of the past. Per an Executive Order signed by President Trump in March 2025, the IRS will no longer issue or accept paper checks after September 30, 2025. But don’t fret – the IRS’s online portal makes managing your tax payments and refunds quick and simple. Here is a step-by-step guide to help you feel confident completing these important tasks as the new changes take effect.

Instructions for Paying Federal Tax Payments Online

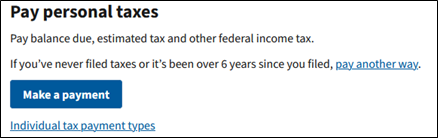

1. Navigate to https://www.irs.gov/payments/direct-pay

-

- Note, this page is for individual tax payments; if you need to make a business payment, you’ll need to navigate to the appropriate payment portal.

2. Choose “Make a Payment”

-

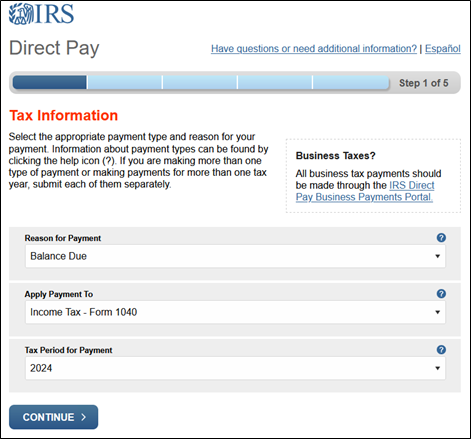

- Determine the reason why you’re making a payment before taking your next steps (and make sure to enter the appropriate tax year!):

- If for taxes due upon filing your tax return, use the guide below:

- Determine the reason why you’re making a payment before taking your next steps (and make sure to enter the appropriate tax year!):

-

-

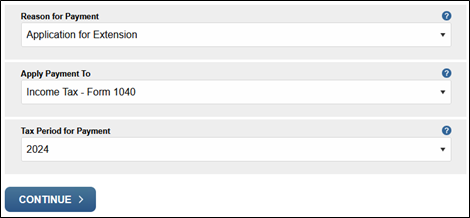

- If for filing an extension, use the guide below:

-

-

-

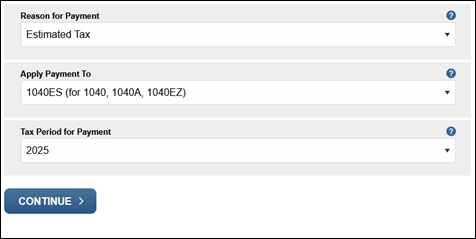

- If for quarterly estimated taxes, use the guide below:

-

-

- Click Continue.

3. Verify your identity with your last tax return year filed (or any recent one if you prefer)

-

- Note, you’ll need to use the primary taxpayer’s information here if it is for a joint return (the first name listed on the tax return).

- Click Continue.

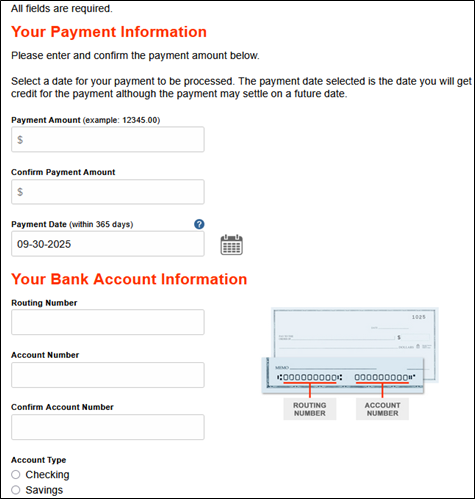

4. You will then arrive at the Payment Information screen:

-

- Enter the payment amount then enter it again to confirm.

- Choose today’s date (or future date if you wish to schedule a future payment).

- Enter the routing number and checking account number for the checking account from which you want to make the payment.

- Let us know if we can help you figure these numbers out.

- Choose account type.

- Enter your email address so you receive a confirmation.

5. Click Continue.

6. Review the information then electronically sign, accept the Debit Authorization, and submit.

7. Save the confirmation page (use CTRL + P to print to PDF) and email for your records.

Instructions for Receiving Your Refund via Direct Deposit

If you’re not already receiving your refund as a direct deposit, rest assured it’s simple to set up:

-

- If you self-prepare your return: Select Direct Deposit as your refund method through your tax software and type in the account and routing numbers for your desired receiving checking account.

- If you file with a CPA: Let your tax preparer know you’d like your refund sent via direct deposit.

- If you file by paper: Choose Direct Deposit as your refund method on your paper return and write in your account and routing numbers for your desired receiving checking account.

Taxpayers who choose direct deposit typically receive their refunds — and other payments, such as stimulus checks or tax credits — more quickly. Just be sure to double-check your account information to avoid delays. For more information on direct deposit with the IRS, visit their website. And, if you have any questions, let us know how we can help guide you through this process.