Rise Up: The Olympic Games and Our Investment Philosophy

The Olympics provide a unique opportunity to see the world shine in a different spotlight; to become a part of something bigger than ourselves and share in the joy and heartbreak felt by all. With the Summer Olympic Games happening once every four years, the spotlight magnifies the performances and accomplishments of the athletes and their countries.

All the while, the world markets in which we invest on a daily basis draw many similarities to the Olympic Games. Some of the core principles of our investment philosophy are paralleled in the truths of the games, and the actions of the athletes are reflected in the behaviors and decisions of investors.

In a commercial brought to you by the Rio 2016 Team, they explained the complexity of the games in 3 brilliantly simple statements:

To see the human body overcome limits and manage the impossible.

It isn’t always pretty to watch, but it’s always beautiful.

The emotion will be everywhere.

To see the human body overcome limits and manage the impossible.

Just as the body is limited, so is our ability to predict what will happen in financial markets. However, human ingenuity is indomitable and infinite. Things that were considered impossible 10 years ago have been conquered, and things that are considered impossible today will be conquered in the future.

|

We watch athletes continue to challenge limits and push boundaries. Their progress may be minimal year after year, but when you add it up over 56 years the difference is spectacular (see gif above). Similarly, it is the markets performance long run which contain the deep structure and reflect the belief in human ingenuity and progress.

Figure 1- Performance of $1 in the market since 1929.

It isn’t always pretty to watch, but it’s always beautiful.

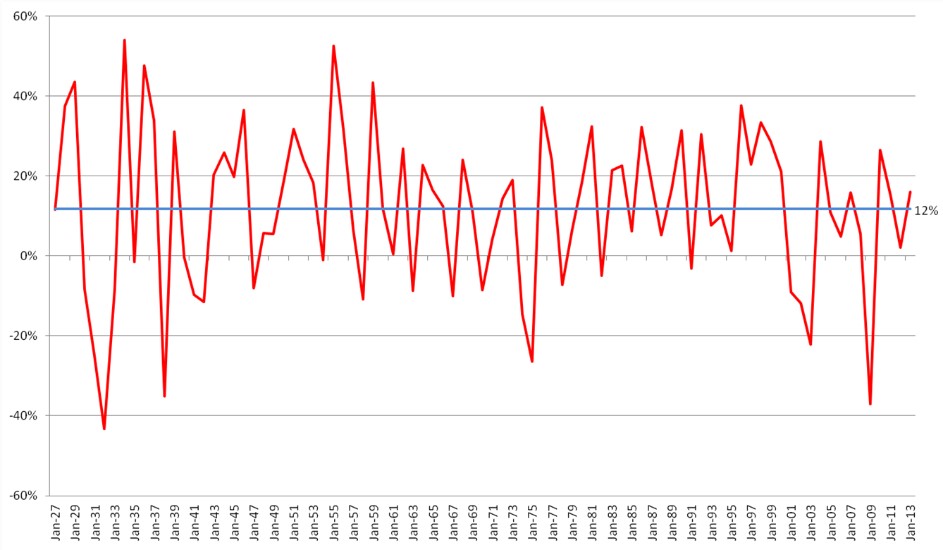

The performances at the Olympics are not always perfect; the athletes are human beings after all. The daily performance of the market is not always pretty, either. One may even describe the harsh volatility in the chart below as “ugly.” However, it is important to realize that beyond the volatility of the day to day, the market comes together with a positive trend in the long term.

Figure 2- Representation of the day-to-day volatility of markets.

The markets factor that “ugliness” into the prices of the stocks and bonds in which people invest. Volatility is driven by the inherent risk of an investment; greater magnitudes of volatility translate to higher expected returns. Similarly, a gymnast will take additional risks in their routines by adding more complicated moves. The choice to increase the difficulty of their routine provides the opportunity to achieve a higher score if they have the discipline to practice the routine until it is perfected.

The emotion will be everywhere.

The emotion is everywhere, in investing and performing, and it may be one of the biggest obstacles to overcome. The important thing to remember in both cases, however, is to not let the emotions drive actions. Olympic athletes practice and train for four years and overcome the day-to-day with their sights set on achieving their goal of competing in the Olympic Games. Investors’ must also keep in mind their long time horizon to retirement in order to persevere through the day-today noise in the markets.

Olympic athletes may be among some of the most disciplined in the world. The training, determination and focus required of them to succeed and master their sport is unimaginable by many. However, similar attention and commitment is vital in order to establish investment policies and processes so that when the emotions do arise. Yeske Buie’s rebalancing policy mitigates the emotions of investing by setting clear rules. We review all non-spending accounts every two weeks, identify the positions that are either 20% greater than or less than their target allocation, and rebalance those positions back to their targets. This allows us to weather the storms and volatility of the markets, without letting our emotions drive the decision-making process.

All in all, as an investor in the markets, you are similar to an athlete in the Olympic Games, but without all the fame and glory. Here’s to never giving up and always going for the gold, whatever the endeavor!