Inflation – Still Not Spooked (Seriously)

Yet again – inflation is the economic topic du jour after this month’s year-over-year CPI reading clocked in at 5.4%, an increase of 0.4% since last month.

We touched on this during our webinar at the end of last month – we tend to agree with the Fed’s assertion that this is a transitory phenomenon. And we appreciate that assertion has come under fire as price increases have continued over the past few months. And so we’d like to spend some time in this space digging into some of the underlying causes of inflation (or at least the culprits currently getting the most attention), the measures the Fed uses to decide if it’s time to do something about rising prices, and, of course, what this all means for our Clients.

First, let’s dive into the drivers of inflation. Supply-chain issues have been getting a ton of press throughout the pandemic, and even more so lately. We thought this piece by Andy Serwer of Yahoo!Finance did an excellent job capturing the shipping crisis, which is currently at the center of the worldwide supply-chain drama. Supply-chain disruptions like shipping delays lead to higher costs for producers, who pass those costs on to consumers by raising prices. This is part of the inflation story.

Then there’s the global energy crunch. Oil is trading above $80/barrel and the national average price for gasoline hit a seven-year high this week. What’s behind the surge in prices? Demand for energy is back as the world economy continues to ramp up activity, but supply hasn’t kept up. When demand outstrips supply, prices rise. This is another part of the inflation story.

And on top of that, there’s the labor market. There are over 10 million available jobs in the US at the moment, and employers are struggling to fill those positions. That means the leverage is in the hands of the laborers, who can afford to leave their jobs for greener pastures with confidence they’ll find a new gig rather quickly. And people are quitting their jobs at higher rates than ever. This could lead to wages being pushed higher, which could ultimately lead to higher prices if companies pass those costs on to their customers. This is yet another part of the inflation story.

And it is here that we’ll emphasize the word “story”. Bad news sells. And the causes above are all facts. And so is this: the two-year inflation rate is 2.5%. In other words, if we zoom out and appreciate that each of the drivers described above are occurring as a direct response to the pandemic, and we adjust our measurement window to look at where prices were before the pandemic began, then we can say that inflation has increased by 2.5% annually for the past two years (related: the Fed’s target rate for inflation is 2%). Not exactly clickbait, is it? But it is an important part of the story.

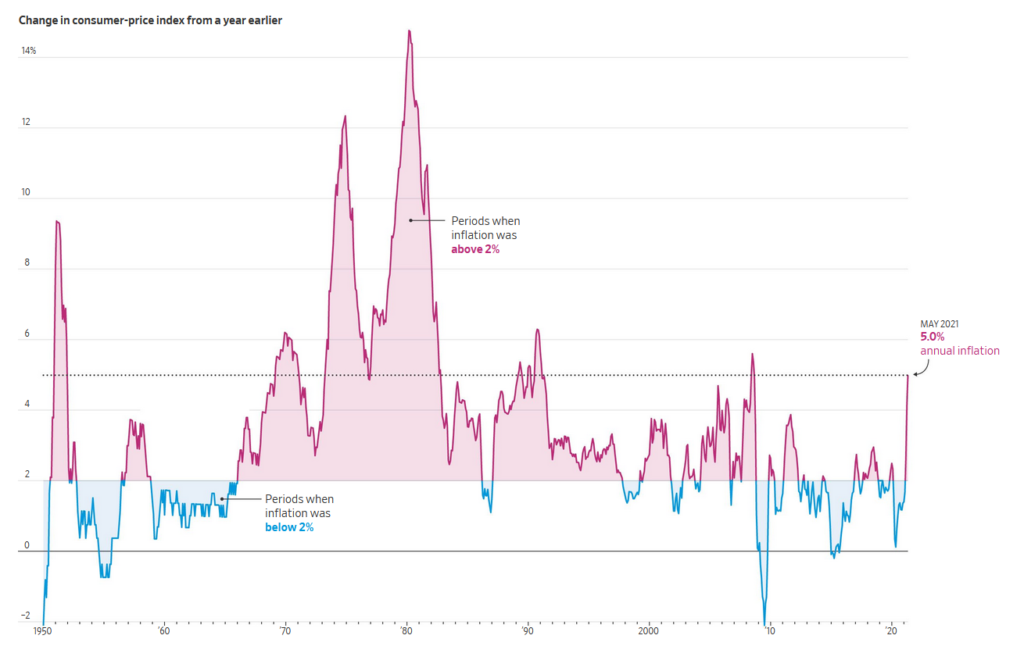

So much of the uproar about inflation has centered around the Fed’s assertion that what we’re observing is transitory (definition: of brief duration; temporary; not persistent). The Wall St. Journal published this chart earlier this year, which illustrates the time periods when inflation has been above 2% since 1950:

We can observe the following:

- Inflation ran above 2% for almost 30 years straight (from the late ‘60’s to the late ‘90’s), and nearly have of that time period occurred after former Fed Chair Paul Volcker “killed” inflation;

- The last 13 years are more of a historical anomaly than the norm (and inflation has been extremely low because interest rates have been low since the height of the Great Recession in 2008-09);

- The dramatic increase in prices over the past few months has literally only been for a few months (and has leveled off at ~5% since hitting that level in May).

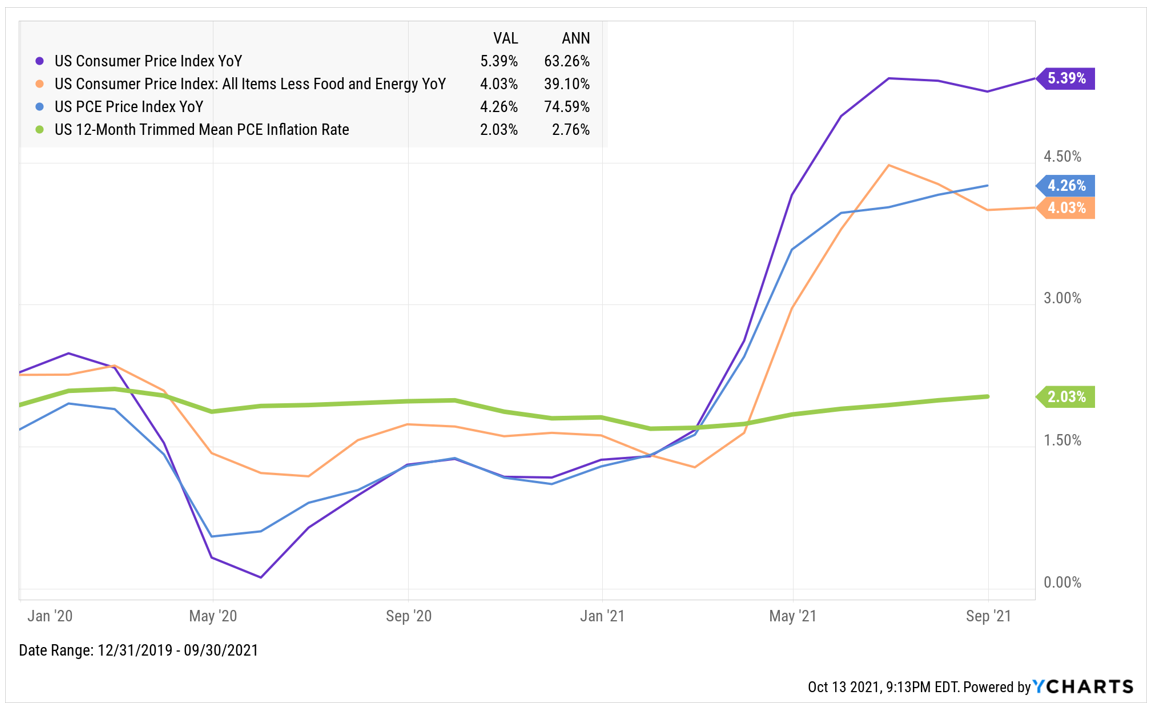

And we should note that up to this point in this post, we’ve been focused on inflation as measured by CPI (the Consumer Price Index), which is often described by economists as a “noisy” statistic (read: it’s influenced by variables that make it a less-than-completely-reliable measure of price levels). That’s why economists also look at Core CPI (CPI minus food and energy, two of the most volatile inputs) to add more context to the inflation story. Core CPI rang in at 4.0% (almost 1.5% lower than CPI) and was unchanged from the previous month’s reading. More not-clickbait.

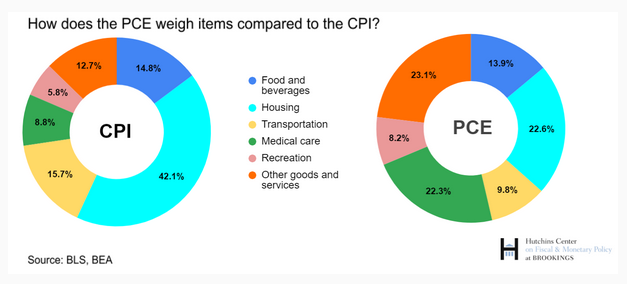

The Fed, however, actually favors a different measure of inflation as its measuring stick. The Fed uses the Personal Consumption Expenditures price index (PCE), defined as “a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.”

What’s the difference between CPI and PCE? The Brookings institute put together this chart, which does a nice job comparing the two statistics:

And, just as with CPI, there’s a “less-noisy” version of PCE that economists can look to for more perspective on price level fluctuations – Trimmed Mean PCE. Here’s a chart comparing the four measures of inflation since the beginning of the year:

So, if you filter out all the noise, one could reasonably observe that a measure of core inflation would indicate that prices are rising at levels consistent with the targets of the United States’ central bank. Again, extremely not-clickbait-y, but maybe a bit reassuring. And given all the negative press these days, isn’t a bit of reassurance a welcome addition to the inflation story?

So what do we make of all this? We can safely say that while it ain’t all good, it ain’t as bad as it looks, either. And regardless of how bad things may seem, we can say with confidence that this too shall pass. Prices are supposed to rise. Interest rates are supposed to be higher than they are now (basically 0%). Economies and markets go through cycles; things get out of whack, then settle down, then get out of whack again, and then ultimately settle down again (emphasis on the word “cycle”). The pandemic isn’t over, but we’re closer to the end than the beginning. And while it hasn’t felt brief, in the grand scheme of things two years could be reasonably defined as a brief period of time. And if the ripple effects are ironed out a couple years after things bottomed out in markets and the economy last spring, that would still be a faster recovery than we experienced after either of the past two recessions. In fact, it already has been a dramatically faster recovery in comparison to the last two, which is part of the reason we’re dealing with this issue in the first place – the speed of the economic recovery has been a chief factor on both the supply and demand side of the equation, ultimately driving prices higher (for now).

We also know this: human beings are ingenious and incentivized to improve their welfare. That’s why we developed vaccines. That’s why we found ways to connect even when we couldn’t be together. And it’s why there won’t always be a backlog of dozens of shipping containers off the coast of California. And why it won’t always take months and months for that appliance you just ordered to arrive at your home. We face challenges, and then we come up with creative ways to deal with them.

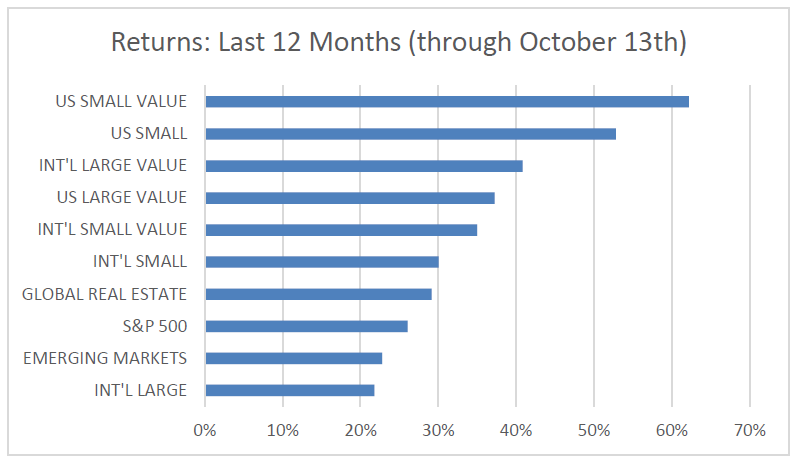

Finally, we can also say with confidence that our Clients are positioned well for whatever may come. Part of that confidence comes from the science behind our approach to managing their investments in the face of the never-ending uncertainty the world offers up. And part of that confidence comes from how our portfolio has performed in the face of this most recent challenge. If you’ve made it this far, we offer this report from earlier this week, which notes that small company stocks, value stocks and real estate tend to do well in periods of higher inflation/rising rates. You don’t say?

As our Clients and readers of this blog know, our globally diversified portfolio is tilted towards small company and value stocks. The premia associated with those investments have been persistent throughout the past 100 years, and have certainly been observable over the past two years. What has always worked will continue to work: a disciplined approach that considers current information within a broader context rewards patience and perspective. That’s the story we’re sticking to.

So, we’ll see what next month brings. Until then, we recommend getting an early jump on your holiday shopping – we’ve heard prices are going up and shipments have been delayed recently…