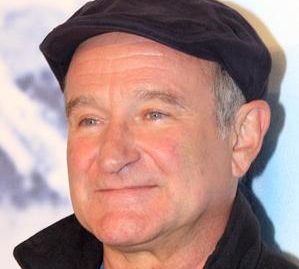

Spare Your Heirs the Drama: Lessons from Robin Williams’ Estate Plan

“The life of comic genius Robin Williams brought joy to millions of fans, and his tragic death has sent shock waves throughout the entertainment community. But as painful as his loss will be for family, friends and fans, it appears that at least according to early reports, Williams took care of business when it came to setting up a solid estate plan.” -Dan Caplinger (Daily Finance)

The revelation of older trust arrangements – made public for reasons discussed below – make it clear that Robin Williams planned carefully for the care of his heirs and the guidance of those handling his estate. And, except for one serious omission in the trust language, he might have had a reasonable expectation that those arrangements would remain private. That this was not the case offers a few lessons for the rest of us. As a starting point, here are three key considerations when planning for your own estate: have estate documents to make your wishes known, determine your privacy preferences, and be aware of the potential gaps.

Estate Documents – Make Your Wishes Known

Having your wishes/desires/directives for how to manage your affairs written down creates a clear path and gives direction to those entrusted with carrying out those wishes. Your estate documents can serve as the final word when decisions need to be made, especially when multiple people are involved, each of whom may have a different opinion of what you intended. Ultimately, you should consult an estate attorney when determining specifically what your estate arrangements should be. Some of the documents that may be useful include a will, trust, transfer on death designations, a durable power of attorney, and/or a health power of attorney. It’s important to note that retirement accounts are distributed on death according to the designated account beneficiaries and will not be easily if at all overridden by a will, trust, or alternative estate document.

A Private Affair

“Most people think of wills as the basic must-have estate-planning document. But for those in the public eye, the downside of using a will as your primary document is that it’s subject to the probate process, which invites public scrutiny of court-filed records. Especially in California, where Williams lived, the probate process is notorious for being long and arduous.” -Dan Caplinger (Daily Finance)

Privacy is an important consideration when planning for your estate and this is one of the major difference between a will and a trust (both of which can direct how your assets pass). A will is subject to the probate process, during which the public can gain access to the document. With a trust, you bypass the probate process, though setting up a trust will generally cost more than a simple will. So one question to answer is whether greater privacy is worth the additional cost of establishing a trust.

In addition to keeping your estate a private affair, trusts can help with access concerns. You can set up trusts for minor children so that someone else is entrusted with managing the assets either indefinitely or until the beneficiary is of a responsible age to manage the assets themselves. This can also be useful in protecting against potential creditors. Even if the beneficiary does not have financial troubles, they may marry or go into business with someone who does. Trusts can help maintain distance and access from those creditors. Finally, trusts can be designed to deal with intricate and contingent distribution preferences, especially for people with children from prior marriages, assets across multiple jurisdictions, and other complicating factors. The key point to remember with a trust is that it will only be useful if you USE it i.e. transfer assets into the name of the trust and/or have your will ‘pour over’ assets into the trust.

“Many times, people make the mistake of creating a trust, but never executing the real estate deeds to move their home into the trust, or leave financial accounts in their own names rather than making arrangements with their brokers to have accounts opened in the name of the trust. Even if you follow the common practice of having a backup will that puts any forgotten assets into the trust at your death, doing that leaves you vulnerable to probate, negating one of the values of having a trust in the first place.” -Dan Caplinger (Daily Finance)

Potential Gaps

One issue that arose with Robin’s estate as reported by Darla Mercado with InvestmentNews (free registration required), was related to a trust document becoming public, a significant concern considering privacy can is often a major reason for using a trust. Mr. Williams had several iterations of his estate plan, which is not uncommon. A problem arose, however, when the trustee of an existing trust had to petition the court to appoint a successor co-trustee (the previous one having passed away), making a private trust document available to the public. This could have been avoided had the trustee or other ‘trust protector’ been given the authorization to appoint a successor trustee without needing to petition the court.

In addition, one can allow authorization to ‘decant a trust’, a strategy that allows a trustee to move assets to another state with more favorable tax rates, or one may consider the use of ‘blind trusts’, which can add an extra layer of privacy for the deceased’s estate.

One should always use a qualified estate planning attorney when determining the best estate planning strategy for your specific situation and desires. The time you take now to proactively think and plan your estate arrangements can save your heirs a lot of drama.