Portfolio Review, Part Deux: On Bonds

And now, for the other half of our 2023 review – a discussion about bonds.

First, an acknowledgement: stocks get a lot of the attention when we make comments about the portfolio’s performance, and rightly so – they make up the majority of the holdings for virtually all of our Clients and dominate the headlines.

And, with that being said, the bonds in our portfolio play an integral role in helping our Clients execute their financial plans. For our Clients who are still accumulating assets and saving for retirement, bonds curb the volatility of their portfolios and offer reservoirs from which they can mobilize funds efficiently and top up the stocks in their portfolio when it’s time to rebalance. For our Clients in retirement, bonds act as the basis of their Stable Reserve, a pool of assets available to fund their spending needs while markets navigate stormy seasons.

But what, exactly, is a bond? And how does a bond’s performance affect the portfolio? We can lean on a piece we published years ago for that explanation – we’ve borrowed, truncated, and rephrased a portion of the post below (the entire post is gold, by the way, and offers relevant context on this piece if you have time for a deep dive):

-

- Bonds are often called a “fixed-income” investment because there are only two things that the bond issuer promises: a “fixed” periodic dollar payment (called the coupon), and the return of the “face value” of the bond at maturity.

-

- With that being said, bonds do not guarantee a particular yield (or rate of return), though the coupon is sometimes described that way based on the implicit yield at the time the bond was issued.

- For example, a $10,000 bond paying a fixed amount of $500 per year was issued with a 5% coupon. However, bonds are traded in the market and as the price of the bond fluctuates, the yield represented by the promised coupon payment of $500 will also fluctuate.

- With that being said, bonds do not guarantee a particular yield (or rate of return), though the coupon is sometimes described that way based on the implicit yield at the time the bond was issued.

-

- The single largest factor that impacts a bond’s price is the general level of interest rates.

- Bond prices move in the opposite direction of interest rates; when interest rates are falling, the rising price of your bond will add to your total return (and vice versa).

- It is for this reason that bonds can offer steadily positive returns when we experience a steady decline in interest rates (which we observed with relative consistency for forty years, from 1982 through 2021, with rates at effectively 0% for most years beginning in 2008).

- The single largest factor that impacts a bond’s price is the general level of interest rates.

From the beginning of 2020 through the third quarter of 2022, our bond portfolio weathered the effects of interest rates being slashed to 0% at the beginning of the COVID crash and then aggressively hiked up to 4% in just six months. Rates would settle a year later at 5.25%, but we can’t use the word “steady” to describe to the way rates moved during that period. Given the choppiness of the environment, the bonds in our portfolio had the following annual returns:

- DFA One-Year Fixed Income: -0.57%

- DFA Five-Year Global Fixed Income: -2.56%

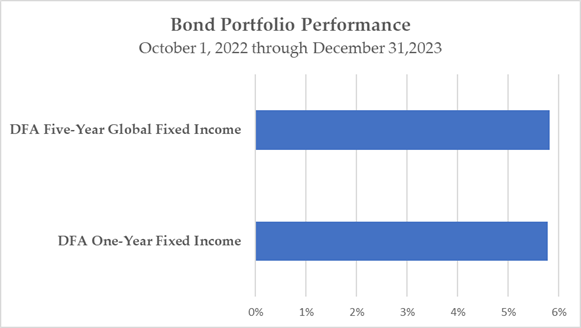

Note that we made a strategic decision to exit the bond market for all Clients during the spring and summer of 2022, harvesting those losses to offset our Clients’ taxable income and holding cash in the form of a money market fund to maximize the yield on the more stable portion of their portfolios (at that time, the money market fund we employed was offering a guaranteed yield of 4%). We re-entered the bond market in the fall of 2022, just in time for the bonds in our portfolio to take off. Over the next fifteen months, the bond funds we employ most frequently were up by ~6%.

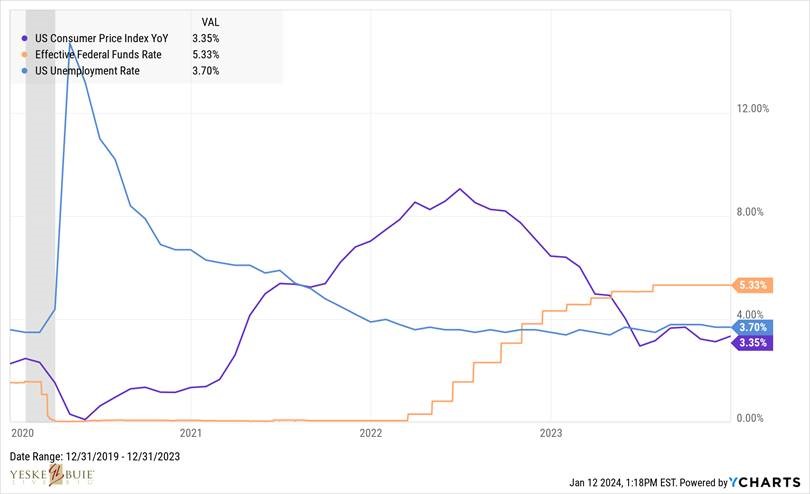

And what explains the sudden turn of events in returns? Let’s do this as quickly as possible using the graph below as a reference):

- Rewind to 2020: COVID hits, grinding economic activity to a halt, leading to

- The unemployment rate spiking (blue line), and in response

- The Fed cuts interest rates to 0% (orange line) to help spur the economy (in conjunction with fiscal stimulus to the tune of $5T), which contributes to

- Inflation (purple line) beginning to run hot in 2021, finally peaking at 9% in 2022, whilst being combatted by

- The Fed raising interest rates as aggressively as they have in 40 years (since the last time they went toe-to-toe with inflation).

Phew. Now that we’re all caught up, we can make this point: look at the circled portion of the chart. That’s where interest rates started increasing at a decreasing rate; in other words, the Fed started to get less aggressive with smaller rate hikes, beginning to signal the end of the rate hike cycle. That’s when bond fund managers could get their feet under them and begin positioning their portfolios to capitalize on the interest rate environment.

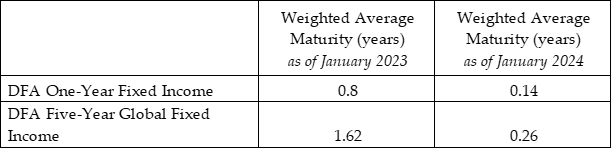

And what’s been the best way to capitalize on the current environment? Go short(-term). Generally, longer-term bonds are associated with higher interest rates, as lenders need to be compensated with a higher return for loaning funds over a longer time period. With that being said, presently, the yield curve is “inverted”, meaning short term rates on bonds are actually higher than long term rates (ex. the yield on a 1-month Treasury Bill is 5.55%, whereas the yield on a 10-year Treasury Bill is 3.95%). Although it may not make intuitive sense, it’s the fund manager’s job to make it make sense by making dollars (sometimes the jokes just tell themselves). So since the Fed began to hike short term rates, fund managers have gone short (and shorter as rates continued to go up before finally flattening in mid-2023):

As we progress through 2024, we wouldn’t be surprised if we see a rate cut or two, although nothing dramatic (and that’s only if the inflation and unemployment numbers continue to look good). And as rates start to come down, we would expect to see lengthening maturities in our bond funds, along with gradually elevated prices. All of which bodes well for bond performance going forward.

Onward, and upward. And looking forward to connecting with you to dive into more detail on our musings about the economy and markets next month!

For questions about bonds or our approach to portfolio management, connect with a member of the Yeske Buie Financial Planning Team.