Search

The Stealth Tax

Year-End Tax Planning with a Twist

Tips to Thwart Tax Thieves

TheLiveBigWay* Digest – The Taxman Cometh

Last Call: Tax Day is Next Monday, April 15th While we normally take care of all of our clients’ account servicing needs, including IRA and retirement account contributions, end of business today (5:00 pm ET for the Vienna office and 5:00 pm PT for the…

Tax Planning for the Fiscal Cliff: The Strategic Perspective

We recently posted an analysis of the tradeoffs involved with realizing embedded capital gains in 2012 before presumed higher rates kick in starting January 1 (Cliffhanger: The Fiscal Cliff and Year-End Planning), in which we focused largely on the tradeoff between keeping more capital invested and eventually having gains…

Matching Like Capital Gains, Losses Can Trim Taxes

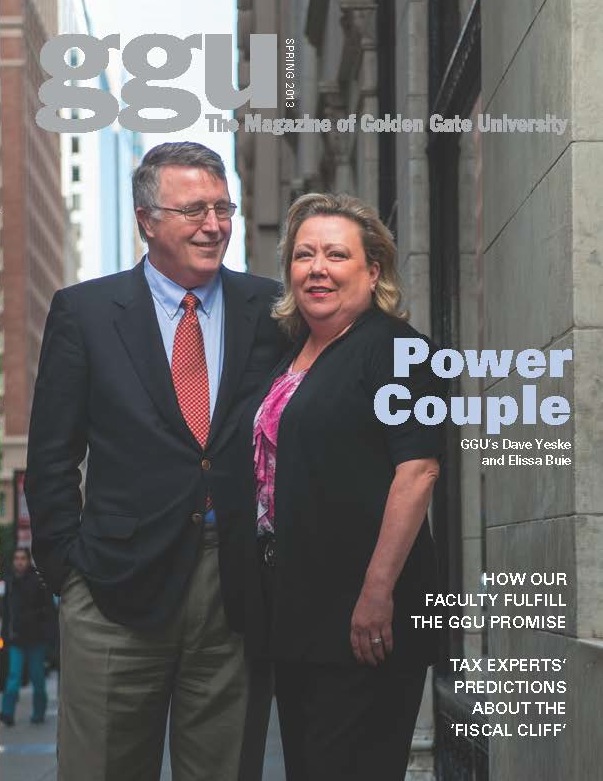

Dave was quoted in a recent article by Dow Jones writer Daisy Maxey devoted to the virtues of preserving short-term losses for use in offsetting short-term gains (as opposed to “wasting” them offsetting long-term gains). Dave’s comments were more focused on the possibility of harvesting all embedded…

Tax Landscape Still Uncertain, Even After the Election

The mid-term elections have passed and we now know more about the political landscape ahead, but investors still face plenty of uncertainty, especially on taxes. David Yeske, managing director of money management firm Yeske Buie, says rebalancing has become more difficult , and QE2 might be the signal for investors to reduce their bond holdings. MarketWatch’s Andrea Coombes reports.

WSJ: Upside Down? Selling Stocks for Tax Losses

By ELEANOR LAISE Hidden in the market’s hideous performance is a unique opportunity for investors to cut their tax bills for years to come. Investors who sell beaten-down holdings can use those losses to offset taxable gains and often a portion of their income. Any…

Contact Info

Washington, D.C. Metro Area

Vienna, VA 22180

San Francisco Bay Area

San Francisco, CA 94104