Live Big® Maps: Your Goals Come to Life

Financial planning derives its greatest value from a deep relationship between a planner and the Client. We’ve written about the importance of our discovery process before and the behavioral science research behind it. As a product of our discovery process, we assemble the Live Big® Map, which summarizes the goals and priorities that are most important to you. In this article, we dive a bit deeper into our Live Big Maps – how they’re constructed and why they’re important – and we’ve also saved space at the end for a few examples featuring some notable names.

How It’s Made

After our discovery meeting, we assemble a Live Big Map, which is intended to encapsulate your values, priorities, and goals in five key areas. The Live Big Map is viewed as a road map to your financial life, starting from the bottom with Risk Management and working up to the Live Big Goals. To construct a Live Big Map, we review notes from our initial meeting and our discovery meeting. From the initial meeting we can learn about your highest priorities and short-term goals. This conversation informs us about what spurred you to action in the first place. From our discovery meeting we identify your key values and life goals. During this conversation we are able to explore your level of satisfaction with your life and how we can organize your resources to help you strike your ideal life balance.

Turning to the Live Big Map itself, we start with the Risk Management goals. Often combined with what we call “financial hygiene,” these goals most often illustrate the areas where you face the greatest exposure or which need the most immediate attention. Goals may include executing an estate plan, naming beneficiaries, or purchasing additional insurance coverage. In each case the purpose of a Risk Management goal is to fill the gaps in your financial life and provide you a stable foundation to pursue your Live Big life.

We shift next to the Short-Term Goals, Hurdles, and Obstacles. These goals can be incredibly diverse and generally your highest priority or main focus in life. If you express a desire to establish a plan to save for retirement, to get organized and feel confident in your current path, or to make a big purchase in the near future, then your Short-Term goals will reflect this present focus. For Clients in a different stage of life, the Short-Term goals may reflect some of the activities with which you fill your time. This may include continuous learning, travel, gardening, or spending time with family. No matter your present stage of life, the purpose of a Short-Term goal is to provide motivation for continuing down the path toward financial success and personal fulfillment.

Looking forward, the Financial Security & Independence goals are often perceived as “retirement” goals. While this works for Clients who have retirement on their radars, this definition does not apply to everyone. More broadly, these goals incorporate opportunities that will lead you to financial independence as well as your dreams for when you achieve financial independence. Examples include such specific goals as pursuing individual projects or the growth of a company or more aspirational goals, such as maintaining your physical, mental, or spiritual health. Regardless of your unique circumstances, a Financial Security & Independence goal is meant to inspire hope for a future of financial independence.

The question asked by Human & Financial Legacy goals is, “How do you want to be remembered?” This question is most succinctly answered by the individuals and causes named in your estate plan, but it’s about more than just naming where your money will go when you die. The true purpose of Legacy goals is the impact you want to have during your lifetime and the values you want to instill in those around you. Common Legacy goals are to provide for the education of children or grandchildren, to take care of family members, to support charitable causes, or even to build deep, long-lasting relationships with one’s community. In other words, Legacy goals recognize who and what matters most to you.

Lastly, Live Big® Goals drive your plan forward. What gets you out of bed in the morning? What is at the top of your bucket list? What do you yearn to achieve, if only you felt empowered to do so? Live Big is at the heart of our philosophy, so we put it at the heart of every Client’s financial plan. These goals are unique to every Client and may include traveling the world, practicing mindfulness and gratitude, or enjoying experiences as a family. Live Big Goals serve as motivation to continue taking steps toward your ideal life, and they offer a reminder that it’s about the size of your life, not the size of your wallet®.

Why It Matters

The Live Big Map is designed to reiterate important highlights of the conversations we have during the discovery process. It is our hope that the Live Big Map says, “We hear you, and our advice will address these elements that are most important to you.” As we continue in our relationship together, your Live Big Map continues to guide our conversations and provide a framework for our advice. Each of our recommendations is made with the intent to guide you down the path toward your ideal financial life.

While the Live Big Map is meant to represent our deep understanding of who you are and what matters to you, it is not meant to be static. Discovery is an ongoing process because we recognize that life is messy and goals are a moving target. Our goal is that your Live Big Map always reflects what matters most to you, so as our relationship continues and we learn more about you, your Live Big Map will evolve. This dynamic approach ensures that we are constantly living in a state of discovery, always curious about what’s next on your horizon.

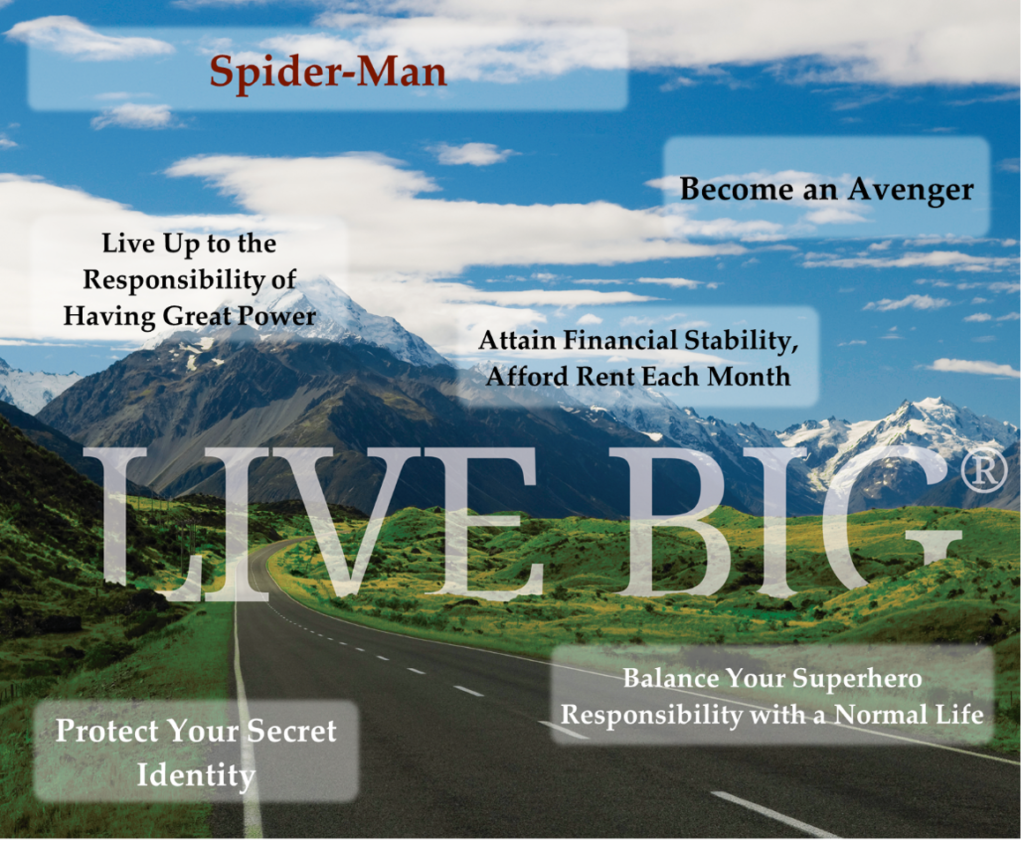

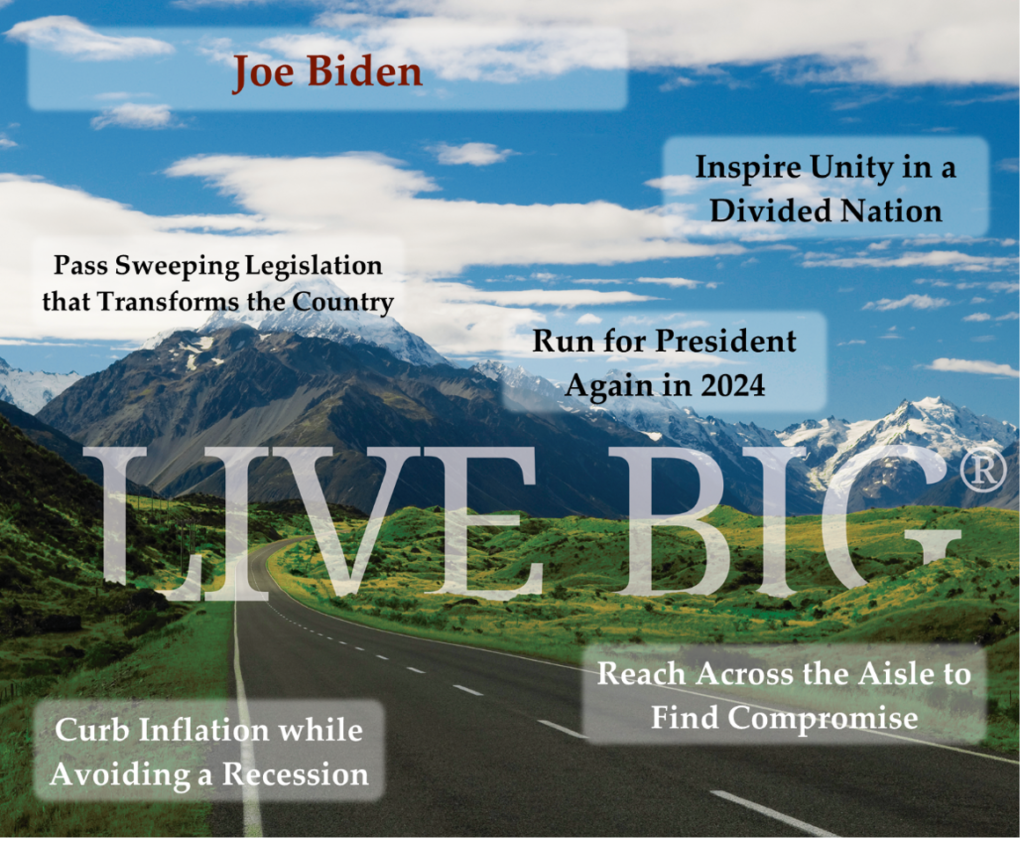

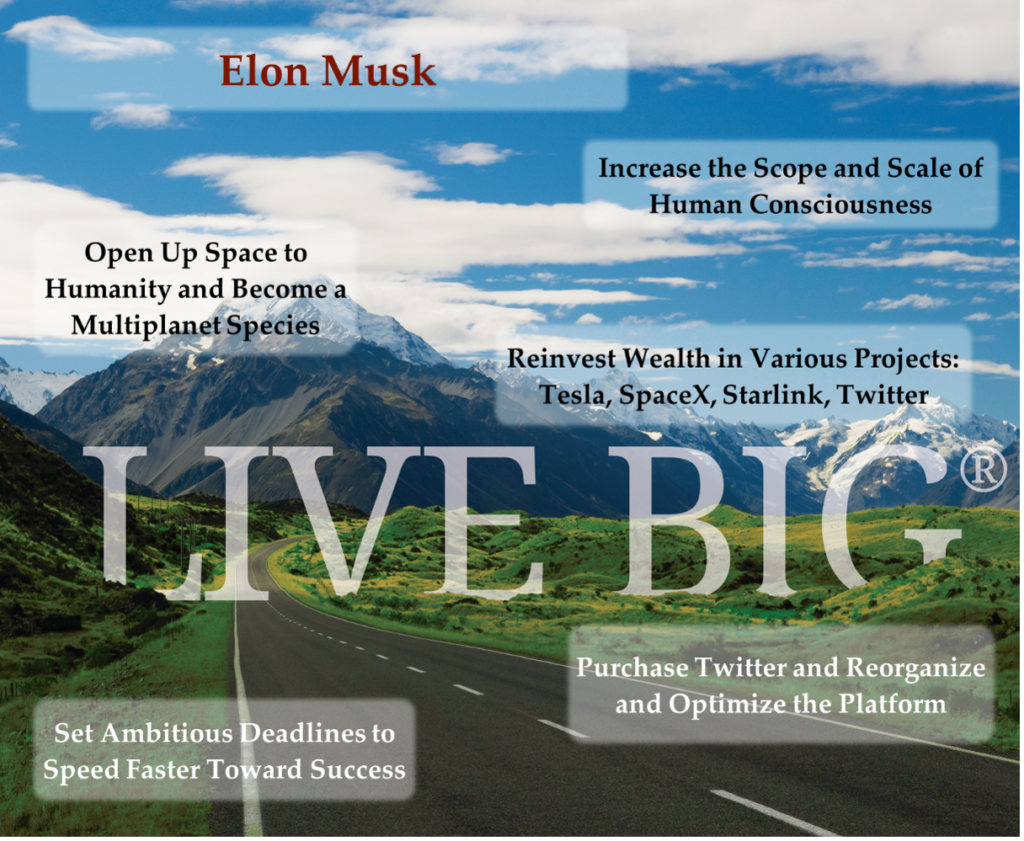

To illustrate the power of our discovery process and the reflective nature of these images, we have created draft Live Big Maps for a handful of prominent figures. Let us know what you think, and feel free to share whose Live Big® Map you’d like to see next!