How You Will Receive Your 1099

While YeskeBuie posts quarterly tax reports to your Client Private Page® for taxable accounts, these reports are for planning purposes only. To complete your tax return, please refer to the Schwab 1099 dashboard (see below for instructions on how to access it) for your Schwab 1099(s) for dividends, interest, and capital gains in your taxable account(s), and your 1099-R(s) for any distributions from your IRA(s). If any of the positions in your taxable accounts require a corrected 1099, Schwab will release them in late-February or early-March.

If you use the Schwab Alliance website, the screenshots and instructions below will help you locate the electronic report. If you have lost your paper copy or are having difficulties accessing the forms online, please do not hesitate to call our office at 800-772-1887 or send us an email and we will be happy to assist you.

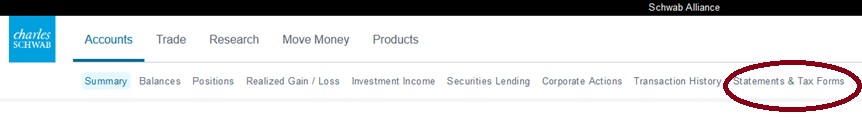

- Log in to Schwab Alliance.

- Select Accounts > Statements & Tax Forms.

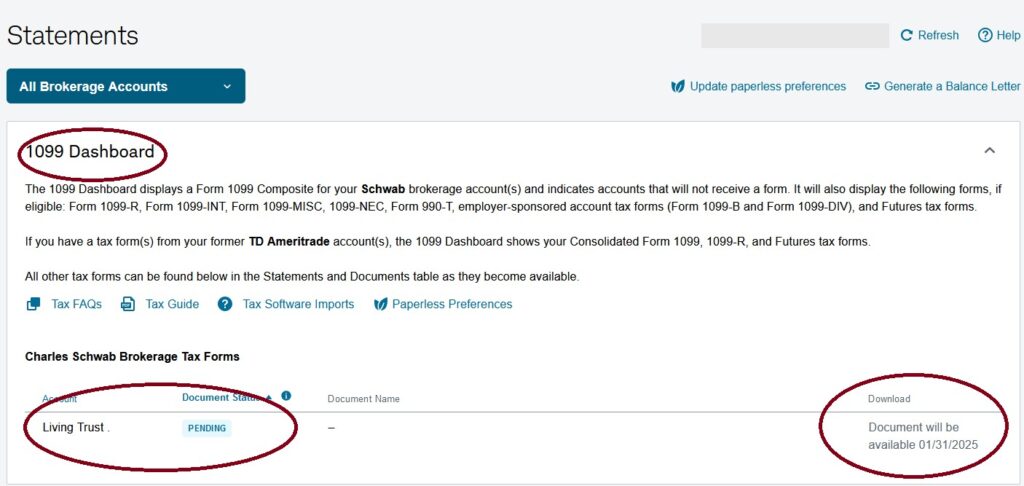

- The 1099 Dashboard will be the first section on that page – find your 1099s and 1099-Rs there.

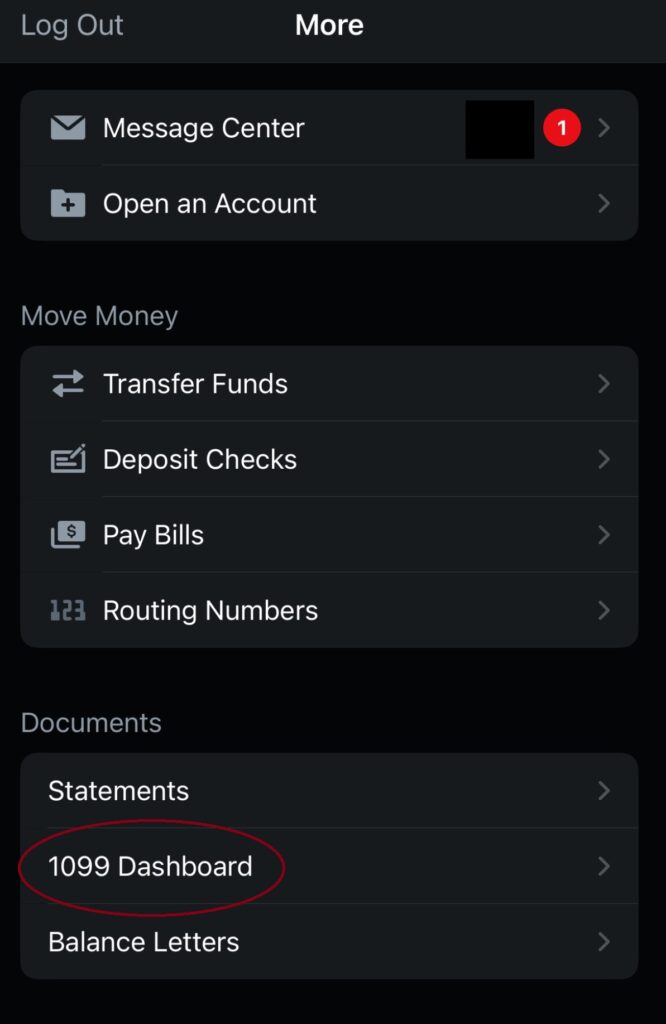

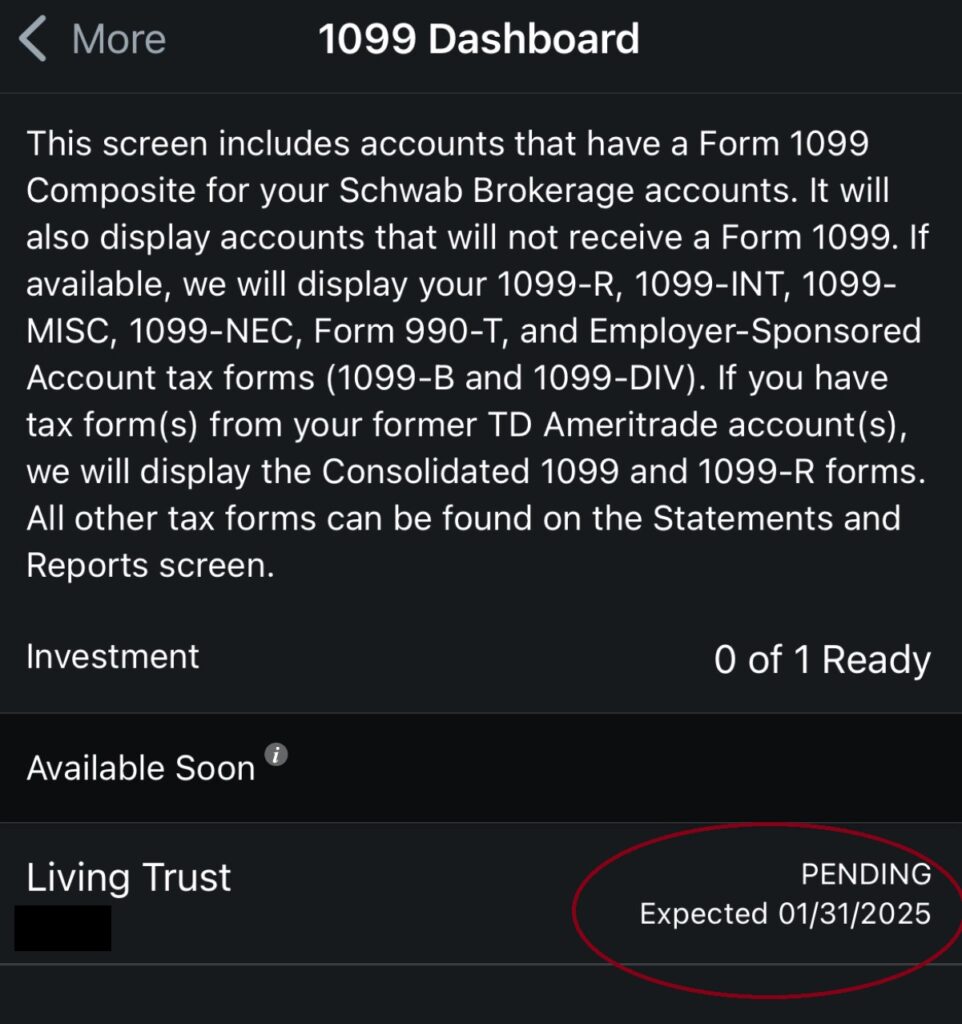

- If you’re on the mobile app, Select ‘More’ in the bottom right, then 1099 Dashboard.