Year-to-Date Market Update

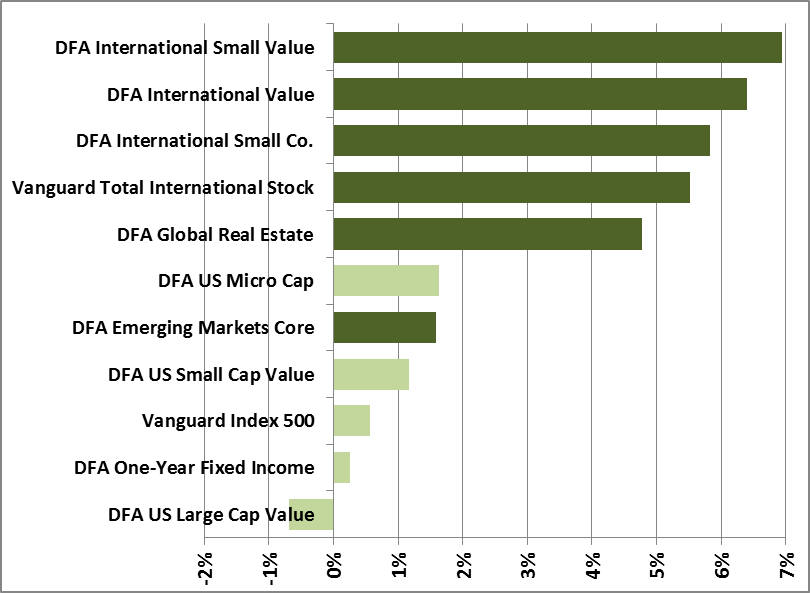

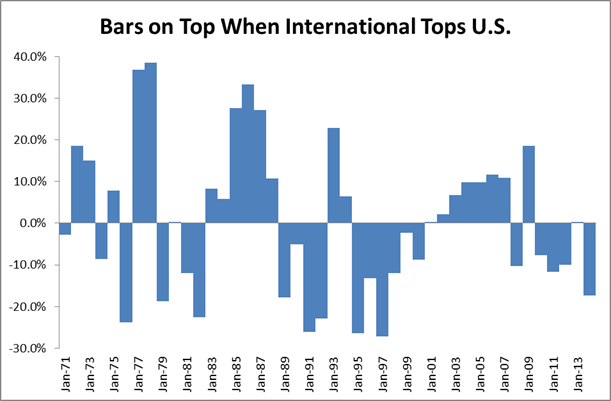

What a difference a day makes, or, at least, a calendar quarter. As everyone knows by now, last year was a good year for U.S. stocks and a not so good year for foreign stocks (at least, for those of us who are dollar investors). The first…