A Different Dimension

We wrote last November about University of Chicago economist Gene Fama receiving the Nobel Prize in Economic Sciences for his work on the “empirical analysis of asset prices,” which is another way of saying “for the scientific exploration of what determines stock prices and returns.” At the time, we thought this notable for two reasons: first, the work of Fama on the concept of “market efficiency” and, later, his joint work with Dartmouth economist Ken French to develop a “three-factor model” of stock returns, has deeply influenced our approach to building and managing investment portfolios for over 20 years.

Secondly, Fama’s research has also deeply influenced – and continues to influence – the work of fund company Dimensional Fund Advisors (DFA), which provides many of the investment building blocks we use when assembling client portfolios.

We’re clearly not the only ones making that connection, however, as the latest issue of Barron’s has a cover article by Beverly Goodman devoted to Dimensional Fund Advisors and the ideas that guide it called, “A Different Dimension” (Goodman wrote an article for Barron’s last August that also focused on Dimensional titled “Where the Smart Money is Headed“). Of course, this has not been the first time that DFA and Gene Fama have made it to the cover of a major business publication. As far back as 1998, DFA was the subject of a Fortune Magazine cover story called, “How the Really Smart Money Invests: Nobel Prize winners entrust their next eggs to DFA where investing is a science, not a spectator sport.” The appearance of this month’s Barron’s article, meanwhile, inspired John Rekenthaler, Vice President of Research for Morningstar to offer his own appraisal of the company titled, “The DFA Model.”

The Force Be With You

That certainly seems like a lot of attention to be lavished on a mutual fund company. In her article, Goodman says that “Dimensional Fund Advisors is unusual” and Rekenthaler declares that DFA “really is different.” Unusual and different in what way, one might rightly ask. And why should anyone care? Goodman explains it this way:

” . . . its overall performance is headline-worthy. More than 75% of its funds have beaten their category benchmarks over the past 15 years, and 80% over five years, according to Morningstar — remarkable for what some investors wrongly dismiss as index investing. Its process is simple and repeatable — and yet no other firm has tried emulating it. When asked why, co-founder, chairman, and co-CEO David Booth, 67, draws a surprising analogy to Star War, and Luke Skywalker’s inability to harness the power of the Force until his devotion was deep and unwavering. ‘We are believers down to our toes,’ Booth says.”

Believers indeed. True believers in an evidence-based approach founded on the best that science has to offer. As Morningstar’s Rekenthaler put it, DFA “is the most self-consciously academic of fund companies.” He also goes on to point out that the company possesses a unique business philosophy with respect to how it chooses which funds to offer and who will be allowed to offer them. A point we will return to later.

True Believers and Efficient Markets

The first tenet for the true believers is the proposition that markets are “efficient.” We hasten to note that the concept of “market efficiency” has nothing to do with markets always being right or never being volatile; indeed, it would take but a little real world observation to see that this could never be the case. Instead, market efficiency (or, academically-speaking, the Efficient Market Hypothesis) suggests that markets generally embed most of what can be known about a stock into its current price. It is therefore difficult or impossible for any individual analyst — or stock picker, if you will — to develop valuable information not already reflected in that price. Prices will move around, to be sure, sometimes violently, but those movements will be in response to NEW information arriving on the scene and not old information that is having its impact after a delay. That is, prices do not move based on old information that might have been available to some careful and perceptive stock analyst. Since new information arrives “randomly,” stock prices will, in the short-run, move up and down randomly, not predictably. Fama puts it bluntly, “active management is a zero-sum game, and that’s before costs. That’s not opinion. That’s math.” Which is not to say there aren’t predictable sources of return that we can work to harness (see Chaotic Systems, or why the market is a lot like the weather). Which brings us to the Fama-French Three-Factor Model.

The Fama-French Three-Factor Model and Stock Returns

The three-factor model was developed by Fama and French in 1993 and proposed that the returns to any stock (or portfolio of stocks) was best explained by a combination of its sensitivity to the stock market as a whole, how big (or small) the stock was, and how expensive (or cheap) it was (that is, does it have a high or low price relative to its assets or earnings). In terms of what an investor most cares about, the Fama-French Three-Factor Model tells us this:

| Small company stocks have higher returns than large company stocks |

and |

Low-priced (value) stocks have higher returns than high-priced (growth) stocks |

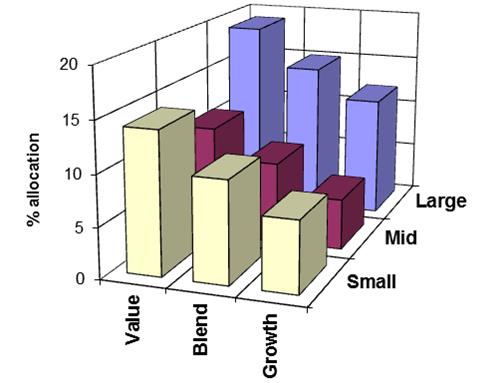

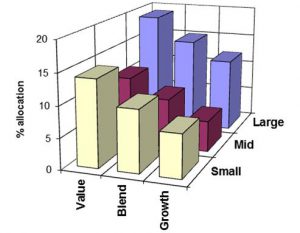

Rekenthaler notes that, with its focus on size and value factors, DFA indirectly “influenced the development of the Morningstar Style Box, which sorts funds according to the same two criteria of value-growth and size.” At Yeske Buie, we’ve taken Morningstar’s two-dimensional style box and converted it into a three-dimensional graph that we believe more vividly illustrates a portfolio’s mix of large and small, value and growth stocks. The following images illustrate the particular mix of large versus small and growth versus value in the current Yeske Buie core equity portfolio. You’ll note that in addition to a significant allocation to small company stocks, there is a notable skew toward value stocks at every size dimension.

|

|

It’s not enough, however, to know that choosing to invest in small company and value stocks is going to impact the returns you earn, the details of how you do that matter. This is one more way that DFA distinguishes its approach from that of the average index fund. As Goodman writes in the Barron’s article:

“Dimensional’s funds aim to capture the returns of an asset class — be it small or large companies, developed or emerging markets — without slavishly adhering to an index. And they do. For example, take the Vanguard Small Cap Value index fund (VISVX), which is based on the S&P 600 Small Cap Value index and is the counterpart to Dimensional’s DFA US Small Cap Value (DFSVX). The DFA fund has a much smaller tilt — its average market value is $1.1 billion, versus Vanguard’s $2.7 billion — and on all measures is much more value-oriented. So the Dimensional fund better captures the market-beating advantage of small and value stocks. In fact, a lot better: The DFA fund returned 42% in 2013, beating 88% of its peers in Morningstar’s small-cap value category, versus the Vanguard fund’s 36% return, which beat just 53%. Over 15 years, which includes periods that were less favorable to small and/or value stocks, DFA’s fund returned an average of 12% a year, beating 80% of peers. The Vanguard fund returned 10% on average, beating just 37% of peers.”

The bottom line is that these “risk factors” — small size and low price — are strongest when you go to the extremes. That is to say, the tendency of small company stocks to have higher returns becomes more pronounced as the size of the stocks get smaller. Likewise, the tendency for low-priced “value” stocks to produce higher returns also becomes more pronounced as the price becomes ever lower relative to a company’s earnings or assets. This means that you would ideally want to make the deepest cut possible when slicing and dicing the market for these risk factors. Dimensional tends to cut much more deeply than your average index fund. And not being an index fund, the folks at Dimensional can also be much more patient when buying or selling stocks that qualify for inclusion in one of their portfolios. Thus, if a company’s shares suddenly qualify for one of DFA’s value portfolios because of a spate of bad news, the managers don’t have to buy right away but can wait for the bad news to be more fully reflected in the stock price. As Rekenthaler puts it, “DFA is leery of trying to catch a falling knife.”

Business Philosophy

Morningstar’s Rekenthaler also makes some interesting points about DFA’s business philosophy. He points out that, like Vanguard and American Funds, DFA is more

” . . . strategic in temperament rather than tactical. They launch relatively few funds, with those funds that they do create being part of a long-term plan rather than a response to current marketplace demands.”

Rekenthaler also notes that all three companies tend to “keep their fund expense ratios low and their senior management in place.” All of which has led Dimensional to become the eighth largest fund company in assets and rising. Which for Rekenthaler poses an obvious question:

“You’d think that more fund companies would decide that having a unique strategic plan, one that makes the company look like no other, is better than being a commodity supplier by giving the marketplace what it desires.

You would think. I doubt that DFA’s success will have much effect, however, just as American Funds and Vanguard’s have not. Bypassing a dollar today for more dollars tomorrow does not seem to come naturally to many fund-company executives.”

But can you get past the bouncer?

The foregoing was the title of a Forbes Magazine article published in 1996, which noted that DFA’s attractive mix of funds were only available through the handful of advisors who had satisfied the company’s rigorous screening process. In her Barron’s article, meanwhile, Goodman notes what she calls “the chief criticism” of DFA, that the way the company operates prevents many investors — especially those with modest assets — from getting access to the funds. At first blush this may seem like a legitimate complaint, but it’s important to note that the company has very specific reasons for making it hard to buy its funds, and they don’t involve a misguided impulse towards exclusivity for its own sake. There are strong operational and philosophical reasons for this selectivity.

First and foremost, by making its funds available through like-minded financial advisors, Dimensional helps to minimize the volume of cash flowing in and out of its portfolios. Retail investors have a high propensity to trade in and out of mutual funds, a point made by Rekenthaler, who observes that investors tend to trade in and out of funds based on short-term performance. One result is that the average investor will generally “buy high and sell low” according to Rekenthaler. But there are other consequences as well and these tend to work against patient, long-term investors. First, the operating expenses that a fund must charge can be driven up by the necessity of processing all the trades that result from hot money flowing in and out of a fund. The perverse outcome is that the long-term investors in a fund see their own net returns eroded by the higher expenses caused by the flow of hot money. The second consequence is less tax efficiency, as the need to liquidate fund holdings to meet the demands of short-term investors exiting a fund can create capital gains that must be distributed to long-term shareholders, unnecessarily driving up their tax costs. On both these fronts, Dimensional’s approach seems to work according to Dave Butler, who oversees Dimensional’s relationship with the advisors who use its funds.

“Look at 2008 and 2009 — we had positive cash flows in both years. I don’t think there’s any other money manager that can say that. I credit the advisors; they kept their clients on track.”

As you know, at Yeske Buie we are committed to an evidence-based approach in everything we do. We believe in developing strategies that are grounded in the best scientific evidence the academic world can supply and then applying those strategies in a consistent and disciplined fashion. This is what led us to make DFA a significant part of our portfolio construction process, contributing, as it does, many important building blocks to nearly all of our clients’ portfolios.

And while Dimensional has been very successful as a business, we think it’s an example of a company doing well by doing good and a tribute to the power of True Believers.

The Yeske Buie Team