How Much Does a Dollar Cost?

How much does a dollar cost? The answer varies depending on your interpretation of the question.

According to the Board of Governors of the Federal Reserve System, physical dollars cost 7.5 cents to print. Note that two-dollar bills cost the same amount to print, which begs another question – why don’t they print more? For another day, perhaps…

If you ask Pulitzer Prize and Grammy winning rapper Kendrick Lamar, you get a very different answer. In his song “How Much a Dollar Cost”, Lamar tells a story of a time he elected against giving a dollar to a homeless man begging for money. Without spoiling the twist at the end, let’s just say the realization Lamar comes to is that his choice to keep his dollar proved to be incredibly costly. Notably, former President Barack Obama picked the song as his favorite release of 2015. Note: this song contains explicit lyrics some may find objectionable.

Opportunity Cost

While Mr. Lamar takes the concept of opportunity cost to an extreme, it’s an appropriate segue to the next way we can consider the question – what is lost in an individual’s pursuit of a dollar? Opportunity cost can be defined as “something one misses out on when selecting one thing over another.” To play with the example described in the link above, in choosing to watch a two-hour movie, one assesses the perceived benefit of watching the movie as having more value than working to earn money over the same two hour period. Using the national minimum wage, the “cost” of this decision is $14.50 (without accounting for the costs of renting the movie and/or buying some snacks to enjoy as you watch).

Diversification

So, then – how exactly does this question relate to you? At Yeske Buie, we believe in employing a globally diversified mix of stocks and bonds to optimize the performance of our Clients’ portfolios. Because markets are complex systems and move in unpredictable ways, and because it’s impossible to know what will perform best ahead of time, spreading your investments among thousands of stocks around the world in a grounded, evidence-based fashion positions your portfolio to capture growth wherever it emerges. And, according to Modern Portfolio Theory, diversifying one’s investments improves the ratio between the expected return and risk of one’s portfolio.

One could argue that the opportunity cost of being diversified is that you “miss out” on the chance to maximize your returns had you been invested in the segment of the market that outperformed the rest. By definition, however, it also means the benefit is that you miss out on being overly exposed to the segment that performed worst. The other problem with that argument is it inherently assumes that one can identify the best performing investments ahead of time; absent a functioning crystal ball, it’s been demonstrated that’s impossible to do with any consistency. So, if we flip the argument on its head, we can say the opportunity cost of not being diversified is the possibility of losing 100% of your investment – an outcome proper diversification ensures against.

Maximizing the Value of Your Dollar

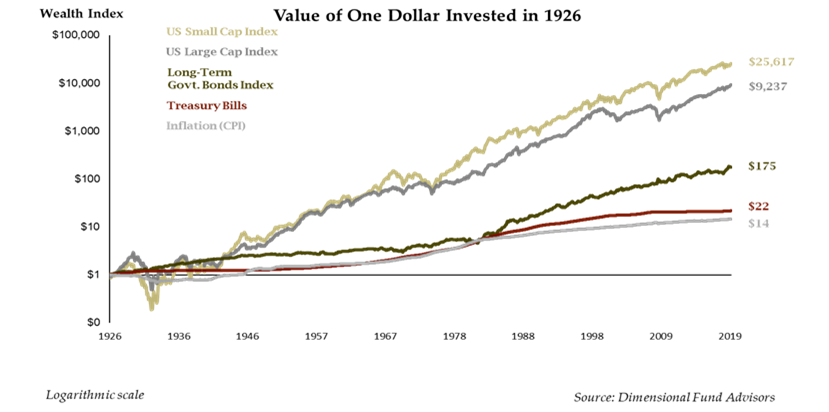

Market movements in the short run are subject to randomness, but over the long run we’ve observed that we can capitalize on the deep regularities inherent to different asset classes. As shown in the chart below, while there can be some choppiness in the short run, in the long run we can expect stocks to outperform bonds and small company stocks to outperform large company stocks (not shown – the tendency for value stocks to outperform growth stocks). Because these phenomena don’t occur every year, we include both stocks and bonds in our portfolio, and within the equity portion of the portfolio we include both large and small companies’ stocks (foreign and domestic, growth and value). So in years in which these deep regularities are not observed (i.e. bonds beat stocks, or large companies’ stocks outperform those of small companies), our portfolio still captures growth.

The only way to ensure that one is positioned to benefit from those deep regularities is to diversify broadly; while any one company’s performance may buck the long-term trends (in either a positive or negative fashion), these phenomena are persistent and pervasive when we zoom out and look at the broader asset classes’ performance. That’s why our portfolio includes over 13,000 companies’ stocks spread across multiple asset classes – a basket that big is that much more likely to capitalize on these deep regularities.

We believe that the optimal approach to investing is to apply a grounded philosophy, diversify across and within asset classes, reduce costs at every opportunity, and to be diligent about rebalancing. It’s a tried and true method of maximizing the value of your dollar, no matter how you define its cost.

To discuss Yeske Buie’s approach to managing investments in further detail, contact a member of our Financial Planning Team.