Things to Consider When Changing Banks

Change can be a good thing. But change for the sake of change does not always result in progress. If you’re thinking about changing banks, it’s important to consider number of factors. In this space, we’ll discuss:

- Deciding to Make a Change

- What to Look For When Choosing a New Bank

- How to Switch Your Bank Account (including an interactive checklist!)

- Think Big with Yeske Buie

What to Look For When Choosing a New Bank

Whether you’re changing banks due to data protection, a move, fees, consolidation of multiple accounts, or you’re just looking for a new banking relationship, you’ll want to be thorough in researching the options available for you.

Here are a few features to investigate when searching for a new bank with the appropriate accounts for you and your family.

- Compare Fees

- Review any monthly or annual charges for the bank and the specific account types you are interested in. Some accounts also require a certain dollar amount of direct deposits in order to avoid triggering extra fees.

- Consider the Bank’s Customer Service

- Does the bank prioritize customer relationships or do they prefer virtual banking? Can you call the bank’s direct line or is there an 800 number? Find out if the representatives appear knowledgeable and able to sort out conflicts. Additionally, what security measures does the bank have in place? Think about what’s most important to you and then find a bank that aligns with your wants and needs.

- Look at the Available Online and Mobile Offerings

- There are some pretty neat fintech options available in the banking world these days. Mobile banking apps can feature disposable virtual cards, credit card transaction disputes, subscription management, AI chatbots, digital account opening, and more.

- Check Out the Savings & Interest Rates on Different Accounts

- Do your research and understand how you can make your money work best for you. Again, it may help to comparison shop before you commit to a particular candidate.

How to Switch Your Bank Account

Once you have done your homework and made the decision on which bank you will be switching to, making sure the transition is smooth can seem overwhelming. However, it doesn’t have to be.

To avoid interruptions with your financial accounts, follow these easy steps:

- Open your new bank account.

- Transfer money to your new bank account.

- You may want to keep a small balance at your old bank, as some institutions charge a minimum balance fee.

- Update your bank information for recurring payments (which we discuss more below).

- Close your old account.

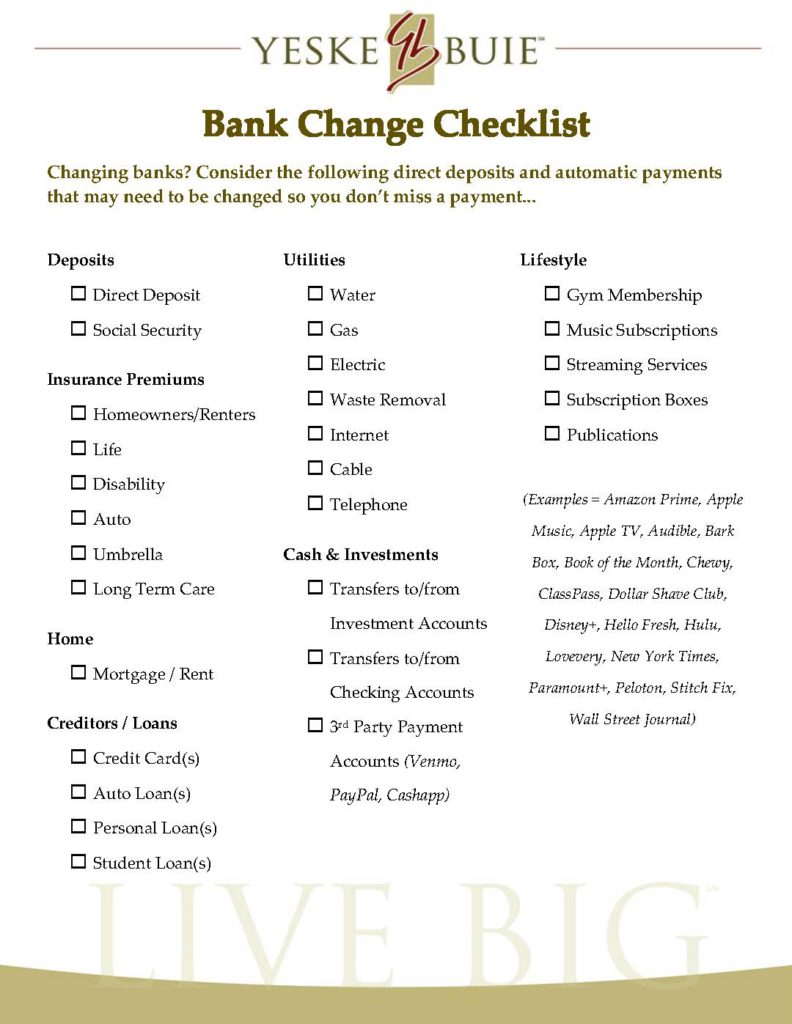

These steps are relatively easy. Nevertheless, one of the most stressful parts of switching banks is often confirming that all direct deposits and automatic payments have been canceled for your old account. They have to be set up for your new account, as well.

To help with this process, we’ve created an interactive checklist to keep track of all the necessary changes.

As you begin this switch, remember to take it one bill at a time. For those you have on autopay, make the necessary changes to your payment method by using a bill paid in your old bank account as a reference. Keep special note of any bills that aren’t paid on a monthly basis, as well, to be sure those payment methods are also updated.

And, while you are signing into all these accounts, consider reviewing your cybersecurity by using a password manager to store all of your unique and hard-to-guess passwords. You can read more about password security in this article we recently posted.

Think Big with Yeske Buie

Our financial planners would love to talk more with you about whether or not changing banks is the right decision for YOU. Whether you’re based in Vienna, VA, San Francisco, CA, or anywhere in between, please don’t hesitate to reach out. We believe our experienced insights are the investment answer you need. Contact us to talk more.