Seismic Security: Do You Need Earthquake Insurance?

Earthquake losses and other catastrophic events are not covered in homeowners and renters insurance policies and will need to be purchased separately (even if you have an open perils policy) to protect your home from these natural disasters. Recent earthquakes around the world (including in the Northeast US and Canada) have raised a lot of interest in earthquake insurance. As such, we felt it timely to rumble through the basics of earthquake policies to help you determine if purchasing coverage would make sense for you.

What Is Earthquake Insurance?

Earthquake insurance is a specialized coverage that protects your property from damage caused by an earthquake. As mentioned earlier, these losses are not covered by standard homeowners and renters policies and require an additional specific policy. A typical earthquake insurance policy will cover three items:

- Structural Damage: The cost of repairing or replacing your dwelling.

- Personal Property: The cost of your damaged belongings.

- Additional Living Expenses: If your property is uninhabitable due to earthquake damages, an earthquake policy may provide coverage for living expenses during the repair process.

It is important to note, however, that due to the customized approach of earthquake insurance policies, each policy can come with varying coverage items and amounts. If you’d like some guidance in reviewing your policy (or a draft) to ensure you understand what coverage you have, your team at Yeske Buie would be happy to connect with you.

General Exclusions from Earthquake Insurance

Understanding what your insurance policies cover and don’t cover is crucial to making sure you are properly insured. Even if an earthquake insurance policy is purchased, there are still common exclusions that should be noted (although again, every policy is different!):

- Damage to the actual land

- Damage to non-dwelling (vehicles, fences, etc.)

- Damage to pool or collectible items in the home

- Fire damage to location caused by an earthquake

Not only are there exclusions in earthquake policies, but like many insurance policies, it’s important to be aware of the deductibles for your policy. Deductible amounts can vary for every policy but are generally greater than average for earthquake policies. These deductibles can be represented in flat amounts (a dollar limit) or by a percentage up to a certain coverage limit.

Should I Get Earthquake Insurance?

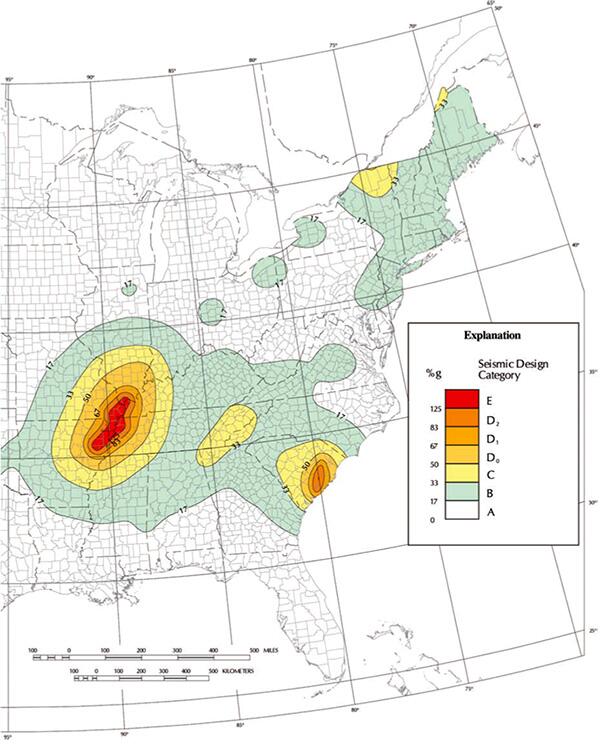

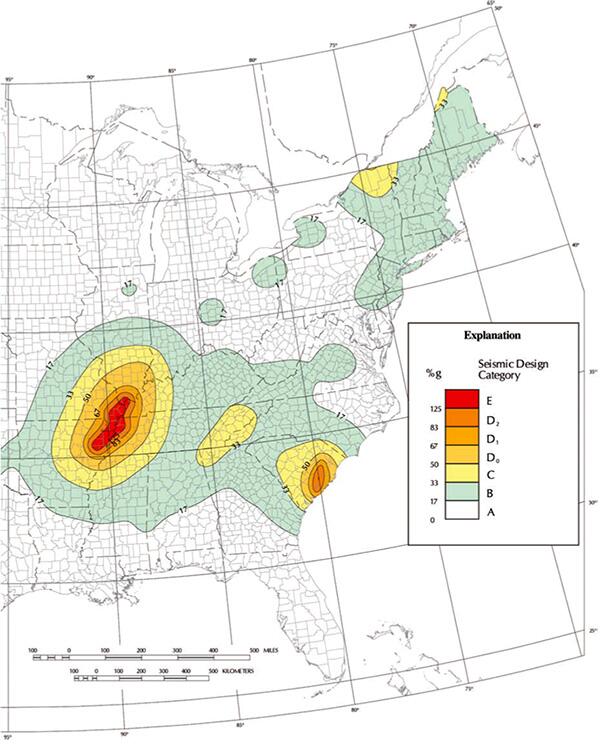

You probably already know the answer to this question – it depends! The decision of whether or not to purchase an earthquake policy is highly personalized and can depend on property location, property age, number of stories, and more. That said, one of the main deciding factors is often the earthquake history in your area. The maps below provided by FEMA track past earthquakes and their magnitudes which can help you learn more about your location’s history. Lastly, it’s important to note that if an earthquake has just occurred in your area, insurers generally will not sell new policies for one or two months.

If deemed appropriate, there are a few ways to acquire earthquake insurance. You can start by contacting your current homeowners or renters insurance company to see if the policy can be added to your existing one, or if it needs to be purchased entirely separately. California insurance companies are mandated by law to sell earthquake policies, however, if you live elsewhere (especially somewhere without many earthquakes), it may be more difficult to secure a policy. Your Yeske Buie team is well-connected with many reputable insurance agents, and we’d be happy to connect you with reliable and competent agents if you need assistance in purchasing a policy.

In short, the key to comprehensive protection lies in being proactive. Review your policies regularly, stay informed about your area’s earthquake risk, and don’t hesitate to reach out to your Yeske Buie financial planning team for personalized advice. By taking these steps, you can ensure that you and your family are prepared for whatever the future may hold.

Additional Resources

- Earthquake Insurance: Understanding Coverage & Costs | Allstate

- Named Perils vs. Open Perils Policy in Home Insurance | Credible

- J. Earthquake Aftershocks Rise to 134, But Becoming Less Frequent

- What is the Difference between Dwelling Coverage and Home Insurance? | Farmers Insurance

- Earthquake Insurance, Explained | ValuePenguin

- Earthquake Insurance: What You Need to Know | NerdWallet

- Earthquake Hazard Maps | FEMA.gov

- What is Earthquake Insurance & Do You Need It? | U.S. News

- Does Home Insurance Cover Earthquakes? | Progressive Insurance

- Earthquake Insurance Guide | California Department of Insurance