When Projections Align with Reality

At Yeske Buie, we think of ourselves as financial planners, not just asset managers. With that being said, the process of creating a Client’s financial plan requires us to build a strategy for their investments and to use assumptions about their portfolio’s performance when crafting their retirement projections; the portfolio’s returns are the fuel that drives the financial plan. We recently back-tested our portfolio’s performance over the past 26 years, confirming again that one of our most critical assumptions continues to fit with reality. In this piece, we share more about our test and the implications of the results.

We start by reviewing our aggregate portfolio’s historical performance as part of the basis for the assumptions we make about future returns. Across all of our Clients’ accounts, the overall mix of stocks and bonds is split roughly 2:1 in favor of stocks (or, in percentage terms, 67% stocks and 33% bonds). If we look at recent history, our cumulative average return (net of fees and expenses) has fallen somewhere between 7% and 9% (range: 7.0%-8.8% since 2008).

As such, we think using an average annual return of 7% in our Clients’ retirement years makes sense, as our typical retiree is invested in a portfolio comprised of 70% stocks and 30% bonds (not far off from our aggregate portfolio). We use this mix because it provides enough growth potential via the allocation to stocks while maintaining a stable reserve in bonds that gives our Clients confidence in the consistency of the “paycheck” their portfolio provides in retirement.

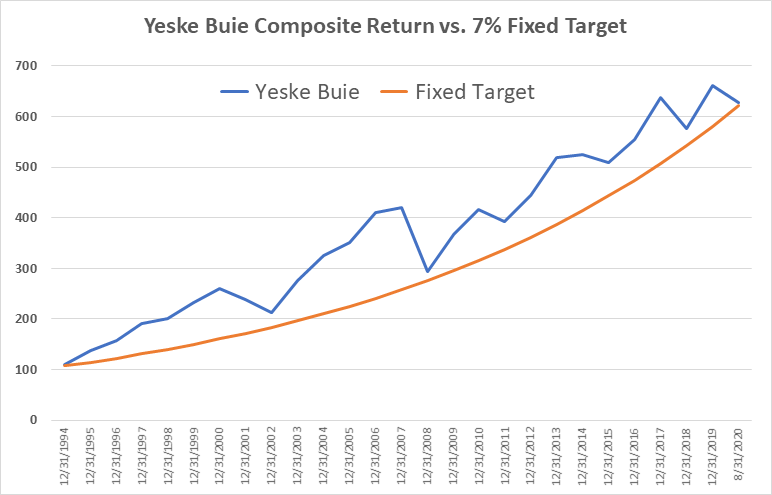

So, how have our assumptions compared against reality? In spite of the twists and turns in financial markets over the past quarter century (The Dot Com Meltdown, The Financial Crisis and Great Recession, and the Coronavirus Pandemic), our aggregate portfolio’s returns have bested a 7% fixed target – see below:

A concise way to sum up the outcome of this analysis is as follows: if you had invested $100 in a vehicle that returned 7% annually on January 1, 1994, your investment would have grown to $621; if that same $100 had been invested in our portfolio it would have grown to $627 (through August 31st, 2020, net of fees and expenses).

For questions about our investment philosophy or our approach to building comprehensive financial plans for our Clients, contact a member of the Yeske Buie Financial Planning Team.

Important Disclosures Related to Performance Reporting and Benchmarks