How to Survive the 2009 Boom in Money Books

By ELEANOR LAISE

We’ve seen the stock-market plunge, the foreclosures surge, the layoffs and the bankruptcies mount. Now comes the inevitable next stage of the economic downturn: a rash of personal-finance books that promise to help readers navigate their way through the rubble — and even to prosper amid it.

To some observers, it’s the surest sign yet that the worst is over.

In other respects, the actual usefulness of many of these books may be less than advertised. Some of the authors offer few specific tips, while others are substantially altering the advice they’ve served up in the recent past.

![[Finance Books]](https://yebu.com/wp-content/uploads/2019/03/PJ-AO156_pjBOOK_D_20090119234733.jpg) Lindsay Holmes/WSJ

Lindsay Holmes/WSJPulp Nonfiction

- Publishers are rushing out new titles tied to the economic crisis.

- Much of the more-specific advice may come too late for many readers.

- Some financial gurus are backing away from home-buying tips they’ve offered in years past.

- Research suggests that stocks perform better after publication of gloom-and-doom financial titles.

Financial gurus whose past books have highlighted low-money-down home-buying strategies and exotic mortgages are now stressing 20% down payments and standard fixed-rate loans. Market prognosticators are revising earlier bullish forecasts to fit the more-somber market mood. Other authors are packaging investment fundamentals into books that promise to help readers beat the current financial crisis.

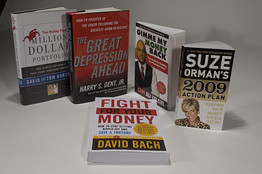

Just a year or so ago, the personal-finance bookshelf was a happy-go-lucky place where everybody and their neighbor was about to become a millionaire. Now it’s more like a bomb shelter stocked with canned goods for a long battle. Pugilistic titles like “Fight for Your Money” and “Gimme My Money Back” are pushing aside sunnier fare like “Millionaire by Thirty” and “You Can Do It!: The Boomer’s Guide to a Great Retirement.” At Amazon.com Inc., the top-selling business book in mid-January was “Suze Orman’s 2009 Action Plan: Keeping Your Money Safe and Sound.” At the same time last year, the top seller was “Ready, Fire, Aim: Zero to $100 Million in No Time Flat.”

“I don’t think anybody’s making that promise now,” says Tom Nissley, senior editor for books at Amazon. “You see a little less of those big promises for what you’re going to make. It’s more like ‘How to survive.’ ”

Personal-finance titles are typically big sellers at the start of the year, when people vow to get out of debt and balance their checkbooks. But as economic woes deepen, publishers, booksellers and readers are paying particular attention to the category.

National book-store chains Barnes & Noble Inc. and Borders Group Inc. are creating special promotions highlighting personal-finance and other titles tied to the financial crisis. Customers are showing a surge of interest in personal-finance books, booksellers say. And publishers are racing to meet the demand.

“We are scrambling to get books on 401(k)s, books on how to best manage your money,” says Drew Nederpelt, publisher at Sterling & Ross Publishers in New York. The relatively small firm, which published no personal-finance books last year, plans to publish six or seven this year, Mr. Nederpelt says.

The mad dash to publish titles tied to the crisis sometimes leaves little time for actually writing the books. “Gimme My Money Back,” for example, “was literally written and printed and shipped in about 40 days,” says Mr. Nederpelt, the book’s publisher. Author Ali Velshi, chief business correspondent at CNN, says he wrote the book in roughly two weeks.

Gimmick Warning

Of course, financial books can lay out complex investment principles in a slower-paced, user-friendly format that’s generally not possible in magazine or newspaper articles or conversations with financial planners. “A Random Walk Down Wall Street,” for example, written by Princeton University economist Burton Malkiel and first published in 1973, is an enduring title that “gives a really sound grounding in the economics of how financial markets work,” says David Yeske, managing director at financial planning firm Yeske Buie. He warns readers away from books that have a neat gimmick. “You can often recognize when a book is going to be the latest version of the grapefruit diet,” Mr. Yeske says.

There may be one way readers can use all these books to their advantage: Ignore the gloomy tone. A study published in the Journal of Behavioral Finance in 2006 found that stocks perform substantially better after the publication of bearish financial books than they do after bullish titles are published.

“If you go to the business section and everything is bullish, it’s time to watch out,” says Larry Speidell, chief investment officer at Frontier Market Asset Management in La Jolla, Calif., and co-author of the study. On the other hand, Mr. Speidell calls the recent publication of “The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in History” “a major buy signal.”

Indeed, the work of Harry S. Dent Jr., author of “The Great Depression Ahead,” shows that financial titles don’t always have perfect timing. While Mr. Dent’s 1993 book “The Great Boom Ahead” was a well-timed forecast of the 1990s bull market, his 2004 book “The Next Great Bubble Boom: How to Profit from the Greatest Boom in History: 2005-2009” proved less prescient.

“Everybody complains that economists don’t make bold forecasts,” says Mr. Dent, who also publishes a newsletter. “We do, but it does mean we’ll be wrong at times.” He adds that he is quick to adjust his forecasts if he senses they’re going off track.

Some financial scribes offer precious little in the way of specifics on handling the current market mayhem, despite their publishers’ promises. The back cover of “Gimme My Money Back” promises readers “a straightforward guide to understanding how we got into the mess we’re in, with concrete, simple, proven steps to get you out of it.” But the book is largely an investing primer that explains the fundamentals of stocks, bonds and mutual funds and offers five model portfolios for investors of various ages and risk-tolerance levels.

A ‘Dummies’ Type

“Intuitively, there’s nothing in the book that you’ve not heard of, but most folks have a problem going and making changes in their 401(k),” says author Mr. Velshi. “It’s almost like a ‘Dummies’ type of book.”

Some authors offer up advice that readers will likely wish they’d heard a year or two ago. In “The Great Depression Ahead,” Mr. Dent warns that “we will see the deflation of three great bubbles — stocks, real estate and commodities — and the broader deleveraging of the greatest credit bubble in history.” And in “The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio,” Motley Fool co-founders David and Tom Gardner warn readers to “be skeptical of long periods of low volatility,” adding that such calm markets are “usually a signal that stormy waters might be just around the bend.”

Personal-finance gurus are also offering up more-conservative home-buying tips that may come too late for many readers. In “The Money Book for the Young, Fabulous & Broke,” published in 2005, Suze Orman recommended hybrid mortgages, which typically have a fixed interest rate for several years and an adjustable rate thereafter, saying they’re “smarter than a thirty-year fixed-rate mortgage if you intend to move within the next ten years.” In her new book, Ms. Orman writes that the ability to buy a home with a standard fixed-rate mortgage is a “requirement” for potential buyers. The fixed-rate mortgage is smarter, she says, “so you never have to worry about your payment rising.”

Shifting Advice

Advice on down payments is also shifting. In “Start Late, Finish Rich,” published in 2005, David Bach wrote, “People often think they need to come up with thousands if not tens of thousands of dollars in cash in order to get a mortgage. This is simply not true.” He added, “There are all sorts of programs sponsored by developers, lenders and even the government that can enable first-time homebuyers to finance as much as 95%, 97%, or even 100% of the purchase price,” going on to list a number of such programs.

But in “Fight for Your Money,” set to go on sale in March, Mr. Bach strikes a more conservative tone, warning readers, “Just because a bank or other financial institution might be willing to lend you a certain amount of money doesn’t mean you should take it all. Buying a house almost always costs more than you think it will.”

“I’ve never recommended financing all of your home,” Mr. Bach said in a recent telephone interview. “I’ve always suggested that ideally you put at least 10%, if not 20%, down.”