Author: Yeske Buie

Of Brainwaves and Tsunamis

We thought it might be time to comment on the economic and financial turmoil, not to mention human suffering, that has arisen as a result of the earthquake and tsunami in Japan.

Yeske Buie Live Big® Digest

The San Francisco Business Times named Yeske Buie a top wealth advisor in its 2011 rankings. The list was compiled by NABCAP, which conducted an independent evaluation of firms based financial planning, investment planning, accountability, education, credentials, cost, disclosure, technology, performance, and client education model, among other things. https://tinyurl.com/4z3jck8

Live Big® Digest: Super Bowl Edition

How to choose between Green Bay and Detroit — NYT article on “quirky” DFA mutual fund company — Latest DALBAR study on why the average mutual fund investor does so much worse than the average mutual fund — Why watching the market can hurt you.

Yeske Buie Live Big® Digest

Is it a good time to invest? As we roll into the weekend, we wanted to leave you with an unusual poem of sorts. You may find the message challenging at first, but please stick with it to the end in order to get the full effect.

Pros offer 11 tips on saving, spending in 2011

The San Francisco Chronicle’s Kathleen Pender in her Sunday Net Worth column offered tips from 11 financial service professionals, including Dave. Here was what Dave had to say: Get over it! Dave Yeske, managing director, Yeske Buie If it ain’t broken, it ain’t broken. Too…

Is 2011 the Dawn of America’s New Optimism?

That was the question posed by Bruce Nussbaum in his December 30 Fast Company blog. We’ve spent a great deal of time lately thinking about prior cycles of fear and pessimism, so Nussbaum’s post caught our attention.

Yeske Buie Live Big® Digest

Every year, the Yeske Buie team strives to stay ahead of the curve on important, calendar-dependent issues.

Elissa Featured in Investment Advisor Magazine: Future Imperfect

First of all, I think what we’ve done to date is phenomenal. We’ve built a profession that changes people’s lives. To the extent that we’ve made errors, it’s been with the best of intentions, and for lack of a crystal ball.

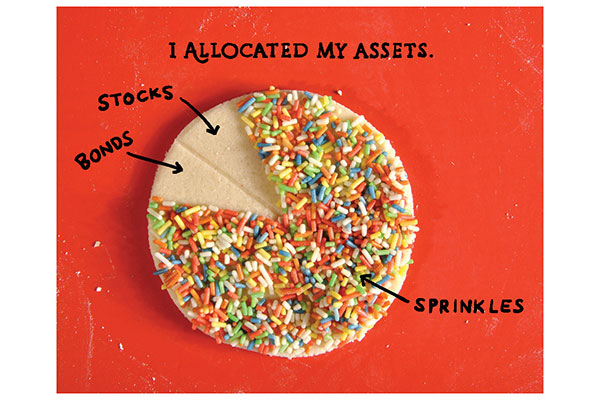

Live Big Digest: Managing Political and Economic Risk in Your Portfolio

To begin with, risk means that more things CAN happen than WILL happen, and since the things that can happen are legion, it would be expensive to individually hedge every possible negative contingency.

Contact Info

Washington, D.C. Metro Area

Vienna, VA 22180

San Francisco Bay Area

San Francisco, CA 94104