How to Read and Understand Your 1040

Let’s face it — tax forms aren’t exactly beach reading. But understanding your tax return doesn’t have to feel overwhelming. When you understand what’s behind the numbers — your income, deductions, credits, and more — you can gain a clearer picture of your financial life and how decisions you make throughout the year can impact your taxes. In this guide, we break down some of the most important lines on the form with simple explanations and helpful visuals to make it all feel a little less taxing.

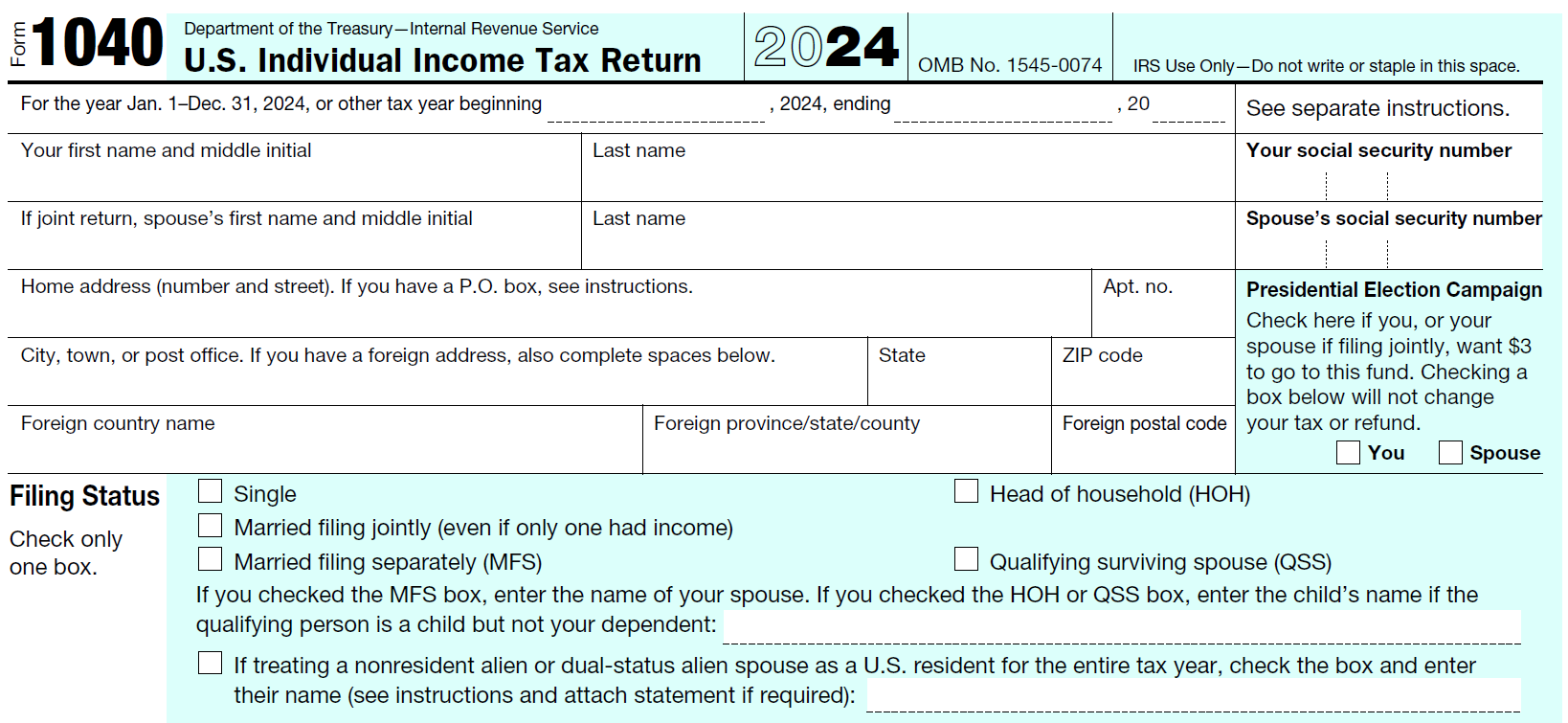

Personal Information and Filing Status

Your 1040 begins with filling out objective information such as your name, address, and Social Security Number. Then, you’re prompted to select a filing status. There are five different tax filing statuses in the U.S.:

1. Single

2. Married Filing Jointly

3. Head of Household

4. Qualifying Surviving Spouse

5. Married Filing Separately

If you’re unsure which filing status you fall under, Yeske Buie recommends reaching out to your CPA or Tax Professional to determine which applies, as there are specific guidelines to each one.

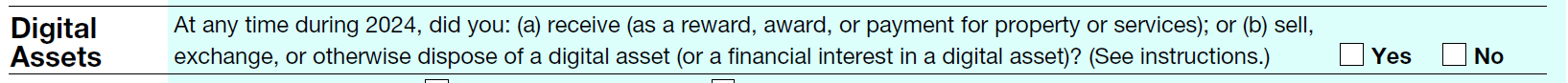

Digital Assets

According to the IRS, digital assets are generally anything created and stored digitally that provides value, such as convertible virtual currencies, cryptocurrencies, and non-fungible tokens (NFTs). The IRS treats digital assets as general property that are taxable, if you’re wondering why this is included on your return.

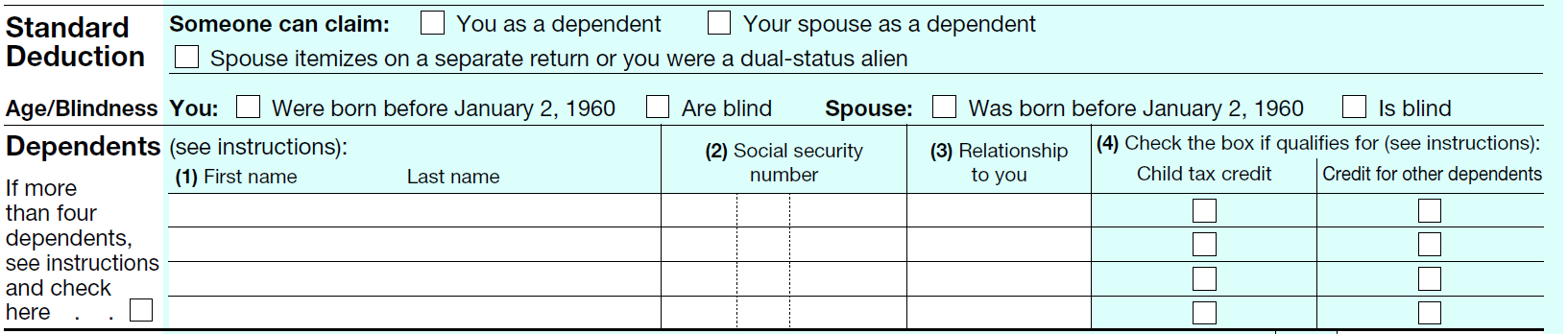

Standard Deduction and Dependents

The following sections, regarding your standard deduction and dependents, directly affect how much of your income is taxed. You can think of the standard deduction as a set amount that the IRS lets you subtract from your income, thereby lowering the amount of income taxable to you. The amount of your standard deduction depends on a few factors, including your filing status, age, and blindness (and, if you’re interested in the history behind how the deduction for the blind came into existence like we were, this article from Slate explains it well).

The dependents section lets the IRS know who relies on you financially. Claiming dependents (whether that be your children, or maybe other family members who rely on you for most of their financial support), can allow you eligibility for tax credits and potential tax refunds, both of which could lead to savings.

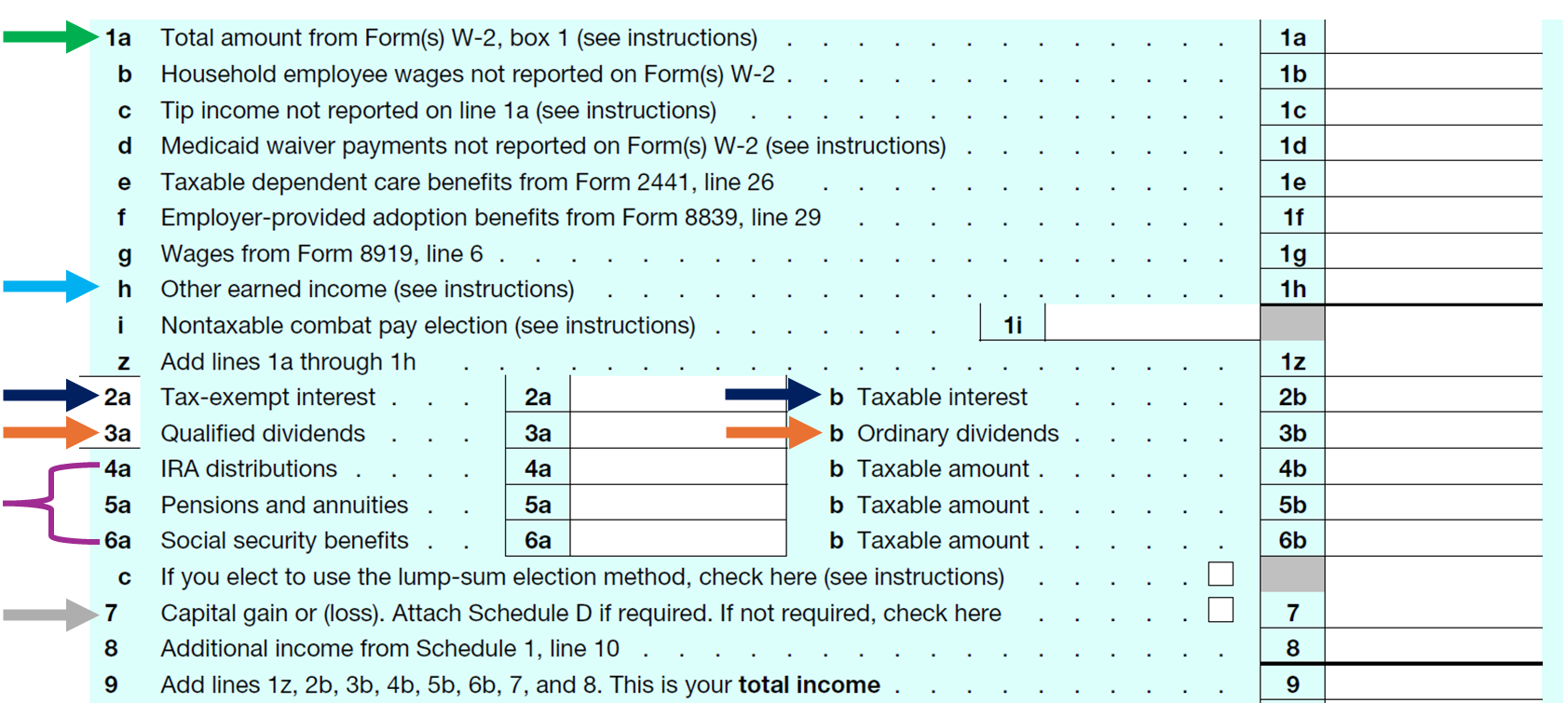

Income

Moving to the largest section of the 1040, this is where all types of your income are reported. Let’s learn more about some of the most common sources of income.

- Wages: Often the main source of income, first on the list is your wages (green arrow), reportable from sources where you may work as a regular employee, directly hired by a company to complete work for them. Wages can include bonuses and/or any compensation you receive beyond your regular salary.

- Interest Income: The next most common item is interest income (navy blue arrows), which, at its most basic level, is defined as the income someone receives from lending money to someone else. There are two types of interest income, including taxable and tax-exempt. Most interest falls under the taxable interest category and includes things like savings account interest (think of the money you earned on that high-yield savings account this year!), Certificate of Deposit interest, and interest from taxable bonds. Tax-exempt interest is free from taxes at the federal and/or state level. Some examples include municipal bond interest or Treasury bond interest.

- Dividend Income: Next on the 1040 is your dividend income (orange arrows), produced when a company distributes a portion of its profits to shareholders. Your account custodian will issue an annual 1099, which includes your reportable qualified or ordinary dividend income. The difference? Qualified dividends are often taxed at lower/preferential rates, whereas ordinary dividends are taxable at ordinary income rates.

- Retirement Income: For those who may be taking distributions from hard-earned retirement savings, you may see income reported on your IRA Distributions, Pensions and Annuities, and/or Social Security Benefits lines (purple bracket). Additionally, there are spaces included to report taxable and non-taxable portions of those distributions, which depends on many circumstances such as income, filing status, and types of contributions made. Yeske Buie recommends getting in touch with your tax professional for specific guidance on the taxable amounts of your IRA Distributions, pensions and annuities, and Social Security benefits.

- Capital Gain (or loss): Moving to your net capital gains or losses (gray arrow), these are reported from selling investments or property throughout the tax year and are calculated in detail on your Schedule D. Gains and losses may be from stocks, mutual funds, real estate, or other capital assets. Note that if you do have a net capital loss, you can only deduct up to a certain amount against your income per year.

- Other Income: Lastly, there is a line specifically for other income (light blue arrow), which captures the income that may not have been included in the above sections, such as business income, rental property income, self-employment income, unemployment compensation, alimony received, gambling winnings, or potential taxable distributions from your Health Savings Account, to list a few.

The sum of the above sources of income equals your total income.

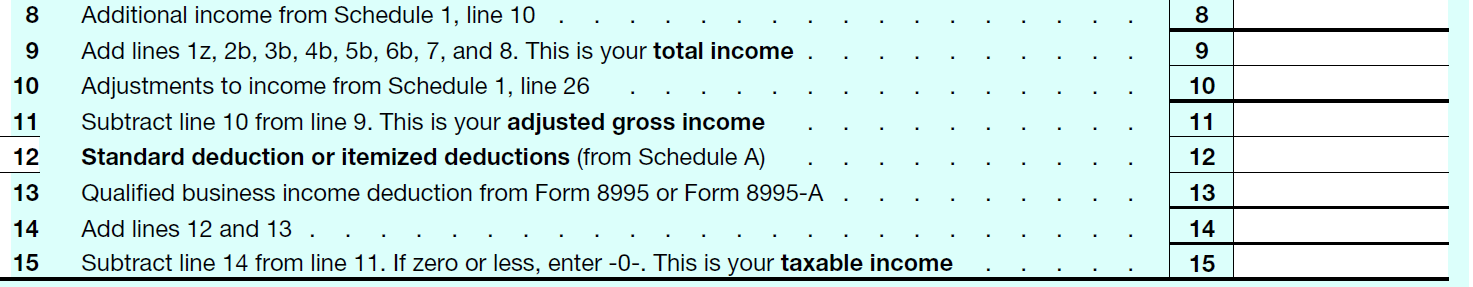

Adjusted Income

This brings us into our next section, which includes adjustments made to your income, as well as your deductions to income.

The above lines focus on the applicable deductions and adjustments, which ultimately bring you to the amount of income you’re going to be taxed on. Included below is a brief list of common potential deductions that may apply to you, which can also be found in your Tax Schedule 1:

- HSA deductions

- Deductible self-employment taxes

- SEP contributions

- Self-employed health insurance deduction

- IRA deductions

- Student loan interest deduction

After subtracting the amount of income adjustments, your adjusted gross income, or AGI, is the result. From there, subtracted is the higher of your standard deduction or itemized deductions, as well as any qualified business deduction if you’re self-employed, and the result is your taxable income.

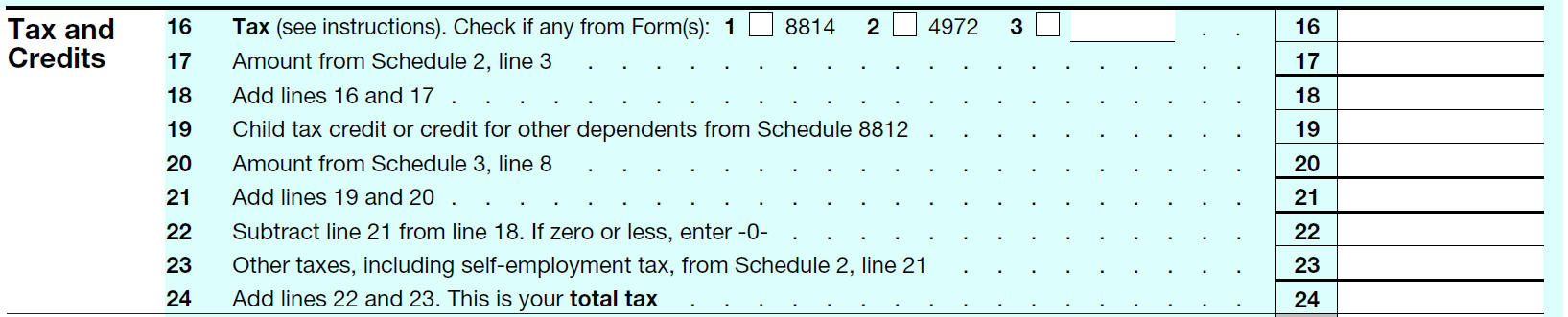

Tax and Credits

In calculating your taxes, the IRS posts annual tax rate schedules that allow you to see what marginal tax bracket you fall into, as well as how to calculate your total taxes due. Then, added to that are any additional taxes from Schedule 2, such as alternative minimum taxes, self-employment taxes, or household employment taxes.

If you’re eligible for any nonrefundable tax credits for your qualifying children or dependents, the IRS allows you to subtract this amount from your taxes due, as well as other credits such as foreign tax credits, retirement savings contributions credit, education credits, clean vehicle credits, and education credits, among others.

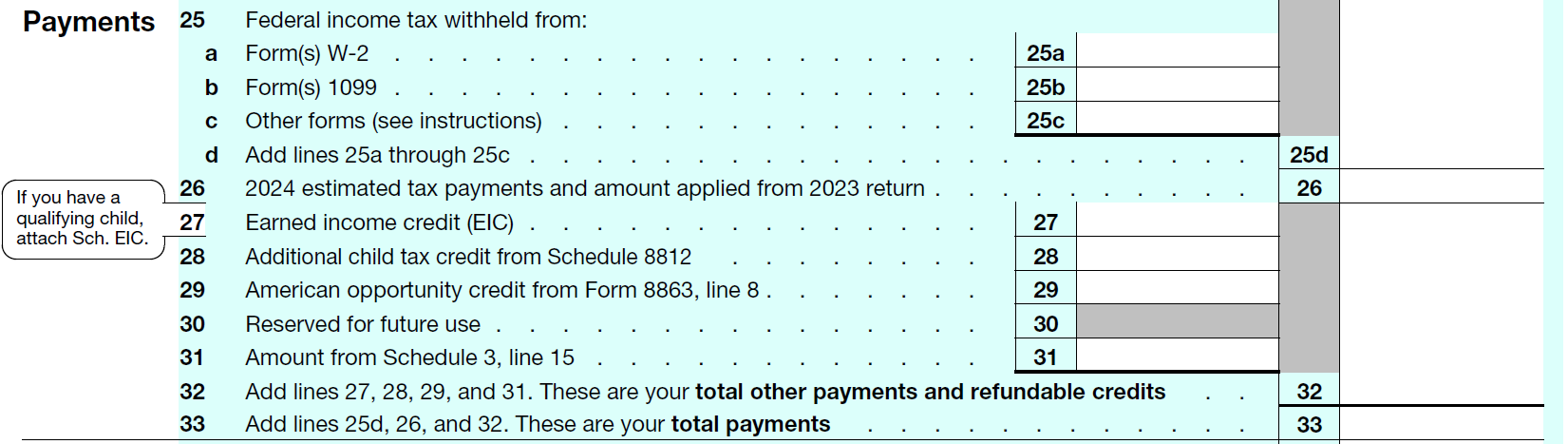

Payments

This section essentially serves as a record of how much you have already paid towards your total tax liability, and includes taxes withheld from your paychecks, estimated tax payments, and/ or an amount from last year’s return (if you overpaid and elected to apply that payment to your current year’s taxes).

Additionally, refundable credits are included in this section and act like payments that were already made towards your tax bill. Even if you owe zero taxes, you can still get money back because these credits are treated like prepaid taxes. Such credits include the Earned Income Tax Credit, American Opportunity Credit, and potential additional Child Tax Credit for those who didn’t get the full nonrefundable Child Tax Credit due to low income.

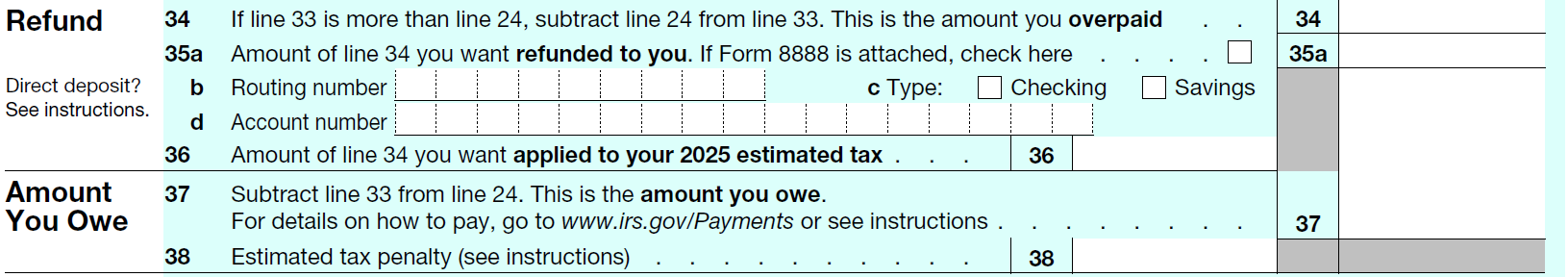

Refund or Amount Owed

If the IRS owes you money, meaning you paid more than what you owe in taxes, you’ll get a tax refund. If the opposite is true, you owe the IRS money. A big refund likely means that you overpaid your taxes during the year, and owing a large sum of money may mean that you did not withhold enough income for taxes, which could lead to penalties if large enough.

A solid grasp of the 1040 can help you to make more informed and strategic decisions. And, there are unique circumstances to each individual’s return, which may include details listed that have not been included in this article such as variations of the form 1040 or the additional forms and schedules you may be required to complete.

As financial planners, we’re constantly thinking of ways to best prepare for each Client’s unique tax situations to help align strategies with long-term financial goals. If you have any questions or concerns, we’re happy to collaborate with your tax professionals to help guide you in making proactive and tax-smart decisions throughout the year.