Yeske Buie Live Big® Digest – Spring Break Edition

Normally, I’d be saying Happy Tax Day, but this being Emancipation Day, the Tax Man must wait until Monday for his big payday. This is also, for many, the beginning of Spring Break. That’s certainly true for Elissa and Dave, who will be devoting the next week to a California college tour with youngest daughter Alisson. Of course, this being Alisson’s Spring Break, we couldn’t make it all work and no play, so we’ve thrown in a few non-academic stops. A visit to UC Santa Cruz will be paired with an afternoon and evening on the Santa Cruz Beach Boardwalk, while a tour of UCLA will be preceded by a day at Disneyland. Alisson has indicated that this blend meets her work/play criteria for a Spring Break excursion.

Being financial planners, however, we find that thoughts of higher education also make us think about a saving opportunity that is uniquely suited to students. Specifically, we think parents would do well to encourage their children with summer jobs to put aside some of each paycheck and invest those savings in a Roth IRA.

The Roth Advantage

The power of this strategy rests on three factors:

1.) Most students won’t earn enough to owe much, if any, taxes.

2.) Investments in a Roth IRA grow tax-free.

3.) Small investments made when you’re young can grow impressively when the power of time is harnessed.

Contributions made to a traditional IRA are tax-deductible, but they only grow tax-deferred. Withdrawals are fully taxable at “ordinary income” tax rates, which include the highest federal rates. Contributions to a Roth are not tax deductible, but have the advantage of growing tax-free. This means that all future withdrawals are made completely free of state or federal income taxes. Since most student earnings are subject to little or no income taxes (the typical student can earn up to $5,800 per year without owing any taxes at all), the tax deduction for a traditional IRA contribution is of little or no benefit anyway, so why not make an after-tax contribution to a Roth and take advantage of its unique tax-free growth feature?

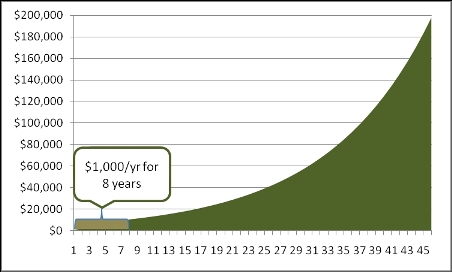

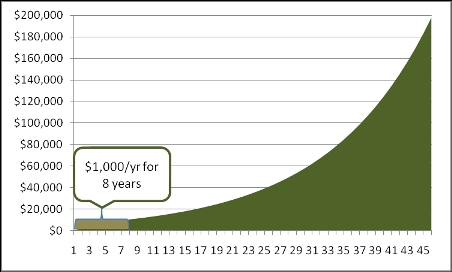

Finally, students in their late teens and early twenties have one of the most powerful financial forces at their disposal: time. Small savings made now can grow mightily when given the chance to compound over many years. Take the example represented by the chart below. This shows what happens when $1,000 per year is invested in a Roth over the course of eight years. If a 20 year old initiated such a savings program, and the IRA grew at an 8% rate, those eight installments of $1,000 would grow to nearly $200,000 of tax-free savings by the time she reached her 65th birthday.

Nut and Bolts and Suggestions

A student can make a maximum contribution of up to $5,000 per year to a Roth IRA, but the amount cannot exceed the student’s actual earnings. So, for example, if that summer job resulted in total pay of $1,400, the maximum Roth contribution would also be $1,400.

One thing you might consider in order to help your student start developing healthy savings habits now, is asking that they commit to setting aside 10% of their earnings. This is a level of saving that would serve them well over their lifetime. To sweeten the pot, you might consider matching them dollar-for-dollar for any amount they saved and contributed to a Roth. This kind of arrangement would result in a student who earned $5,000 from summer or part-time work in a given year making a $1,000 contribution, including Mom and Dad’s/Grandma and Grandpa’s/Auntie and Uncle’s “match.”

And speaking of healthy financial habits, here’s a great article on how to help kids of any age begin to learn about money by scheduling “family finance nights.” In the article, the late Dr. Bill Anthes of the National Endowment for Financial Education (NEFE) suggests topics and activities that can get you started. ‘Money Night’ With Kids Intills Smart Financial Habits

And, of course, at Yeske Buie we have many more ideas and resources for helping you start, or sustain, a healthy money dialogue with your kids.

Have a great weekend!

The Yeske Buie Team