Numbers to Know Next Year

Although 2020 has been anything but normal, there are some normal numbers updates we confirm around this time each year. Those numbers include things like maximum IRA contribution amounts, catch-up contributions, Social Security increases, and more.

Read on to see the updated numbers you can plan for in 2021 (and pay special attention to the note about one item you might be able to take advantage of prior to 12/31/2020 – the $300 above-the-line charitable deduction).

Now, we noted this piece was about updated figures we can all expect for 2021 limits and specifications, but not every number changed. Let’s first review the numbers that are not changing.

- The IRA contribution limit will remain unchanged in 2021 – the annual contribution limit for Roth and Traditional IRAs will stay at $6,000 (with an additional $1,000 catch-up contribution for anyone 50 or older).

- In general, IRA contributions are deductible against income on your tax return, but only if your income is below certain limits (or if you nor your spouse, if applicable, has access to an employer-provided retirement plan at work). If you qualify in all other areas, but your income bumps into those limits, the amount of your contribution deductible will phase out until it eventually reaches $0.

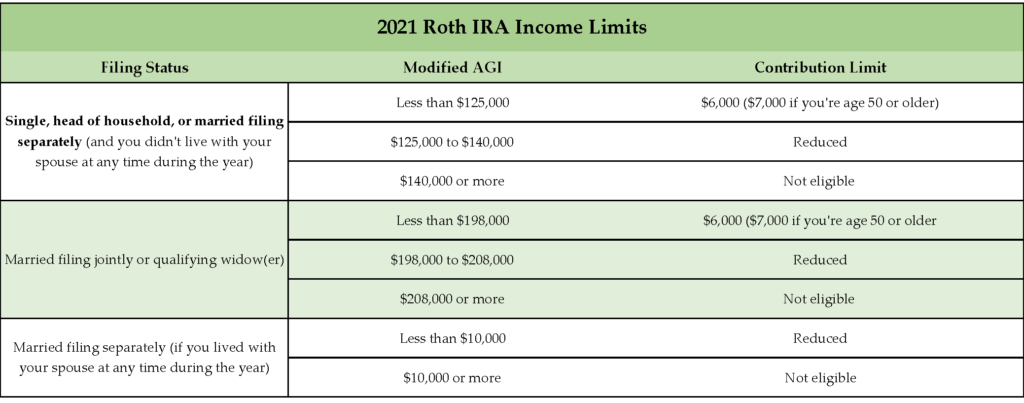

- Similarly, Roth IRA contributions are only allowed if your income is below certain limits.

- The limits are detailed and can be found in the tables, sourced from Investopedia, here.

- Similarly, the maximum 401(k) contribution will not change in 2021 – it will remain at $19,500 with an additional $6,500 catch-up contribution allowed for those 50 and over.

- The overall plan limit will, however, increase from $57,000 to $58,000 (which affects employer matching and nonelective contributions and special after-tax salary deferrals allowed in some plans, as well as Individual 401(k)s and SEP IRAs).

So, what is changing? Here are a few updates:

- The Standard Deduction (which reduces your taxable income and is an option along with itemizing deductions) will increase to: $25,100 for those married filing jointly (up $300 from $24,800 for 2020); $12,550 for single taxpayers (up $150 from $12,400 for 2020), and; $18,800 for heads of households (up $150 from $18,650 for 2020).

- For those who are 65 or older or blind, an additional $1,300 is allowed (for married filing jointly – $1,650 if single or head of household and not a surviving spouse). For those who are both 65 or older and blind, this additional deduction is doubled.

- Speaking of those who utilize the standard deduction, starting with the 2020 tax year (this year, so you can still take advantage of this before 12/31/2020), taxpayers will be able to deduct $300 of charitable contributions made as an above-the-line deduction (which means this $300 will reduce your Adjusted Gross Income (AGI) and you will still get the above-mentioned Standard Deduction to further reduce that AGI).

- The Social Security and Supplemental Security Income cost of living adjustment (COLA) will be 1.3% in 2021. This means those receiving Social Security benefits will receive an increase of 1.3% on their monthly benefits for next year.

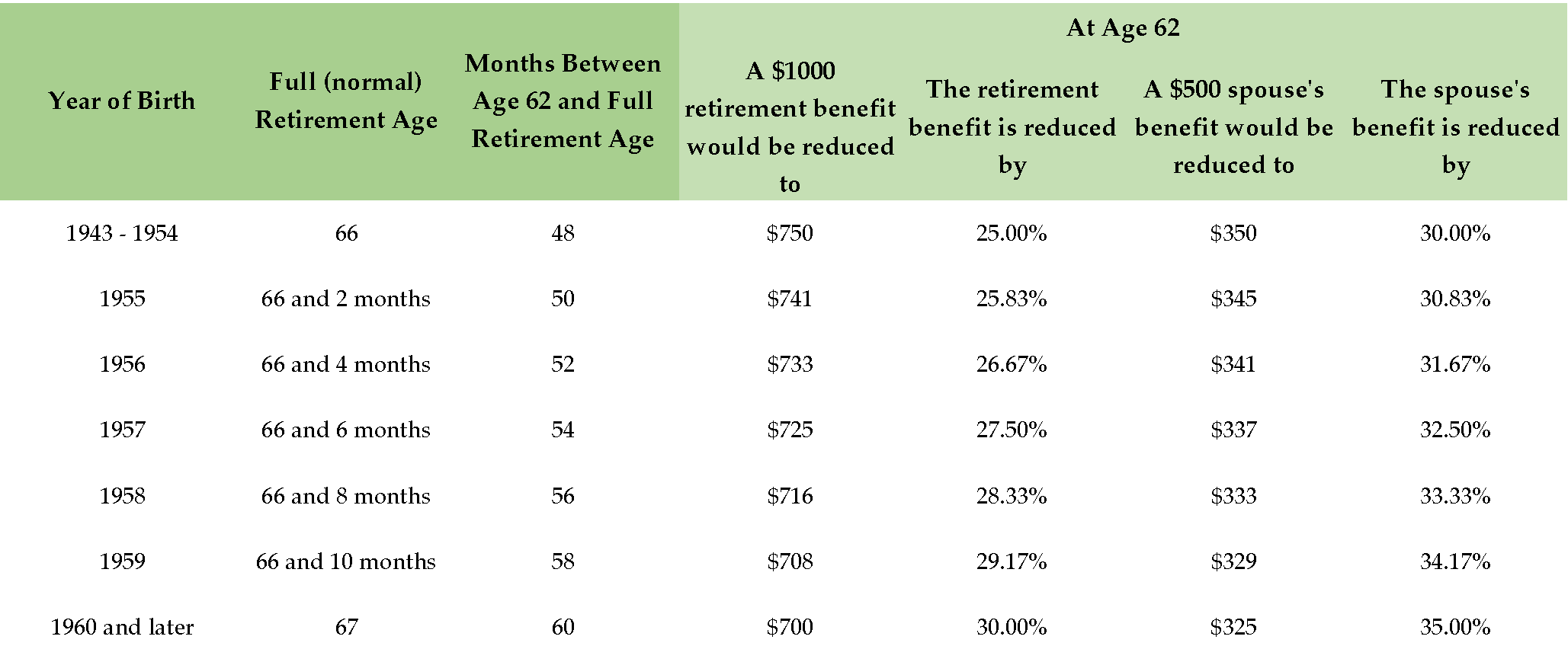

- Related to Social Security – if you file for benefits prior to your Full Retirement Age (detailed below, from SSA.gov), and continue earning money, you may be subject to reductions in your benefits. For 2021, that reduction will begin when your income goes above $18,960. For every $2 you earn over that threshold, Social Security will reduce your monthly benefit by $1.

- For those who will reach their Full Retirement Age (FRA) in 2021, the reduction will be $1 for every $3 earned over $50,250 until their FRA birthday.

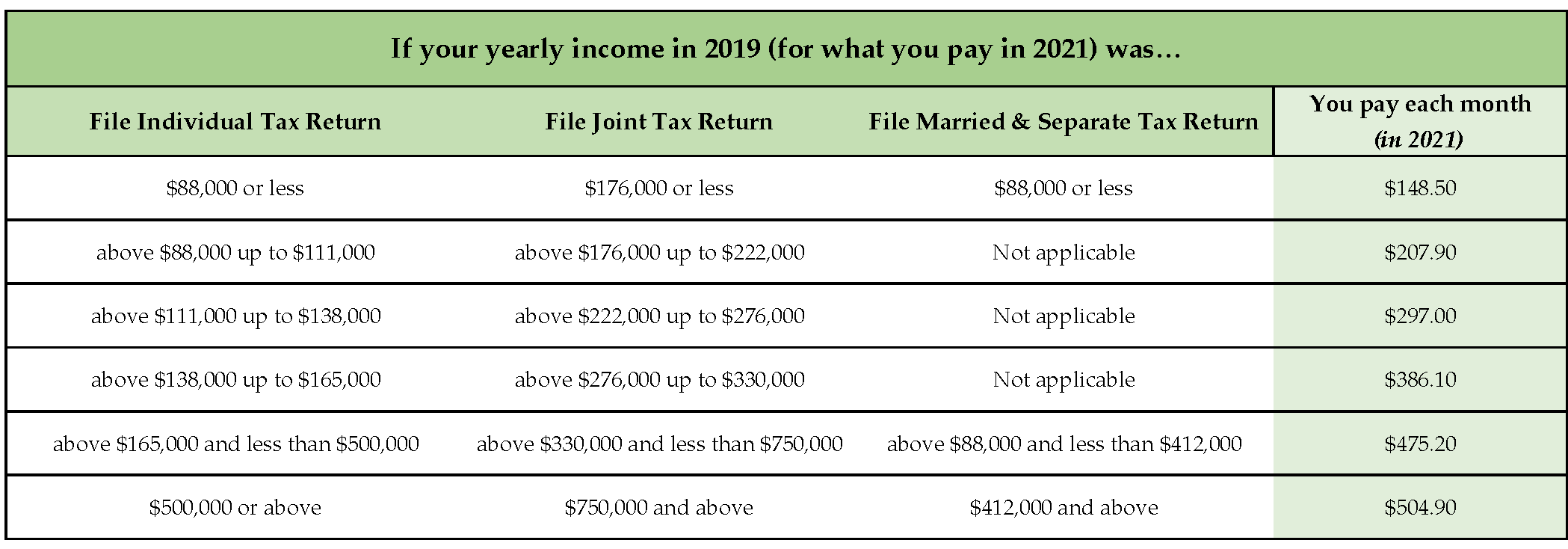

- The 2021 Medicare premiums have been updated, too, with each premium bracket increasing a few dollars per month:

- The base Part B premium will be $148.50 per month, with an additional income-related monthly adjustment amount beginning for individual filers who have Adjusted Gross Income (AGI) above $88,000 and married filing joint filers who have AGI above $176,000. You can see the full table of Part B Premiums (from medicare.gov) here:

- Contribution limits to Health Savings Accounts (HSAs), tax-advantaged medical savings accounts available to those with a High Deductible Health Plan (HDHP), will increase slightly to $3,600 per individual/$7,200 per family (up from $3,550/$7,100). The catch-up contribution for those age 55 or older remains at $1,000.

- On a related note, the minimum deductible for HDHPs will remain unchanged at $1,400 for self-only and $2,800 for a family.

- The maximum out-of-pocket amounts for HDHPs will increase slightly to $7,000 for a self-only plan/$14,000 per family (up from $6,900/$13,800).

What actions can you consider based on these updates?

- If you’re turning 50 in 2021 and you’re actively contributing the max to an IRA or Roth IRA, consider making catch-up contributions of $1,000 per year going forward (for a maximum contribution of $7,000 in 2021, for which you have until April 15, 2022 to contribute).

- And, don’t worry! If you turned 50 this year and normally contribute the maximum, you have until April 15, 2021 to make your total 2020 IRA contributions so you can still make the catch=up contribution of $1,000!

- If you’re turning 50 in 2021 and actively contributing the max to your employer 401(k), update your deferral amount to ensure you contribute not only the maximum of $19,500, but also the catch-up contribution allowed of $6,500.

- Note that deferrals to your employer 401(k) are calculated within the calendar year, so if you turned 50 this year and did not take advantage of the catch-up in 2020, you can make the changes to your deferral amount now and take full advantage in 2021.

- If you’re on Medicare, remember that your annual premiums are based on your Modified Adjusted Gross Income (MAGI) from two tax years prior. For example, your 2021 premiums will be based on your 2019 tax return.

- If you have a year with high income due to a one-time transaction (like the sale of a home or business, a major capital gain event, or perhaps your last year working), you can likely file an appeal to Medicare for them to reassess your premiums based on your current (and lower) income. If you feel this might apply to your situation, let’s discuss and we’ll be happy to help.

We hope this information is helpful to you in thinking about the coming year (at least from the standpoint of retirement account contributions, deductions, and Medicare premiums – we know there is a lot more to think about and look forward to in 2021!). If you have any questions about how anything above might directly apply to your LiveBig® life, we’d love to help you think it through and answer your questions.