Investing Isn’t a Race – It’s a Road Trip

When it comes to investing, it’s easy to get swept up in the rush – fast trades, market timing, and the constant hum of market noise. But successful investing isn’t about speed, it’s about direction, intention, and resilience. Our approach to investing is that it’s not a race, it’s a well-planned road trip.

As someone who has taken plenty of road trips in my life and has been studying financial planning for five years, the intersection of these two pursuits came to me… well… on one of my recent drives from New Jersey to Virginia. Fueled by a little highway inspiration, this piece explores three ways investing mirrors a road trip by focusing on three key decisions that shape an investor’s journey. Buckle up!

Active vs. Passive Investing

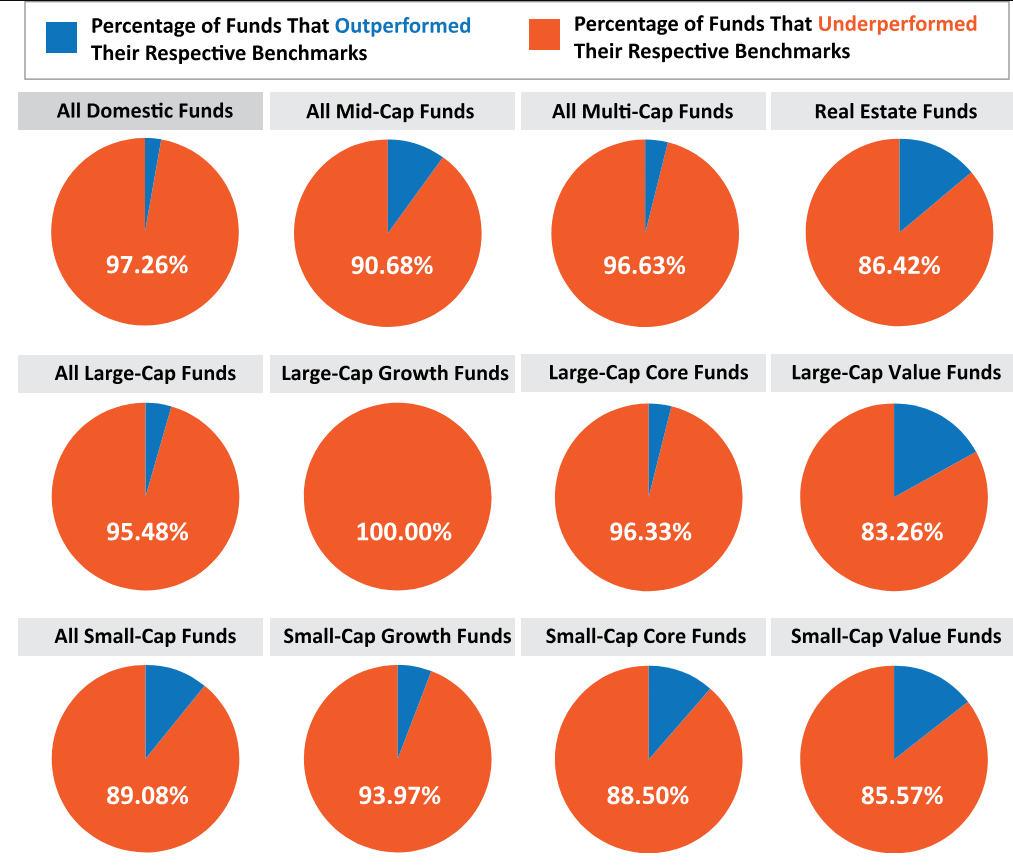

Embracing an active or passive approach to investing is a defining choice in identifying your investment philosophy. Active investors attempt to time the rise and fall of the stock market and identify specific stocks for outperformance while passive investing is focused on the long run. Historical returns show us that very few active managers are actually able to achieve their goal (as the below “Active Funds vs Their Benchmark: U.S. Equity” chart shows us).

What does this tell us? Partly that markets work and are efficient (this piece discussing the market’s reaction to President Trump’s tariffs exemplified this as well). If someone can consistently identify outliers within the market and capitalize on opportunities at the expense of other investors, it would indicate that the market is not efficient. Contrary to the active investing ethos, passive investors believe in efficient markets and look to broadly invest across multiple asset classes. They do not attempt to time the market or invest in a specific “hot” stock.

So how does this compare with road trips? How many times have you been driving and seen someone constantly switching between lanes, looking for an opening to get past everyone else on the same road, just to end up next to (or ahead) of that same person at the next red light? There is no guarantee that bouncing between lanes will get you to your destination faster – and even if you do, it might not be worth the increased risk of an accident. Active managers act in a similar fashion – bouncing around the market looking for an opening to put themselves ahead of everyone else, although as shown earlier in this article, most of the time they still end up behind the passive investors.

Equity vs Fixed Income Allocation

Another choice that all investors are faced with is their portfolio allocation. For the purposes of this article, we will only look at the broad decision of equities vs. fixed income (there are also plenty of diversification decisions that are made within each of these asset classes). Historical returns show us that equities have higher average returns than bonds (and, therefore, equity tilted portfolios usually grow faster than the fixed income tilted portfolios over a significant time horizon). Similarly, on a road trip, the left lane is typically designed to be the ‘fast lane’ (although when commuting home on Route 66, I question this). We can compare this lane to an equity tilted portfolio. Zooming in the left lane should get you to your destination faster (higher expected returns) compared to cruising in the right lane which may add some time to your journey (lower returns).

But, we are ignoring a huge factor here – risk. There is more volatility, or risk, associated with a heavier tilted equity portfolio than a fixed income portfolio. Historical averages tell us that the standard deviation (a measure of risk) of a 100/0 (100% equities, 0% fixed income) portfolio is significantly larger compared to a 50/50 (50% equities, 50% fixed income) portfolio – which would be considered very conservative. When determining your portfolio allocation, it is important to understand your risk tolerance (which is the degree of risk that you are willing to endure). Once assessed, you can select the appropriate portfolio allocation. Likewise, it is important to feel safe and comfortable on the roads. Just because the speed limit is 70 miles per hour, should you be going that fast? If you do not feel comfortable or safe – of course not! The same is true for your portfolio allocation.

Should You Hire a Financial Advisor?

Our final comparison of the day: should you take the trip alone or should you bring a co-pilot (or CERTIFIED FINANCIAL PLANNER®)? While I enjoy some nice time alone in the car, having a companion on your journey has a lot of benefits – someone to help with the navigation, spot wrong turns, be with you during traffic jams, remind you to get gas, plan rest stops, and even take the wheel when you’re feeling fatigued.

This is all true for hiring a CFP® as well—at least, it should be if it’s the right match! Much like choosing the right co-pilot for a long road trip, selecting a financial planner is a deeply personal decision. And as you would when building friendships, be intentional when choosing your advisor. The relationship with a CFP® should be built on trust, transparency, and a shared commitment to your financial wellbeing. After all, this is someone who will sit beside you on your journey for years, possibly decades, and may even support future generations of your family. You’ll want to feel comfortable enough to share your goals, values, and important personal details along the way.

Also importantly, a CERTIFIED FINANCIAL PLANNER® is held to the fiduciary standard, meaning they are required to act in your best interest at all times. In addition to this ethical responsibility, CFP® professionals must meet rigorous education, examination, and experience requirements. So when you choose the right planner, you’re not just getting a co-pilot, you’re gaining a qualified partner who is fully committed to helping you reach your destination.