Live Big® Digest: Super Bowl Edition

Since Yeske Buie’s offices are located in Vienna, VA and San Francisco, CA, our natural rooting interest when it comes to football revolves around the Washington Redskins and San Francisco Forty Niners. Alas, neither of those teams will be competing on Sunday, so our search for a reason to take sides led us to Brett Arends’ novel argument: “Support Green Bay; annoy the rich.” Arends points out that Green Bay is the only NFL team not owned by a billionaire oligarch. It is, in fact, the only NFL team organized as a non-profit corporation, essentially owned by the 102,000 residents of Green Bay, Wisconsin. The team’s ownership structure would actually be illegal under current NFL ownership rules, which limits the number of owners to 32, but was grandfathered at the time these rules were adopted in the 1980s. So, stick it to The Man on Sunday and cheer for the Packers!

And speaking of quirky, that’s just how New York Times reporter Ron Lieber described Dimensional Fund Advisors (DFA) in an article last Saturday. The company draws such passionate fans, writes Lieber, “that people frequently refer to it as a religion.” Well, you know how much we like DFA for its precise slicing-and-dicing of the market, giving us perfect building blocks for filling the small-company and value-stock allocations in our portfolios. But we also thought an advisor quoted near the end of the article actually got it right when talking about the value of using DFA funds AND being in a relationship with a good advisor:

“DFA’s advantage, if any, is likely to show up to the right of the decimal point on your total return. But good financial planners, he continued, do more than pick the right passive investments for the money they charge. They help set realistic goals that dictate your mix of investments. They shield you from tax mistakes. The very best keep you from letting behavior and feelings get in the way of intelligent decisions. All of this, in aggregate, shows up to the left of the decimal point.”

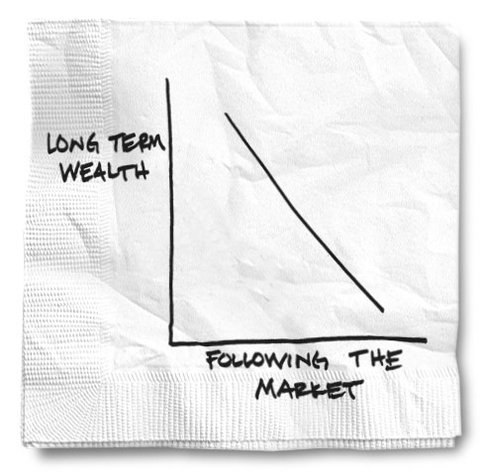

The impact of behavior on financial success reminds us of the latest results of the ongoing Dalbar study, which has been comparing the returns to the markets and those realized by the average investor for many years. The latest update from last year shows the average investor still lagging the S&P 500 by over 5% a year over the past 20 years, barely overcoming inflation for that same time frame. As always, the reason for the dramatic underperformance (see chart below) is the tendency of the average investor to get in and out of the market. Or, as Lou Harvey, DALBAR’s president put it, “Mutual fund investors do not achieve the returns cited by fund firms due to their irrational behavior.”

And while we’re talking about investor behavior, we note Carl Richards’ observations in the New York Times on “The Case for Ignoring the Stock Market.” Richards puts it this way:

“Watching every market move, listening to CNBC in the background or spending a bunch of time researching gurus’ forecasts takes a lot of time and generates a lot of anxiety. And it almost always leads to behavior that results in big mistakes that cost us (not make us) money.”

Here’s his graphic analysis of the situation:

Have a great weekend everyone and Gung Hay Fat Choy!