Weighing Bucks and Benefits

Considering a job offer, or comparing a number of offers, can be a daunting task. The trick is not to evaluate them in a vacuum or even solely one against another, but as it relates to everything going on in your life. Let’s assume there is something intrinsically compelling about the opportunity in front of you, and dive into a few common areas we’d encourage you to explore as you make your decision.

Salary

The obvious reason it is important to consider your starting salary is because you don’t want to miss out on valuable income in your first year. However, it is important to consider that raises, and often bonuses, are generally based on your current salary (i.e. 3% raise to help with the cost of inflation) and can also significantly impact how well your 401(k) works for you. 401(k) deferrals and the employer match are also dependent upon your current salary. This means your ability to take advantage of the opportunity for additional compounding within your tax-deferred account can have a significant impact on the long-term.

To use round numbers, consider the following example as an illustration of the impact salary can have on an individual’s overall financial situation:

Employee 1 has a starting salary of $90,000 and Employee 2 has a starting salary of $100,000. They both get annual raises of 3%.

In 10 years, Employee 1 is earning $117,430 – an income which Employee 2 exceeds by the end of year 7. What starts as a $10,000 difference in salary grows into more than $13,000 by year 10! Consider that impact over the span of a 30 year career, or when looking to switch companies, and the decision whether or how much to negotiate can have long-term ramifications on your cash flow.

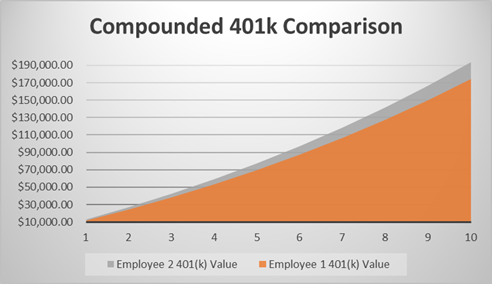

Now, using the same employee situation detailed above, consider the impact to their 401(k) balances over 10 years if they both defer 10% of salary and get a 3% employer match. Also assume the account balances grow at 6% annually.

Because the 401(k) account balance also reflects employer contributions in addition to an annual growth rate of 6%, the impact is much more significant than the difference in salary. Beyond the impact of the difference in cash flow afforded by the higher salary, Employee 2’s 401(k) balance is nearly $19,500 more ($193,670 v. $174,300) than that of Employee 1’s balance at the end of 10 years.

Fringe Benefits and Other Perks

Before jumping into a salary negotiation or picking a job with the highest salary with “money blinders” on, it is important to understand all of the other perks of your offer. Being mindful of those other benefits can serve as a negotiation tool; everything you receive is included in your “total compensation” even though it may not make it directly into your wallet.

Medical Insurance

- What does your current job offer in terms of health, dental, vision, Life, or short- and long-term disability insurance coverages?

- Do the plans offered compare favorably to your current coverage in terms of price and choice of providers?

- If the coverages recommended for your financial plan are not offered by your employer, it may require securing a personal policy or making changes to your financial situation to ensure the resiliency of your financial hygiene (i.e. increasing your emergency fund to cover gap in an insurance policy with a higher deductible).

Higher Education Assistance or Additional Skills Training

- If you have plans of enhancing your talents through formal education or a training program, is there any flexibility with your potential employer offering financial support?

- Have you considered the potential tax impact of employer-provided financial support for additional formal education or training?

- Are there opportunities to attend conferences, or travel that may be appeal and provide opportunities for a different work experience?

Stock Options

- Does your potential employer offer discounted opportunities to buy company shares?

Vacation and Flexible Work Policies

- How do the vacation policies compare to those of your current employer? What about opportunities to work remotely?

Additional Perks

- Is childcare provided or is a benefit offered to help supplement cost? Is parental leave provided and/or encouraged?

- Are stipends provided for a smart phone, gym membership, or vehicle/transportation costs?

- Will you have access to food and beverage throughout the day that may impact your need to purchase your morning coffee or afternoon snack?

- Are there personal development opportunities such as mentorship programs or business/life coaches?

Awareness of everything being offered may offer a helpful perspective compared to simply weighing salary figures. Everything you receive within a job offer may not come in the form of money – which, depending on the structure of the benefit programs, may be more beneficial from a tax standpoint than if you were to receive the income and pay for those benefits out of pocket.

Evaluating all of these trade-offs is where the nuances of who you are and what is important to you manifest themselves in your decision-making. We can help you think through the trade-offs to make sure that you are equipped with the knowledge to establish authentic priorities and are confident when having conversations with potential future employers.