Groundhog Day Redux

We thought we’d offer a few observations now that Congress and the White House have managed to come to an agreement on raising the debt ceiling. As we suggested a week ago, a deal was indeed done, though not before the arrival of the eleventh hour. Among other things, this episode was interesting for the way it revealed how little the pundits really knew about what was weighing the market down of late. Clearly it was more than the debt ceiling dance, since the day the deal was sealed the Dow shed 265 points.

It turns out that signs of slowing economic growth might have been the bigger factor. But don’t quote us on that: the market processes so much information, from so many sources, that it’s rarely possible to point to just one driving factor. And here’s where some perspective is often helpful. Back in the summer of last year, there were similar worries about the condition of the US and World economy. Consider this sampling of headlines:

“Fearful Investors Are Pulling Out”

Adam Shell. USA Today, May 20, 2010

“Fear Returns—How to Avoid a Double-Dip Recession”

Cover story. Economist, May 29, 2010

“Discouraging Job Growth Batters Stocks”

Don Lee. Los Angeles Times, June 5, 2010

“Rapid Declines Rattle Even Optimists”

E.S. Browning. Wall Street Journal, June 14, 2010

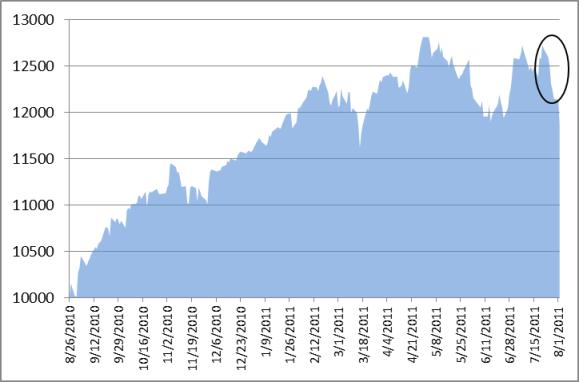

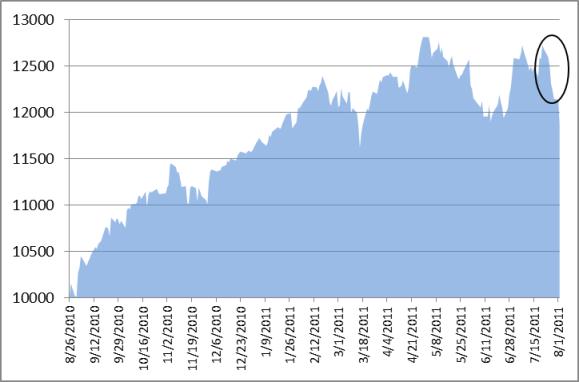

Next, consider the chart below, which illustrates the value of the Dow Jones Industrial average over the 12 months ended yesterday. We’ve circled the recent decline that has everyone so alarmed.

At the end of the day, short-term volatility is the price we pay for long-term growth. And while there seems to be some truth to the old saying that “the market climbs a wall of worry,” we’d rather leave the worrying to all those anxious headline writers.

The Yeske Buie Team