The Case for Emerging Markets

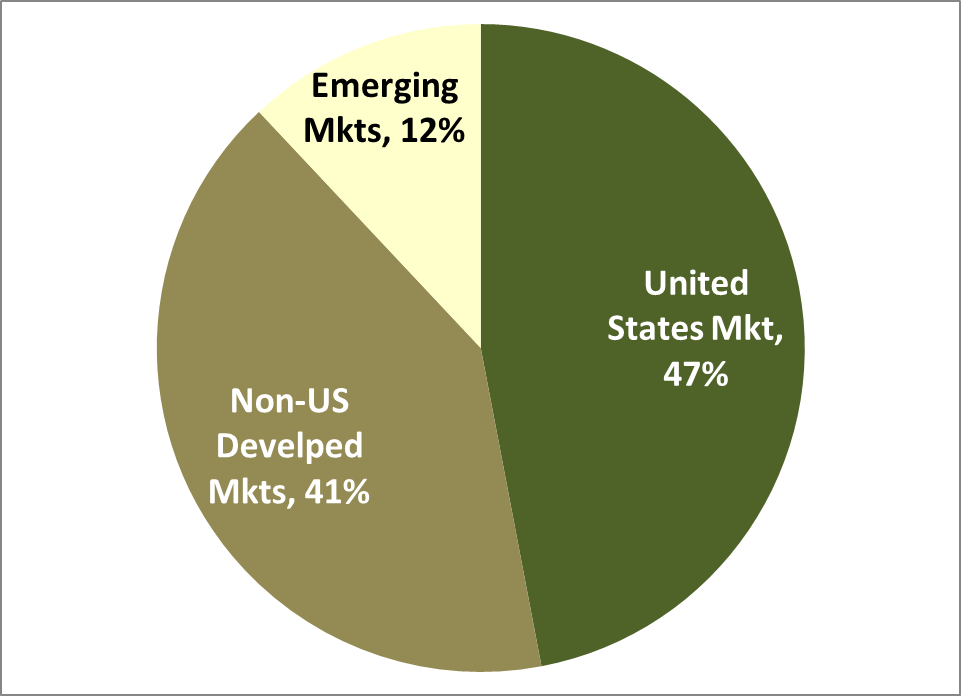

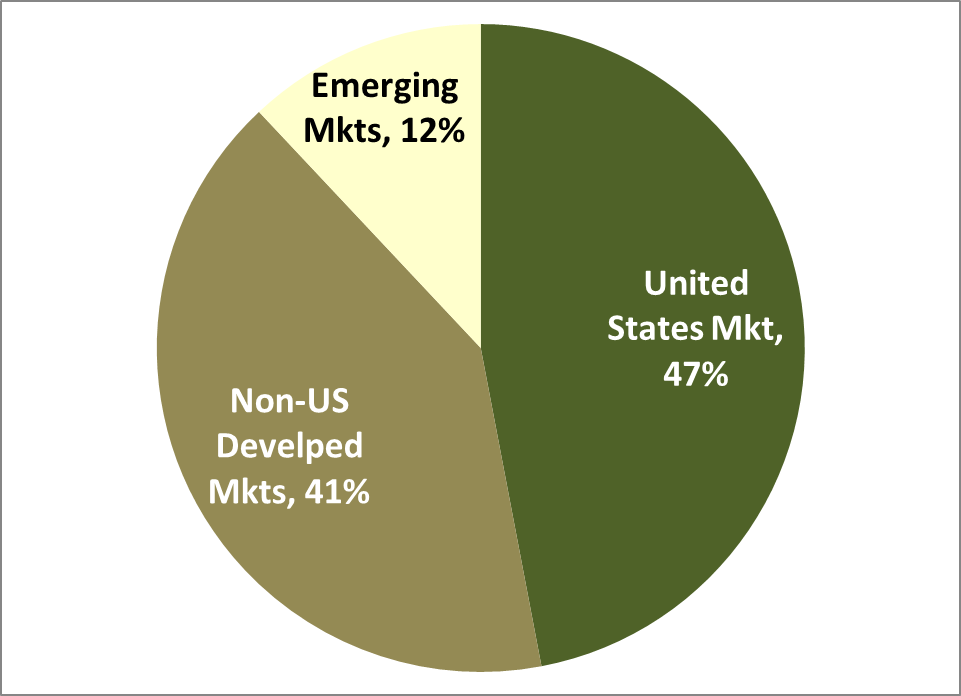

When we examine sources of risk and return in the market, we conclude, among other things, that there is no systematic return associated with geographic allocation. One of the practical results of this conclusion is that we always aim to be “geographically neutral” when assembling a global portfolio. So, while we may dial up our exposure to small cap and value stocks, taking them well beyond their relative share of the overall market, we allocate across countries and regions in a manner that is proportional to their share of the world stock market. For example, with the value of the US market representing 47% of the value of the world stock market, we allocate half of our portfolio to US stocks (so, not EXACTLY neutral, since we allocate 50% rather than 47%, but close). The one exception to this principle has been emerging market stocks, which are significantly underweighted in our equity portfolios. Our reasoning for doing this has been that stock markets in emerging economies lacked the transparency and efficiency found in more developed markets, and that the depth and breadth of tradable securities was insufficient for the level of diversification we seek. While this situation has been steadily improving, valuations in recent years have also become very high, which left us hesitant to dive in to what appeared to be an overheated sector. Having said that, several factors now lead us to believe that the time has arrived to incorporate a larger share of emerging market equities into our portfolios.

Current and Future Market Share

As a consequence of rapid and accelerating growth among the major emerging economies, their share of the world stock market has grown to 12%, a proportion that is becoming too large to ignore.

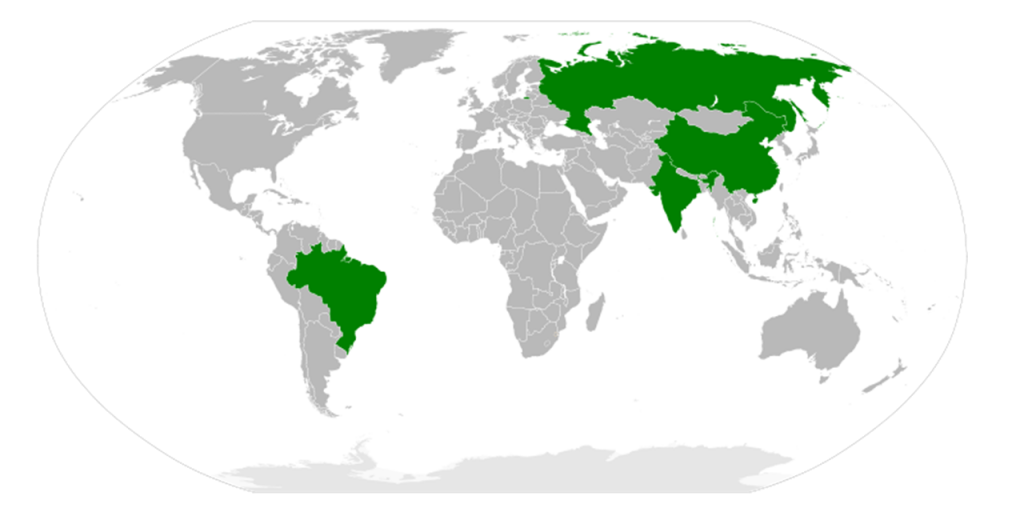

And it’s not just the current share that emerging stock markets have attained that demands attention, it’s their trajectory. As an example, consider four of the most prominent emerging markets, Brazil, Russia, India, and China, collectively referred to as the BRIC countries.

Together, these four countries represent 25% of the world’s land mass and 40% of the world’s population. Most importantly for this discussion, they are also among the world’s fastest growing economies. In fact, a recent paper by Goldman Sachs predicted that the BRICs will account for 41% of world market capitalization by 2030. This segment of the global stock market is therefore becoming ever harder to ignore and the question becomes less about “if” we should expand our exposure and more about “when.” The events of the past year would seem to have answered that latter question by presenting us with what appears to be an attractive entry point. Here’s a summary of returns by market segment and region for the past year and prior years:

While all non-US stock markets had double-digit losses in dollar terms, the emerging market losses were the deepest, creating what we hope is a “reasonable” entry point.

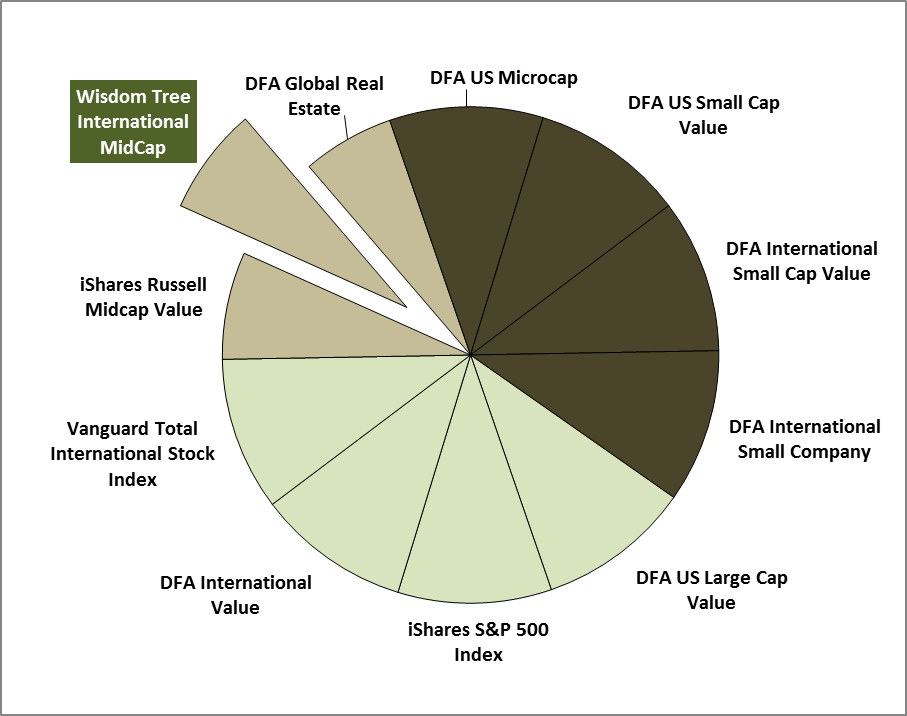

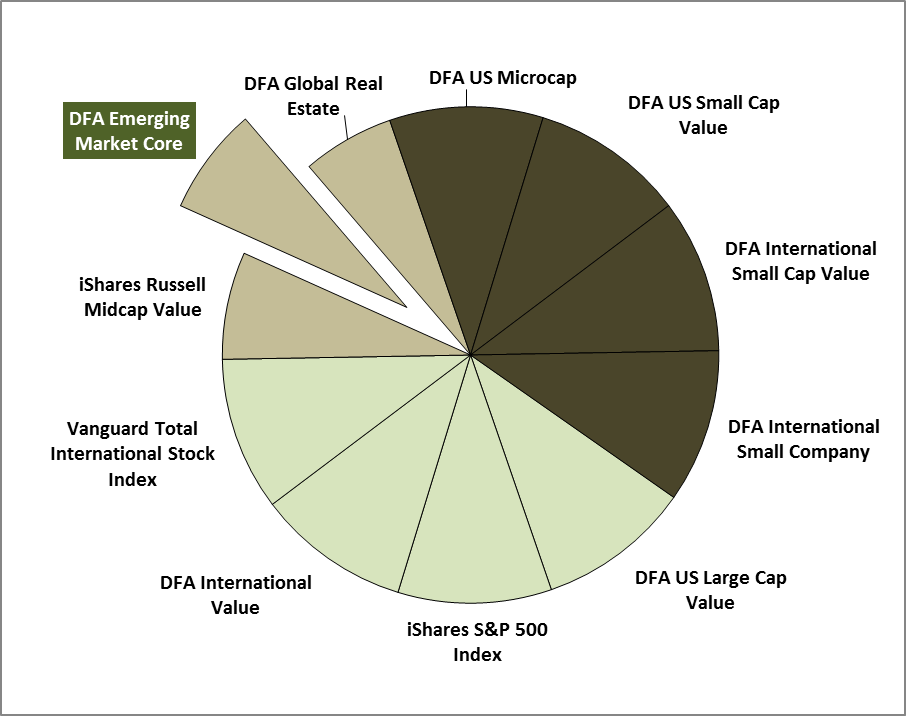

As far as how we will integrate more emerging market exposure in our portfolios, we have decided to replace the Wisdom Tree International Mid-Cap Value fund with the DFA Emerging Market “Core” Portfolio (see below).

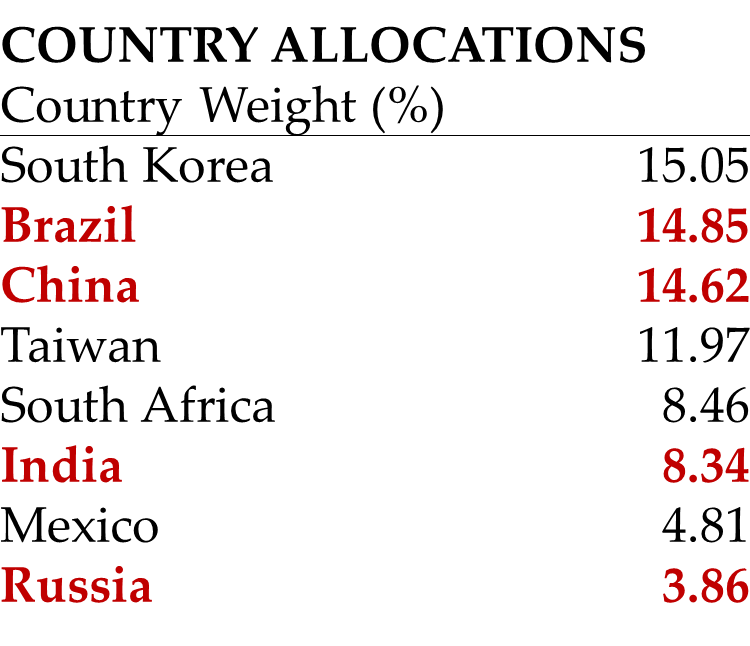

This will effectively raise the emerging market share of our stock portfolios to 8%, with the DFA Emerging Market Core Portfolio receiving a 7% allocation and the other 1% coming from the Vanguard Total International Stock Index fund, 1/10 of which is devoted to emerging markets (this is before accounting for the bond allocations). While 8% will still underweight emerging markets compared to their current 12% of the world stock market, we feel it’s a prudent step in the right direction. And since we’ve been focusing on the BRIC countries, it’s worth noting that 42% of the new DFA portfolio is devoted to the BRICs.

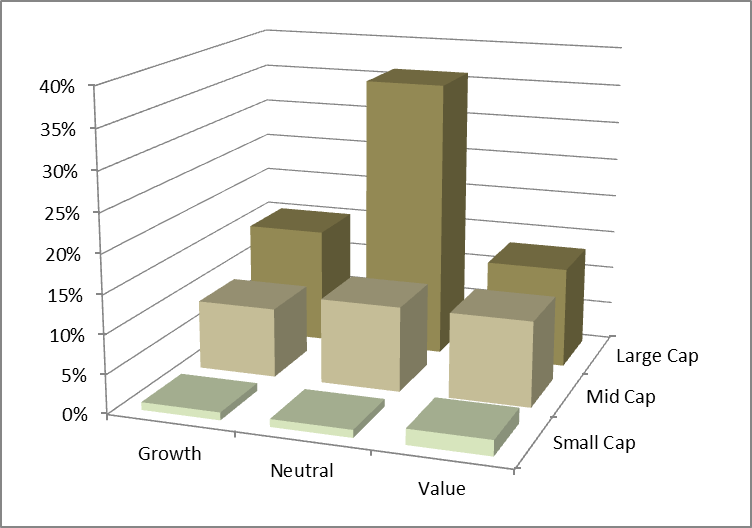

To construct this fund’s portfolio, DFA starts with the total stock market across 20 emerging markets. They then dial up the share of small company stocks relative to large company and value stocks relative to growth. The first chart below shows the neutral market weighting of size and value categories in these markets while the second chart shows how DFA weights those same size and value categories within the portfolio.

You can readily see the significant tilt toward mid-cap, small-cap, and value stocks in the DFA portfolio relative to the neutral market weighting for these factors. This kind of tilt toward small cap and value stocks is also present in our portfolios as a whole.

We will be implementing this change in all client portfolios by the end of January.