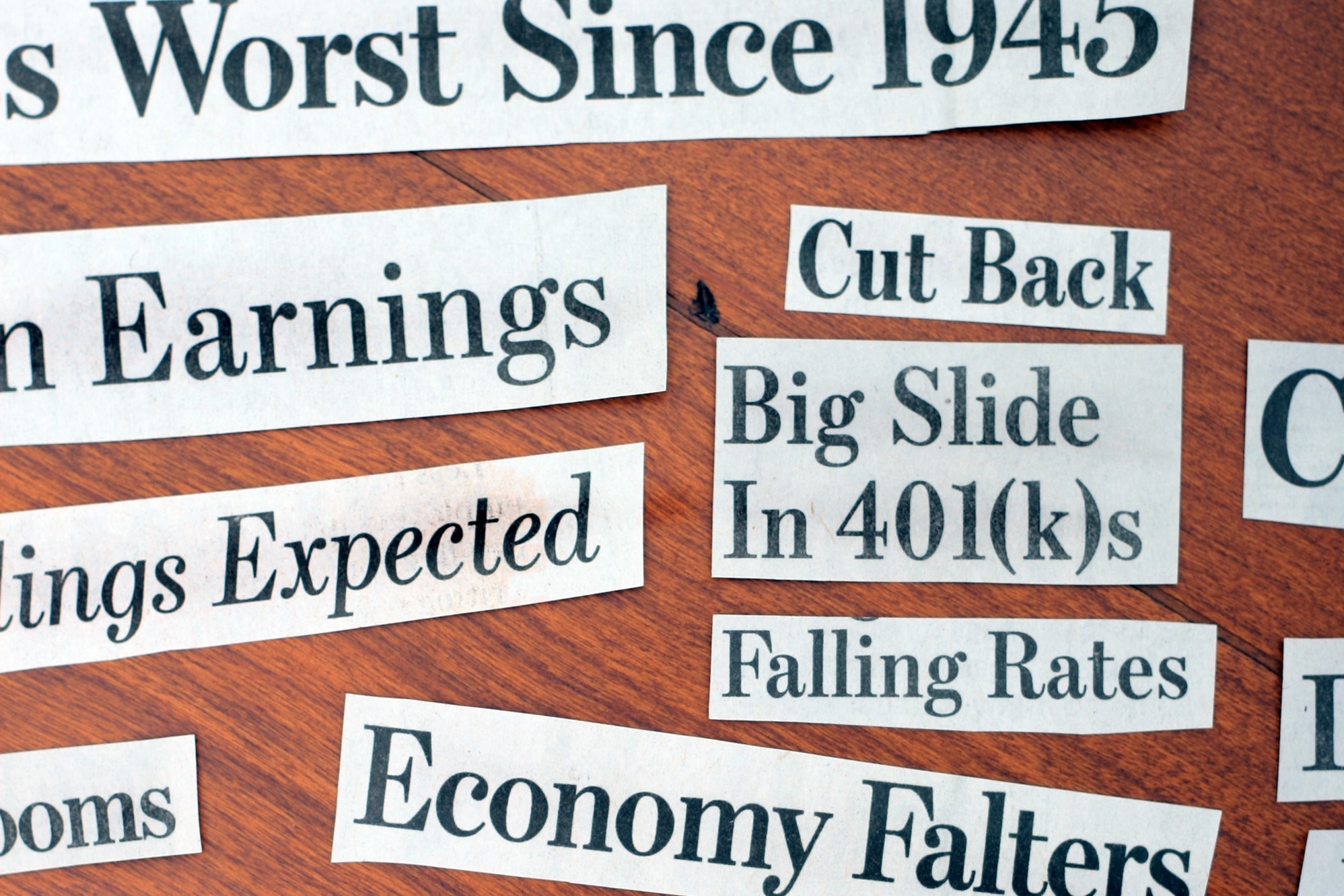

The Coronavirus Crisis vs. The Great Recession

It is a natural human activity to draw comparisons, and many have been evaluating the similarities and differences between the coronavirus crisis and the Great Recession. While both situations have some similar characteristics, there are many notable differences. A CNBC article featuring thoughts from Dr. Dave Yeske outlined the following major differences:

- Banks’ Roles Then and Now

- A Proactive Federal Reserve

- A Rapid Market Decline

Related to the actions of the Federal Reserve, the article argues that we’ve seen more government support during the coronavirus crisis than we did during the Great Recession. Dave emphasizes this point by sharing the following:

“The Fed and federal government showed up early and showed up big,” said CFP David Yeske, founder of Yeske Buie, a registered investment advisor. “They had to throw money at the problem.”

The third difference outlined in the article notes that while the market decline during the Great Recession lasted nearly 18 months, the decline during the coronavirus crisis happened in mere weeks. To this point, Dave shares:

“This is a great example of why you can’t try to time the market.”

Highlighting Yeske Buie’s investment philosophy, Dave adds:

“We build resiliency for our clients by diversifying among asset classes and building appropriate reserves. This doesn’t change our financial planning approach. We have an abiding faith that we will recover from this.”

To read the full article, please visit the CNBC website: Here are key ways the coronavirus crisis differs from the Great Recession.