Rounding Up the Gang at Far West

As has become an annual event, the Yeske Buie Financial Planning Team – minus Elissa and Dave who were living big on their African safari! – once again attended the Financial Planning Association’s Far West Roundup conference in Santa Cruz, California. At Far West Roundup, a smaller, more intimate conference compared to most, some of the brightest minds in the profession gather on the University of California’s Santa Cruz campus to discuss any and all topics related to financial planning.

While the conference is only three days long, the opportunities for learning are exponential. Over the long weekend, the team engaged in nine informational sessions that resulted in insights and takeaways that we hope to weave in to the work that we do for our Clients. Below, we share a summary of each of the nine presentations and highlight the key lessons gleaned from the experience of our peers. We hope you find the learnings as impactful as we do!

Session 1: Undue Influence Through the Eyes of The Victimizer — Glen Hammel, PhD

The conference sessions began with an entertaining and insightful presentation by Dr. Glen Hammel that sought to bring awareness to the unfortunate reality of artful manipulators that Clients and Financial Planners may encounter due to the nature of our work. The presentation emphasized the importance of the practical and interpersonal skills needed for assessing whether someone, such as a Client, has become a victim of such an influencer. Ryan Klemm shared the following takeaway from the presentation: “I learned that it is important to be aware of how people react to stressors including acts of manipulation, so that we can better understand our Clients and take action, when needed.”

The conference sessions began with an entertaining and insightful presentation by Dr. Glen Hammel that sought to bring awareness to the unfortunate reality of artful manipulators that Clients and Financial Planners may encounter due to the nature of our work. The presentation emphasized the importance of the practical and interpersonal skills needed for assessing whether someone, such as a Client, has become a victim of such an influencer. Ryan Klemm shared the following takeaway from the presentation: “I learned that it is important to be aware of how people react to stressors including acts of manipulation, so that we can better understand our Clients and take action, when needed.”

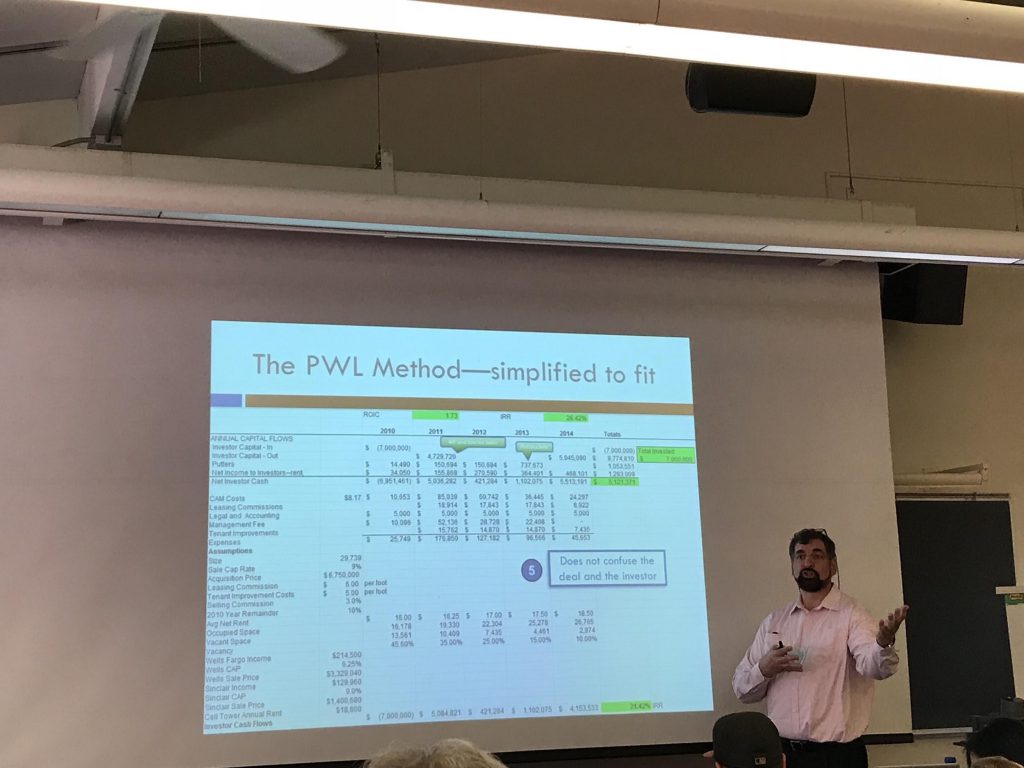

Session 2: PE Surgery 101: Dissecting Real Estate Deal Terms – Martin Stever

Martin’s session was a discussion about things to keep in mind when Clients are involved in a real estate deal, including exploring the terms of the deal to ensure that all the associated costs and fees are understood. Martin noted that this is especially important when there is a jungle of legal verbiage written into the deal. Cole DeLucas found this session to be quite informative and noted that, “This session reminded me of the importance of being able to help a Client explore the factors of any big decision. We like to be a Client’s “first call” when faced with a big decision and that is a responsibility that I do not take lightly.

Martin’s session was a discussion about things to keep in mind when Clients are involved in a real estate deal, including exploring the terms of the deal to ensure that all the associated costs and fees are understood. Martin noted that this is especially important when there is a jungle of legal verbiage written into the deal. Cole DeLucas found this session to be quite informative and noted that, “This session reminded me of the importance of being able to help a Client explore the factors of any big decision. We like to be a Client’s “first call” when faced with a big decision and that is a responsibility that I do not take lightly.

Session 3: A Thousand Insights into Long Term Care Insurance (more or LESS) – Claude Thau

Claude’s presentation on the topic of long-term care offered new perspectives that helped the session attendees explore important considerations when making a recommendation for a Client. These considerations included current health status, pricing trends, combination vs. stand-alone insurance, and more. Claude reinforced these ideas with case studies that argue the benefits of buying insurance now as premiums continue to increase. The team will certainly keep these studies in mind when exploring long-term care insurance with our Clients.

Claude’s presentation on the topic of long-term care offered new perspectives that helped the session attendees explore important considerations when making a recommendation for a Client. These considerations included current health status, pricing trends, combination vs. stand-alone insurance, and more. Claude reinforced these ideas with case studies that argue the benefits of buying insurance now as premiums continue to increase. The team will certainly keep these studies in mind when exploring long-term care insurance with our Clients.

Session 4: Harnessing the Opportunity of Responsible & Impact Investing – Andrew Olig

Responsible investing, an investment strategy that seeks to consider both financial return and social and environmental good, has been of growing interest to many in the profession. Socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity, and avoid investing in businesses involved in alcohol, tobacco, fast food, gambling, weapons etc. Andrew’s presentation offered insights on factors that are used to screen socially responsible investments. Alishia DuBois said of the presentation, “I appreciated Andrew’s insights on this topic and I now feel better able to talk with our Clients about this approach to investing.”

Responsible investing, an investment strategy that seeks to consider both financial return and social and environmental good, has been of growing interest to many in the profession. Socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity, and avoid investing in businesses involved in alcohol, tobacco, fast food, gambling, weapons etc. Andrew’s presentation offered insights on factors that are used to screen socially responsible investments. Alishia DuBois said of the presentation, “I appreciated Andrew’s insights on this topic and I now feel better able to talk with our Clients about this approach to investing.”

Session 5: Pirates without Borders – Steve Ryder

Steve entertained the Far West crowd with a very informative session about the severity of security breaches and the danger of cybercrime. Steve shed light on the issues that some small advisory firms might encounter when faced with protecting their Clients. Cole DeLucas found the presentation to be very informative and encouraging as he compared Steve’s insights to the great strides that Yeske Buie takes to protect our Clients from outside threats: “Steve shared some amazing insights on everyday threats a Financial Planning firm faces, and one of my favorite aspects of our firm is the seriousness that surrounds our compliance efforts. Our Clients’ safety is our number one priority!

Steve entertained the Far West crowd with a very informative session about the severity of security breaches and the danger of cybercrime. Steve shed light on the issues that some small advisory firms might encounter when faced with protecting their Clients. Cole DeLucas found the presentation to be very informative and encouraging as he compared Steve’s insights to the great strides that Yeske Buie takes to protect our Clients from outside threats: “Steve shared some amazing insights on everyday threats a Financial Planning firm faces, and one of my favorite aspects of our firm is the seriousness that surrounds our compliance efforts. Our Clients’ safety is our number one priority!

Session 6: The Most Important Asset is You…Approaches to Investing in the Portfolio of Your Life — Nancy Akalin, PhD & Murat Akalin, MD

We can summarize Dr. Nancy and Murat Akalin’s presentation in three words… health is wealth! This presentation emphasized the importance of finding balance in life as a way to improve focus and deal with stress. Nancy and Murat used the below acronym to help attendees remember the importance of self care: AWAKENING. Alishia DuBois particularly enjoyed this session, adding the comment: This session was hands down my favorite one. Just as a balanced portfolio is essential to optimize long-term gains, so is a balanced life.”

We can summarize Dr. Nancy and Murat Akalin’s presentation in three words… health is wealth! This presentation emphasized the importance of finding balance in life as a way to improve focus and deal with stress. Nancy and Murat used the below acronym to help attendees remember the importance of self care: AWAKENING. Alishia DuBois particularly enjoyed this session, adding the comment: This session was hands down my favorite one. Just as a balanced portfolio is essential to optimize long-term gains, so is a balanced life.”

- Authenticity: To inspire you to make a positive change

- Why: This reminds us that what we do important to us

- Action: When you want to make a change, be intentional, create powerful action steps, and follow through

- Keep Focus: Keep what is really important in-sight

- Ease: Find ease through meditation or spirituality

- Network: Network or connect in an authentic way

- In Gratitude: Be conscious, be grateful

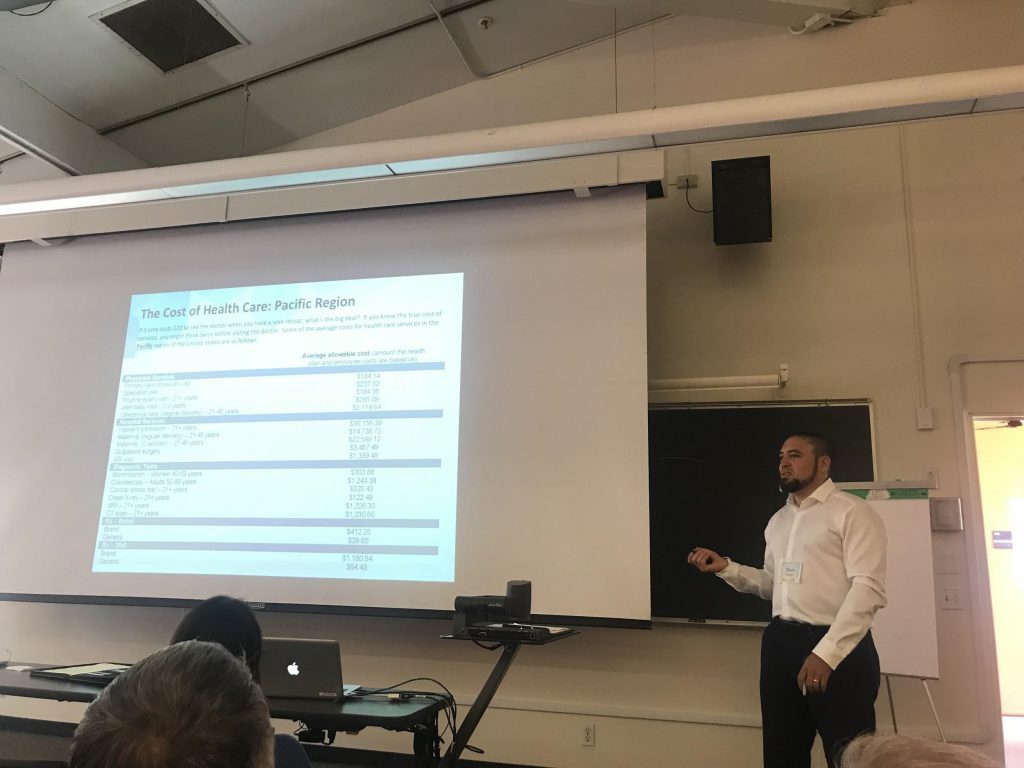

Session 7: Early Retirement: The Health Coverage Challenge – Matt Lemen

Matt explored the importance of health coverage due to rising costs of health care services and premiums and the shrinking numbers of early retirees being offered employer sponsored coverage. Matt went into great detail to teach the Far West participants about retiree benefits, COBRA, the individual and family plan market, small group insurance, independent health care programs, and more. Matt added that the emergence of the Affordable Care Act has been one of the reasons that fewer and fewer employers are offering retiree benefits. The team feels that presentations like Matt’s help ensure we stay up-to-date on the realities our Clients may be facing.

Matt explored the importance of health coverage due to rising costs of health care services and premiums and the shrinking numbers of early retirees being offered employer sponsored coverage. Matt went into great detail to teach the Far West participants about retiree benefits, COBRA, the individual and family plan market, small group insurance, independent health care programs, and more. Matt added that the emergence of the Affordable Care Act has been one of the reasons that fewer and fewer employers are offering retiree benefits. The team feels that presentations like Matt’s help ensure we stay up-to-date on the realities our Clients may be facing.

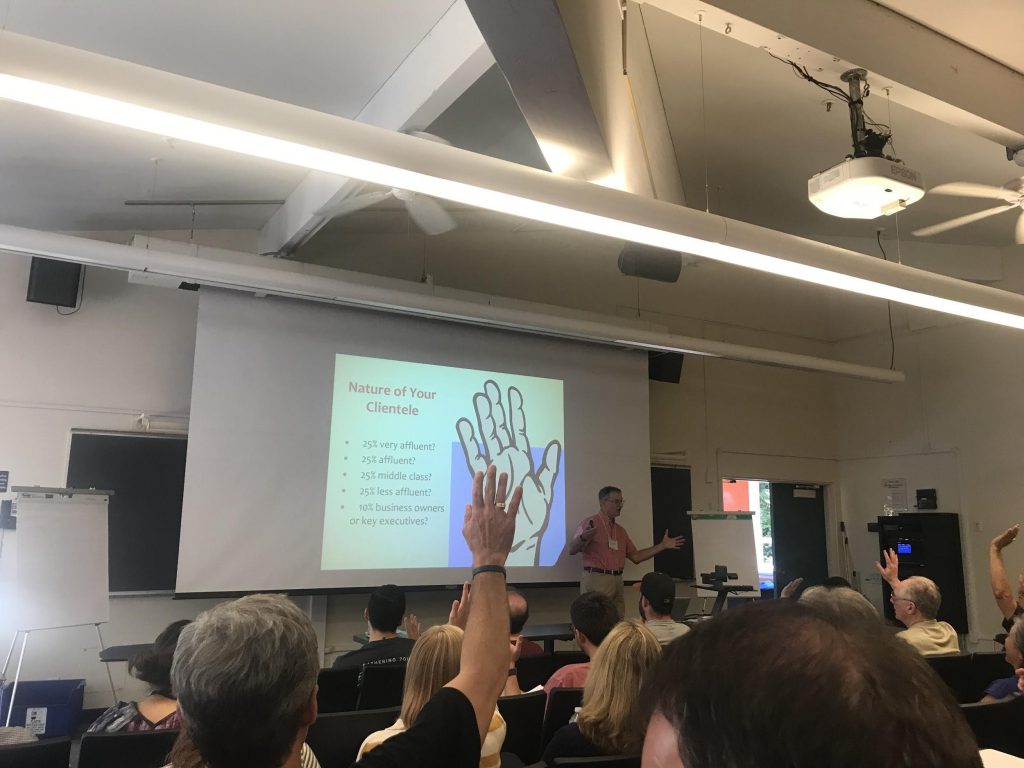

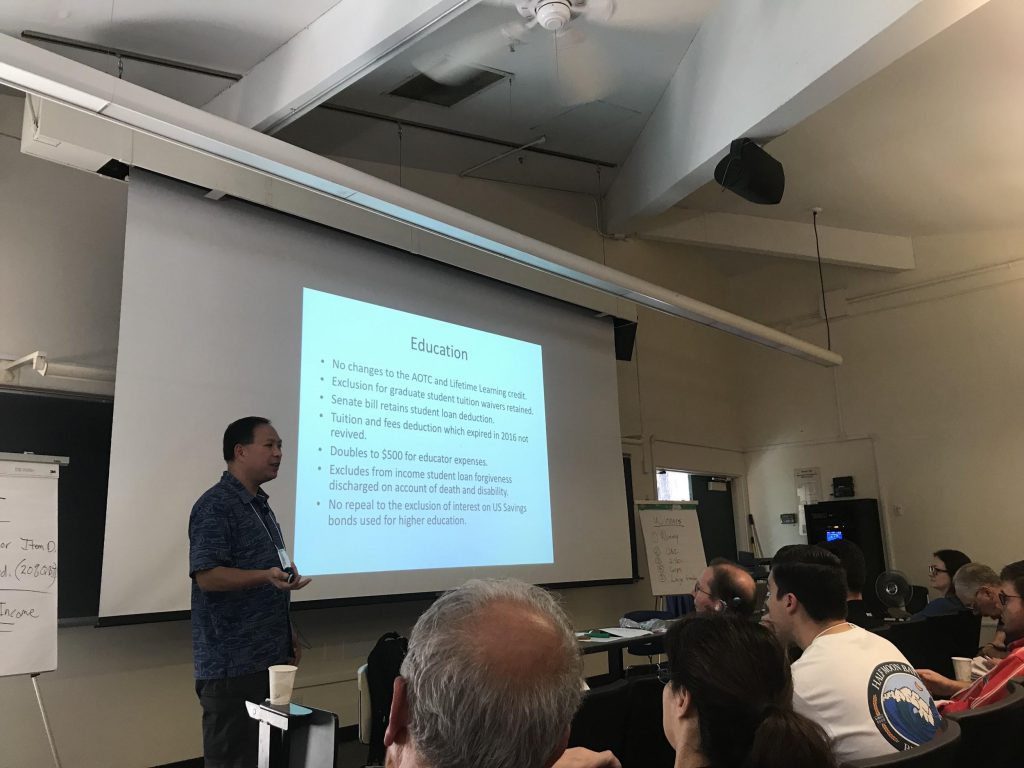

Session 8: Be a Hero to your Client with Smart Tax Planning — Larry Pon

It can be difficult to make tax planning entertaining, but presenter Larry Pon succeeded! Larry’s presentation used real case studies to help attendees gain a greater knowledge of the 2018 tax laws, and he added a Big Bang Theory theme to sprinkle in a bit of humor. Despite the humor, Larry touched on very important aspects of the new tax laws including the new code for small businesses, considerations for Roth conversation analyses, and a “win-win” opportunity to fund favorite charities. Karen Simons found the presentation to be exceptionally helpful, sharing: “I thought Larry did an excellent job of comparing the change in the old tax laws with the new, and helped us gain a deeper understanding of a lot of the changes that took place with this transition”.

It can be difficult to make tax planning entertaining, but presenter Larry Pon succeeded! Larry’s presentation used real case studies to help attendees gain a greater knowledge of the 2018 tax laws, and he added a Big Bang Theory theme to sprinkle in a bit of humor. Despite the humor, Larry touched on very important aspects of the new tax laws including the new code for small businesses, considerations for Roth conversation analyses, and a “win-win” opportunity to fund favorite charities. Karen Simons found the presentation to be exceptionally helpful, sharing: “I thought Larry did an excellent job of comparing the change in the old tax laws with the new, and helped us gain a deeper understanding of a lot of the changes that took place with this transition”.

Session 9: The REAL Household CFOs of Santa Cruz County — Sarah Fallaw, PhD

The last session of the conference was presented by Sarah Fallaw and discussed how the field of industrial psychology can help advisors understand and coach Clients on the topic of financial management. As one example, Sarah shared how her industrial psychologists are challenging the way advisors and Clients think about risk tolerance assessments. Sarah also spoke about the importance of being in tune with our Clients on a behavioral level to truly understand how they approach their finances. At Yeske Buie, we aim to understand our Clients down to their core, and Sarah’s presentation validated the importance of this practice and left us feeling even more confident in our own personal technique of becoming familiar with each Client’s motives with money.

The last session of the conference was presented by Sarah Fallaw and discussed how the field of industrial psychology can help advisors understand and coach Clients on the topic of financial management. As one example, Sarah shared how her industrial psychologists are challenging the way advisors and Clients think about risk tolerance assessments. Sarah also spoke about the importance of being in tune with our Clients on a behavioral level to truly understand how they approach their finances. At Yeske Buie, we aim to understand our Clients down to their core, and Sarah’s presentation validated the importance of this practice and left us feeling even more confident in our own personal technique of becoming familiar with each Client’s motives with money.

While the team has since returned to their respective offices, the experiences shared and knowledge gained during our weekend in Santa Cruz will remain. We look forward to using some of the ideas discussed to help better serve all of our Clients.