The Best of Far West

As has become an annual event, the Yeske Buie Financial Planning Team (Dave Yeske, Elissa Buie, Yusuf Abugideiri, Jennifer Hicks, Lauren Stansell, Russell Kroeger, Camille Bouvet, Cody Daniels, Zach Bennedsen, and Ryan Klemm) once again attended the Far West Roundup in Santa Cruz, California. At Far West Roundup, some of the brightest minds in the profession meet up on the campus of UC Santa Cruz every year to discuss any and all topics related to financial planning.

For the seventh time, Dave Yeske served as sheriff for the weekend. Normally, the sheriff is charged with opening up the conference by posing a question to all attendees. However, this duty had to be passed off due to some unfortunate automotive problems. Not to be slowed down, Dave communicated his question to the attendees remotely (aren’t cell phones great?) and the rest of us tried to tackle the question of how to get millennials involved in the planning profession. While the sheriff’s question resonated with the attendees throughout the weekend, the individual sessions covered a variety of topics and the learnings will remain for months to come. Below we share a summary of these sessions and the team’s thoughts on their practical applications.

For the seventh time, Dave Yeske served as sheriff for the weekend. Normally, the sheriff is charged with opening up the conference by posing a question to all attendees. However, this duty had to be passed off due to some unfortunate automotive problems. Not to be slowed down, Dave communicated his question to the attendees remotely (aren’t cell phones great?) and the rest of us tried to tackle the question of how to get millennials involved in the planning profession. While the sheriff’s question resonated with the attendees throughout the weekend, the individual sessions covered a variety of topics and the learnings will remain for months to come. Below we share a summary of these sessions and the team’s thoughts on their practical applications.

Things My Mother (Nor Anyone Else) Never Told Me About Estate Planning – by Ray Sheffield

Ray provided insight into the extremely complicated process known as estate planning. He explored alternatives to trust structure that will ultimately simplify the trust itself while being very beneficial to the Client. He touched on strategies that advisors currently use that have become outdated, and substituted options to provide value. The Yeske Buie financial planning team found Ray’s educational presentation very informative as we are constantly striving to add the most value to our Clients’ estate planning. Ryan Klemm provided a statement regarding what he took away from the presentation: “I think educational presentations like this are extremely important to the thoroughness of continuing education, especially with offices on opposite coasts, in determining the best planning strategies that can add value to Clients no matter where they reside.”

Ray provided insight into the extremely complicated process known as estate planning. He explored alternatives to trust structure that will ultimately simplify the trust itself while being very beneficial to the Client. He touched on strategies that advisors currently use that have become outdated, and substituted options to provide value. The Yeske Buie financial planning team found Ray’s educational presentation very informative as we are constantly striving to add the most value to our Clients’ estate planning. Ryan Klemm provided a statement regarding what he took away from the presentation: “I think educational presentations like this are extremely important to the thoroughness of continuing education, especially with offices on opposite coasts, in determining the best planning strategies that can add value to Clients no matter where they reside.”

Whoever says he knows all that one needs to know about ____ in China is either a fool or a liar – by Tim Kochis

Did you know that China has more CFP® Certificants than any other country in the world? Or that the household savings rate in China (about 50%) blows away the savings rate in the United States? If you didn’t, you’re certainly not alone. Tim Kochis’ presentation on China’s financial future and past opened eyes for everyone in the room. The owner of one such set of eyes was Yusuf Abugideiri, who said, “It was refreshing to listen to Tim’s description of China’s history and see how he used that to frame the discussion about what to expect from the Chinese economy over the next decade or two. His perspective, as someone who has traveled to the country over 30 times in his life, was insightful and helped me reframe my understanding of how their economy is evolving.”

Did you know that China has more CFP® Certificants than any other country in the world? Or that the household savings rate in China (about 50%) blows away the savings rate in the United States? If you didn’t, you’re certainly not alone. Tim Kochis’ presentation on China’s financial future and past opened eyes for everyone in the room. The owner of one such set of eyes was Yusuf Abugideiri, who said, “It was refreshing to listen to Tim’s description of China’s history and see how he used that to frame the discussion about what to expect from the Chinese economy over the next decade or two. His perspective, as someone who has traveled to the country over 30 times in his life, was insightful and helped me reframe my understanding of how their economy is evolving.”

CFPB: An In-Depth Look at Advocacy, Services and Resources – by Pam McClelland

Pam’s presentation stressed the importance of financial protection in today’s reliance on technology as well as the education that advisors are able to provide to enhance their Clients’ safety. The Consumer Financial Protection Bureau’s focus is to establish an easy and effective way to report fraud or other deceptive financial acts that occur in the Client’s life and to provide action to resolve the issue and make sure steps have been implemented for it not to happen again. The CFPB achieves action through the process of empowerment, enforcement and education. Pam shared in-depth diagrams to show the different bureaus and advocacy organizations that work tirelessly to fight against financial breach and informed us of the framework that acts as a regulatory piece to the industry itself. Jennifer Hicks provided a comment on what the presentation meant to her: “While I enjoyed all the sessions at Far West Roundup, Pam McClelland’s session about the Consumer Federal Protection Bureau was one of my most favorite. She explained the tools, resources and initiatives that the CFPB is pursuing, which was not only inspiring, but also relevant to the work I have done for Financial Planning Days.”

Pam’s presentation stressed the importance of financial protection in today’s reliance on technology as well as the education that advisors are able to provide to enhance their Clients’ safety. The Consumer Financial Protection Bureau’s focus is to establish an easy and effective way to report fraud or other deceptive financial acts that occur in the Client’s life and to provide action to resolve the issue and make sure steps have been implemented for it not to happen again. The CFPB achieves action through the process of empowerment, enforcement and education. Pam shared in-depth diagrams to show the different bureaus and advocacy organizations that work tirelessly to fight against financial breach and informed us of the framework that acts as a regulatory piece to the industry itself. Jennifer Hicks provided a comment on what the presentation meant to her: “While I enjoyed all the sessions at Far West Roundup, Pam McClelland’s session about the Consumer Federal Protection Bureau was one of my most favorite. She explained the tools, resources and initiatives that the CFPB is pursuing, which was not only inspiring, but also relevant to the work I have done for Financial Planning Days.”

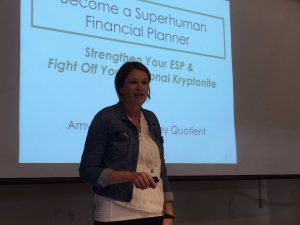

Become a Superhuman Financial Planner: Strengthen Your ESP and Fight off Your Personal Kryptonite – by Amy Mullen

During Amy Mullen’s presentation, she discussed our ability to frame financial decisions and clear the path for Clients to move forward confidently. She addressed the value of understanding, from the Client’s perspective, the questions “where are you now? Where do you want to be? And what are you willing to do to get there?” – knowing that trade-offs are inherent in every actionable decision. Variations of this quote float around, but it was especially powerful for our team during this Far West Roundup because it represented a challenge for our individual and professional development as we aspire to add value to our Clients and the financial planning profession. It presents the question, as a financial planner, how are we able to add value at this time? What contribution do we wish to make in the future? And what effort is necessary to achieve that dream? Financial Planning Team member, Russell Kroeger, provided a truly representative quote when sharing, “Opportunities like Roundup are always empowering and provide experiences that help our team personify our BIGS (worldviews).”

During Amy Mullen’s presentation, she discussed our ability to frame financial decisions and clear the path for Clients to move forward confidently. She addressed the value of understanding, from the Client’s perspective, the questions “where are you now? Where do you want to be? And what are you willing to do to get there?” – knowing that trade-offs are inherent in every actionable decision. Variations of this quote float around, but it was especially powerful for our team during this Far West Roundup because it represented a challenge for our individual and professional development as we aspire to add value to our Clients and the financial planning profession. It presents the question, as a financial planner, how are we able to add value at this time? What contribution do we wish to make in the future? And what effort is necessary to achieve that dream? Financial Planning Team member, Russell Kroeger, provided a truly representative quote when sharing, “Opportunities like Roundup are always empowering and provide experiences that help our team personify our BIGS (worldviews).”

Life Insurance as an Asset Class? – by Richard Weber

Ever wonder how your life insurance agent comes up with a price for your policies? No? Well that’s ok, because Dick Weber is wondering for you. As an insurance fiduciary, Dick helps Clients find the best insurance solutions for their goals, and makes no commission in the process. Very astutely, Dick pointed out that when a Client cannot otherwise differentiate value in a product, he or she defaults to making a choice based on price. Dick shared his insights into how someone can evaluate the details of their insurance policy, and walk away feeling good about their choice.

Ever wonder how your life insurance agent comes up with a price for your policies? No? Well that’s ok, because Dick Weber is wondering for you. As an insurance fiduciary, Dick helps Clients find the best insurance solutions for their goals, and makes no commission in the process. Very astutely, Dick pointed out that when a Client cannot otherwise differentiate value in a product, he or she defaults to making a choice based on price. Dick shared his insights into how someone can evaluate the details of their insurance policy, and walk away feeling good about their choice.

Planning for Cross Border Families –The U.S. Doesn’t Always Play Nice! – by Andrew Fisher

It has never been easier to live a global life, but that doesn’t mean it’s actually easy. Particularly difficult is the prospect of managing your financial life across multiple countries. From taxes to retirement accounts to real estate, having border-spanning financial obligations is the reality for many. Andrew Fisher eloquently described some of the challenges this entails, and offered up solutions that he employs. Andrew warned that attendees might leave the session with more questions than they had when they started, and this was certainly the case for many. However, the questions spawned allowed advisors to have more intelligent conversations about the unique situations that cross border families face.

It has never been easier to live a global life, but that doesn’t mean it’s actually easy. Particularly difficult is the prospect of managing your financial life across multiple countries. From taxes to retirement accounts to real estate, having border-spanning financial obligations is the reality for many. Andrew Fisher eloquently described some of the challenges this entails, and offered up solutions that he employs. Andrew warned that attendees might leave the session with more questions than they had when they started, and this was certainly the case for many. However, the questions spawned allowed advisors to have more intelligent conversations about the unique situations that cross border families face.

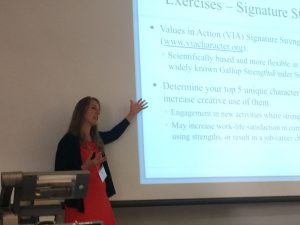

From Personality to Saving Behavior: Bridging the Savings Gap – by Sarah Asebedo

It was great to see Sarah present at Far West Roundup, as she was a professor for a few of our Residents! Sarah explored the discussion between the association of personality and the financial habits that an individual exhibits. As the title of the presentation states, she “bridged the gap” between emotion and money. The main take-away from the presentation was the importance of how an advisor, using a Client’s connection between emotion and money, can utilize their strengths as well as recognize their weaknesses and in return provide an opportunity for growth. Sarah is breaking into “uncharted waters” with her research and it was very rewarding to see the impact that positive psychology and behavioral traits can have on a Client’s financial well-being. Camille Bouvet found the presentation exceptionally interesting and provided a thought: “Not only was her research eye-opening and applicable to everyone saving for retirement, but as my former college professor, Dr. Asebedo inspired me to continue pushing the envelope and seeking out research opportunities in the evolving financial planning field.”

It was great to see Sarah present at Far West Roundup, as she was a professor for a few of our Residents! Sarah explored the discussion between the association of personality and the financial habits that an individual exhibits. As the title of the presentation states, she “bridged the gap” between emotion and money. The main take-away from the presentation was the importance of how an advisor, using a Client’s connection between emotion and money, can utilize their strengths as well as recognize their weaknesses and in return provide an opportunity for growth. Sarah is breaking into “uncharted waters” with her research and it was very rewarding to see the impact that positive psychology and behavioral traits can have on a Client’s financial well-being. Camille Bouvet found the presentation exceptionally interesting and provided a thought: “Not only was her research eye-opening and applicable to everyone saving for retirement, but as my former college professor, Dr. Asebedo inspired me to continue pushing the envelope and seeking out research opportunities in the evolving financial planning field.”

Financial Planning in the Midst of Divorce – by Mark Prendergast

Mark’s presentation stressed the importance of a financial advisor’s role during the divorce process. He explained the thoroughness needed to allow Clients to focus on the emotional situation at hand, knowing that the stress of finances are being taken care of. This is a situation where the relationship that exists between an advisor and their Client is tested and Mark provided advice on how advisors can lessen some of the burden that is inherent through a divorce. Through an interactive discussion with the conference attendees, Mark stressed the importance that an advisor has the ability to add value to both husband and wife without a conflict of interest and how to do so. Mark has created a niche in the financial planning industry through specializing in divorce planning and each team member walked away with valuable information.

Mark’s presentation stressed the importance of a financial advisor’s role during the divorce process. He explained the thoroughness needed to allow Clients to focus on the emotional situation at hand, knowing that the stress of finances are being taken care of. This is a situation where the relationship that exists between an advisor and their Client is tested and Mark provided advice on how advisors can lessen some of the burden that is inherent through a divorce. Through an interactive discussion with the conference attendees, Mark stressed the importance that an advisor has the ability to add value to both husband and wife without a conflict of interest and how to do so. Mark has created a niche in the financial planning industry through specializing in divorce planning and each team member walked away with valuable information.

Cultural Intelligence: Different Values & Behaviors in Financial Planning – by Stephanie Lee

After multiple sessions that nodded towards the global nature of our profession, Stephanie addressed that nature head on. In a light-hearted but very informative session, Stephanie spoke on some of the differences that make every culture so unique and wonderful. The thorn to this rose is that when we interact with someone from another culture, we may not be effective communicators. Worse yet, we may say or do something that is unintentionally offensive! Stephanie shared communicative idiosyncrasies from around the globe, highlighting some of the cross-cultural faux pas one should try to avoid. Cody Daniels succinctly summed up how this presentation tied into financial planning, stating “As a financial planner you have the opportunity to work with Clients of various backgrounds and cultures. . . . This presentation was interesting to me because it helped me understand in better detail the “cultural themes” that every community has. Knowing these themes allows advisors to better communicate with their Clients and implement the financial plan.”

After multiple sessions that nodded towards the global nature of our profession, Stephanie addressed that nature head on. In a light-hearted but very informative session, Stephanie spoke on some of the differences that make every culture so unique and wonderful. The thorn to this rose is that when we interact with someone from another culture, we may not be effective communicators. Worse yet, we may say or do something that is unintentionally offensive! Stephanie shared communicative idiosyncrasies from around the globe, highlighting some of the cross-cultural faux pas one should try to avoid. Cody Daniels succinctly summed up how this presentation tied into financial planning, stating “As a financial planner you have the opportunity to work with Clients of various backgrounds and cultures. . . . This presentation was interesting to me because it helped me understand in better detail the “cultural themes” that every community has. Knowing these themes allows advisors to better communicate with their Clients and implement the financial plan.”

While the team has since returned to their respective offices, the knowledge gained during our weekend in Santa Cruz will remain. We look forward to using some of the ideas discussed to help better serve all of our Clients.