TheLiveBigWay® Financial Planning Process

The Discovery Process is the first step in YeskeBuie’s financial planning process once we’ve decided to work together – but it certainly doesn’t end there! Discovery is a vital and ongoing part of our work together, and as we prepare your financial plan, we dive into two realms of financial planning: the financial hygiene realm and the aspirational realm. In this space, we share more about our work in both of these areas.

Financial Hygiene

Financial hygiene is all about your foundation – are your assets protected and are your wishes known? In this realm, we discuss your types and amount of insurance, your beneficiary designations, and your estate plan.

Insurance

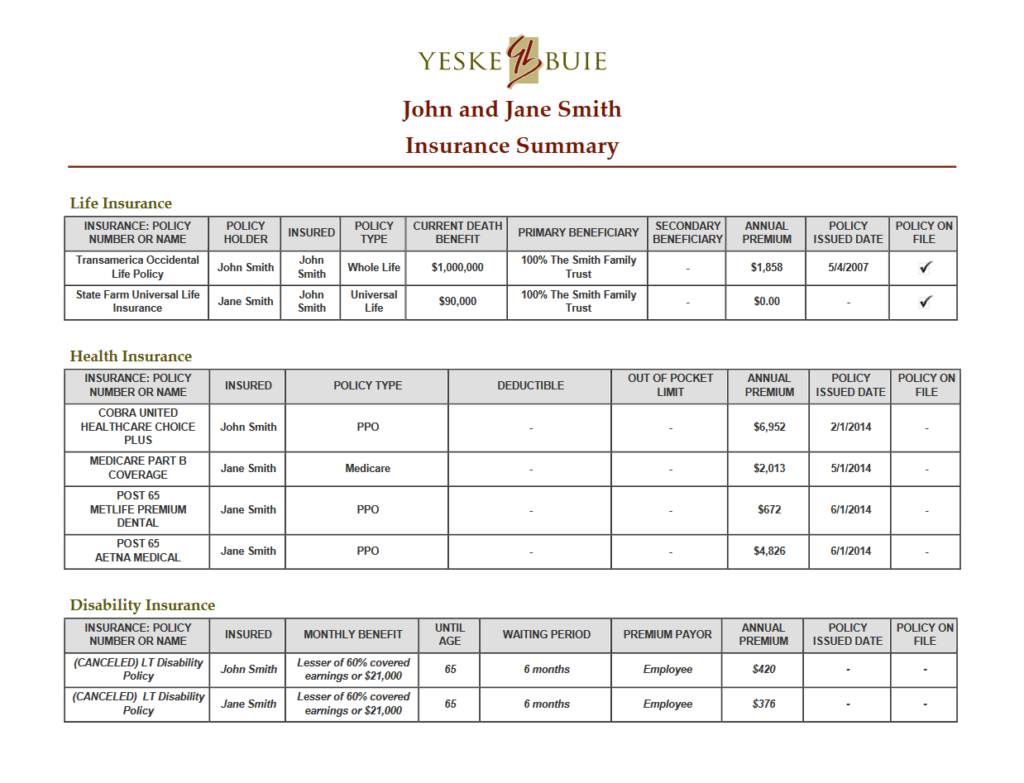

For insurance, we like to review the insurance coverage in place for your life, health, home, belongings, cars, umbrella, disability, Social Security, and more. The result of this review comes in the form of your insurance summary.

In preparing this report, we review your current insurance coverage in light of your current assets, income, and debt, and we specifically look for potential gaps. One big one, for example, is personal property coverage on your homeowner’s, condo, or renter’s insurance policy. Oftentimes, personal property coverage is a significant percentage of total dwelling coverage on an insurance policy (sometimes as high as $500,000-$800,000 of coverage, or more, based on your home’s value). But, many items you own are subject to much lower sublimits, especially things like fine art, collectibles, coins, wine collections, and jewelry.

Insurance policies tend to limit these items at $1,500 per item and $2,500 per event. That means if something happens and all of your fine art and jewelry is lost in one event, you would get $1,500 per item, up to a maximum of $2,500 for the entire loss of that event. So, if you lose $10,000-$100,000 of art, jewelry, and collectibles in one event, you will only get $2,500 back from your insurance company. Fortunately, there is a solution! You can get these items appraised and specifically insured on your policy. While it does take some time and effort, and increases your premium some, we recommend specifically insuring these items!

Additional insurance analysis includes a review of your life and disability insurance needs to address any gaps we see as it is vital to cover potential lost wages that currently support your home and family.

Estate Plan & Beneficiary Designations

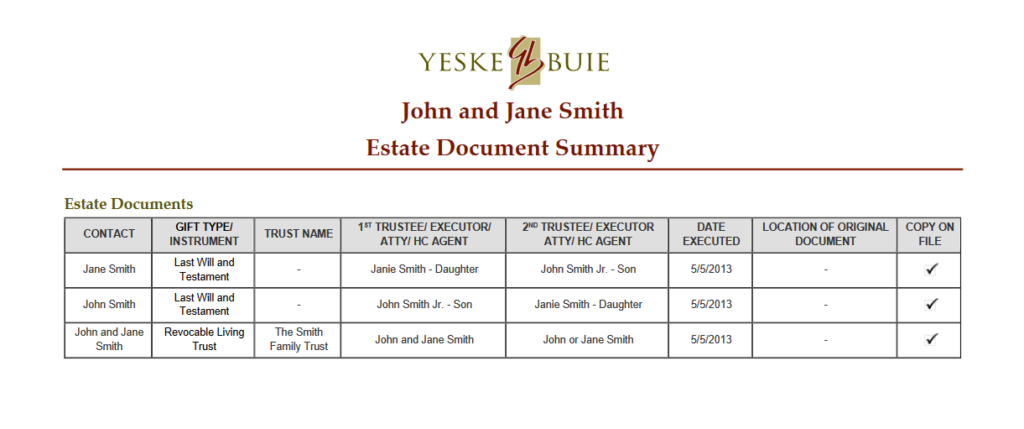

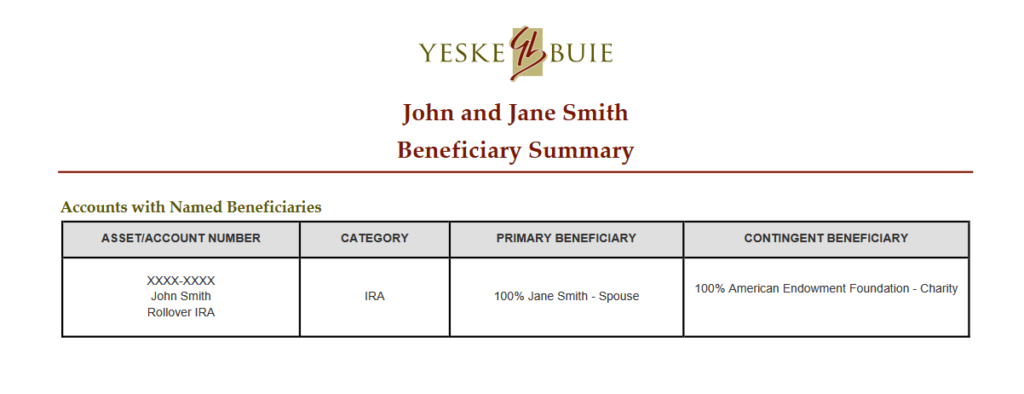

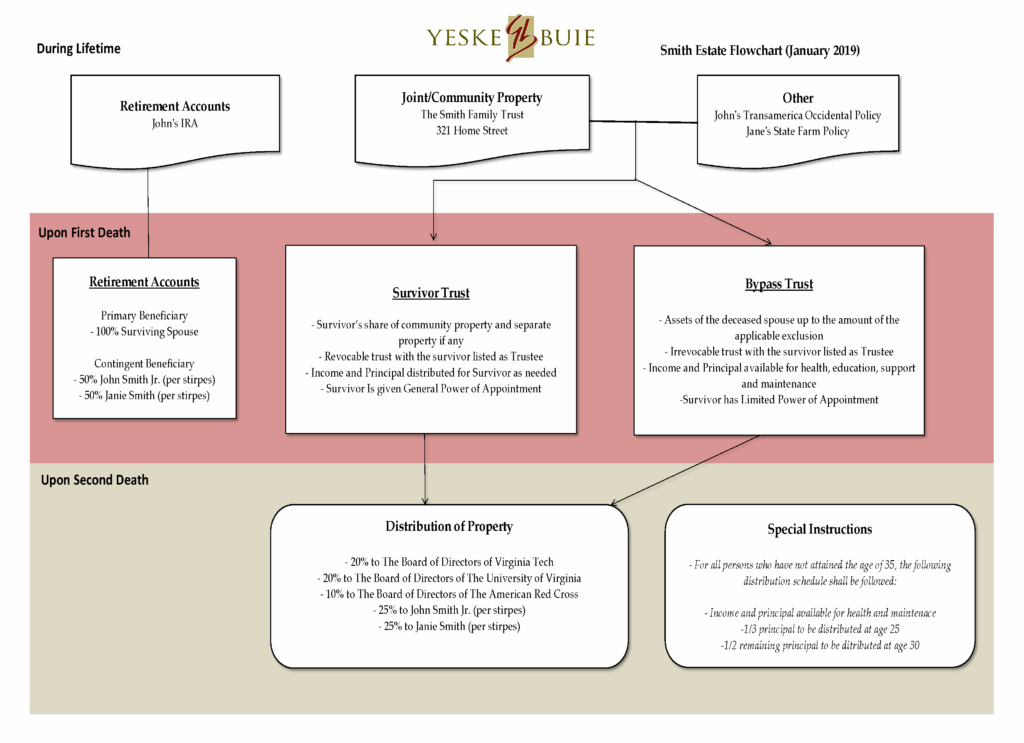

Next, we want to confirm with you that your wishes are known by having an official estate plan in place. This includes confirming your wishes are accurately depicted in your will, trust, powers of attorney, and medical directives. And that your beneficiary designations align with your wishes.

We share this analysis with you in three different ways:

- First, we create your Estate Document Summary to share the people you have designated to carry out your wishes.

- We also create your Beneficiary Summary to share the beneficiary designations on your retirement accounts.

- Finally, we create your Estate Flowchart and Calculations. The flowchart is a visual depiction of the flow of your assets to the next generation. Our goal is to confirm your wishes are accurately depicted and will be carried out at your passing.

Once we’ve completed our financial hygiene review, we move on to the more fun and exciting part – the aspirational realm!

Aspirational Realm

The aspirational realm is all about your future, your path, your goals, and your dreams, and we aim to show you what the future looks like based on your current situation. To do this, we first start by analyzing all the financial data we’ve collected from you, and prepare a plan showing the path you’re currently on. This path shows what your potential future may look like based on your current income, current savings, current spending levels, and desired retirement age. We stress test your path by using software that includes Monte Carlo analysis – a format of analysis that runs 10,000 different scenarios.

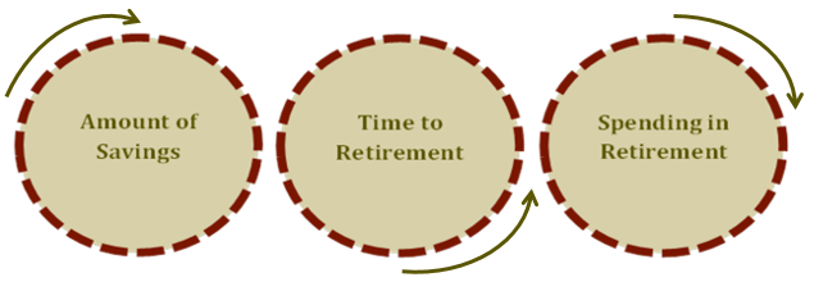

We also review your current situation and path by thinking through three interconnected dials.

In financial planning, you can set or control two of these interconnected dials and when you do so, you lose control of the third.

For example, you can share your required retirement age and confirm that you’re saving as much as is possible. At that point, you lose control of the third dial and we solve for the sustainable retirement spending level based on your desires. Alternatively, you can share your desired retirement age and retirement spending figure and we can share the required saving between now and retirement.

Once we’ve shared this initial path, we can tweak the assumptions in any way you desire; the number of scenarios we can run is unlimited. We can show you the tradeoffs between additional savings, additional work, a glide path into retirement (versus a 100% retirement on a specific day), differing levels of income, home sales and/or purchases, moves into retirement communities, and so much more.

Our goal is to be “good people to think with.” We want to know as much about you and your financial situation as possible so we can see every discussion from a big-picture place and help you walk everything around the block to make an educated decision.

But our planning process doesn’t simply end with the projections. We also complete additional analyses, such as the tax projection, Roth conversion analysis, social security analysis, pension payout analyses, and safe-spending analyses, to name a few. And, we work closely with the other advisors and professionals in your life to ensure all parties are fully aware and on the same page. Many strategies overlap with the expertise your estate planning attorney and accountant have and we want to be sure we’re all working together for your success. Learn more about the additional pieces of the financial planning process and our collaboration with other members of your team in this piece.