The 2017 Trends in Investing Survey

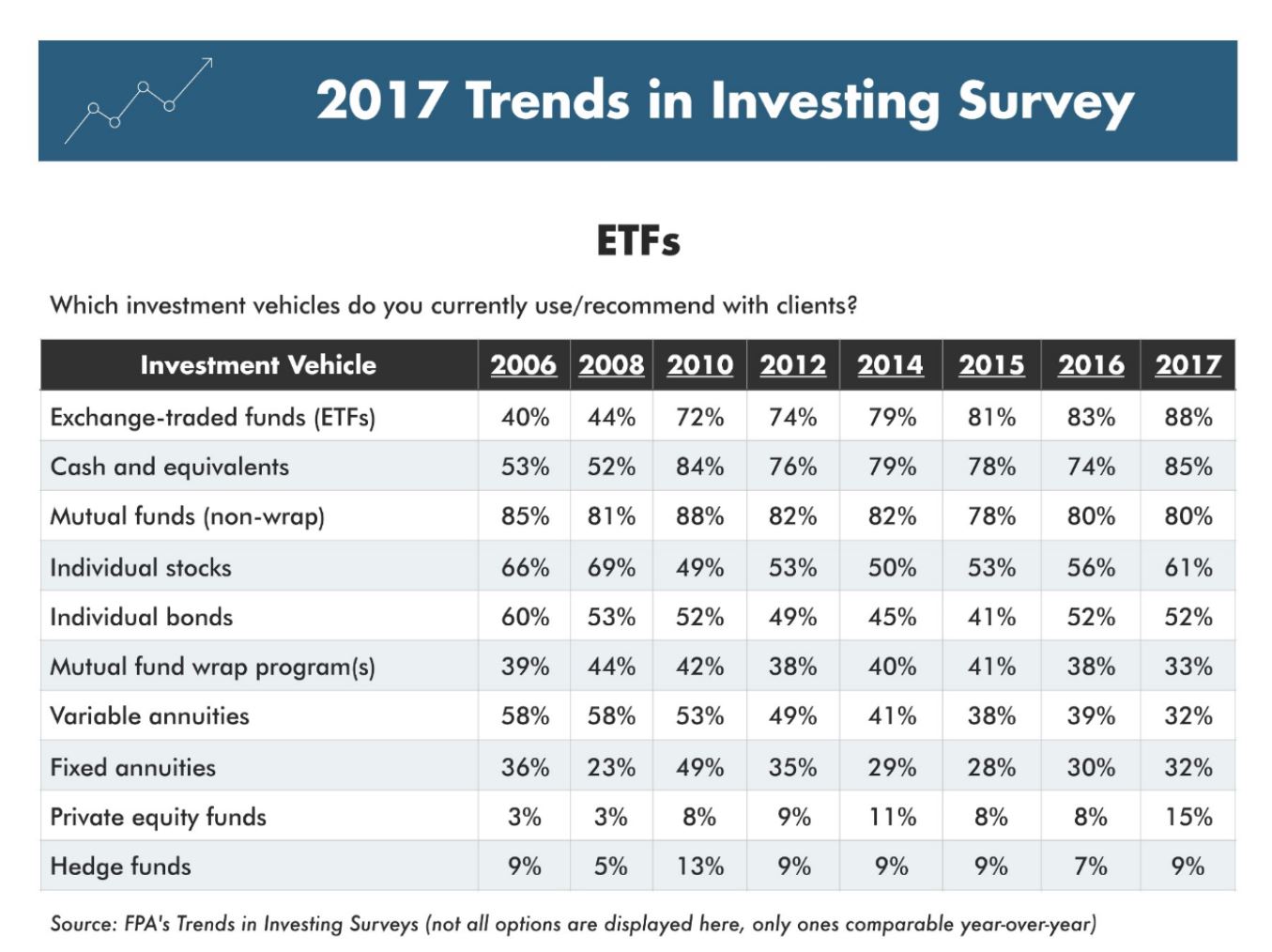

The Financial Planning Association® (FPA®) and the Journal of Financial Planning recently released the results of their annual “Trends in Investing Survey”. The survey includes responses from over 300 advisors of various backgrounds and shows advisor data on investments used, diversification, asset allocation, rebalancing and more. One of the most notable data points is the resounding preference of ETFs for the third year in a row.

In his role as Practitioner Editor for the Journal of Financial Planning, Dave assisted in the development and interpretation of the survey. Helping to shed some light on the survey, Dave shared his thoughts with CNBC reporter, Sarah O’Brien.

Regarding the popularity of ETFs for the third consecutive year, Dave shares:

“ETFs have gone from representing a very small part of [advisors’] tool kit to now representing a very significant part,” said certified financial planner David Yeske, managing director of Yeske Buie. “One of the things it suggests is that financial planners are ever more convinced that active management is hard,” said Yeske.

With the next most popular investment vehicle being cash and cash equivalents, Dave says:

As for the increase in cash-type investments, Yeske said it could signal that advisors are taking a more conservative stance on the market. “This makes me think that planners are feeling a sense of caution about the investment world and are building resilience in client portfolios,” said Yeske, who worked on the survey in his role as an editor at the Journal of Financial Planning.

For the first time, the survey explored portfolio diversification. Dave said of the results:

Yeske at Yeske Buie said that, in the short-term, it’s difficult to prevent portfolio volatility through diversification. “No matter how you diversify, everything will move [up or down] together in the short run,” Yeske said. “[…] diversity is more about achieving a certain amount of investment security and safety over the long-term.”