New Year, Same Story: Inflation Inquiries

As the topic of inflation continues to dominate discussions in the financial and economic worlds, we thought we’d share our take on the most recent CPI reading, the Fed’s plans to raise interest rates in 2022 to combat rising inflation, and what it all means for you and your portfolio.

We’ve made a bit of a habit of talking about this, haven’t we?

CPI readings were published earlier this month, and the trailing 12-month inflation rate has increased to 7% (Core CPI rang in at 5.5%). As expected, the Fed’s continued to telegraph its plans to raise interest rates over the course of the year (it began teasing rate hikes late last year). None of these developments are surprising, and you’re probably not surprised to read that we still don’t think there’s cause for concern. This determination is based on three points:

- Several of the economic indicators we’ve been tracking throughout the recovery are providing reasons to be encouraged.

- We have recent history to use as guidance for how the Fed might approach this round of rate hikes.

- Our Clients’ portfolios are positioned well for a rising-rate environment and have done well throughout this inflationary period.

Economic Indicators – Back on Track?

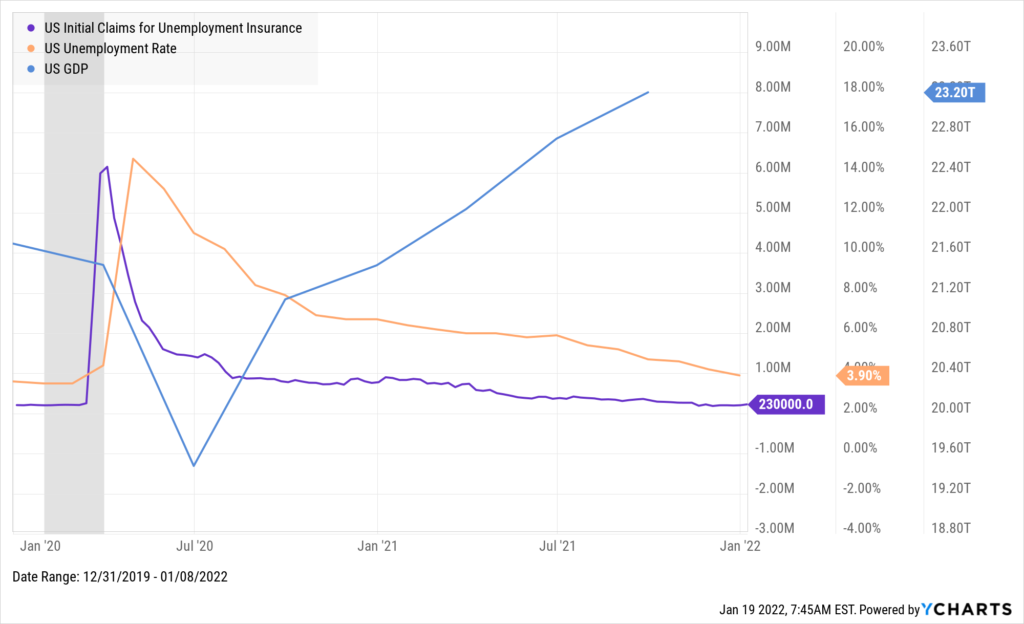

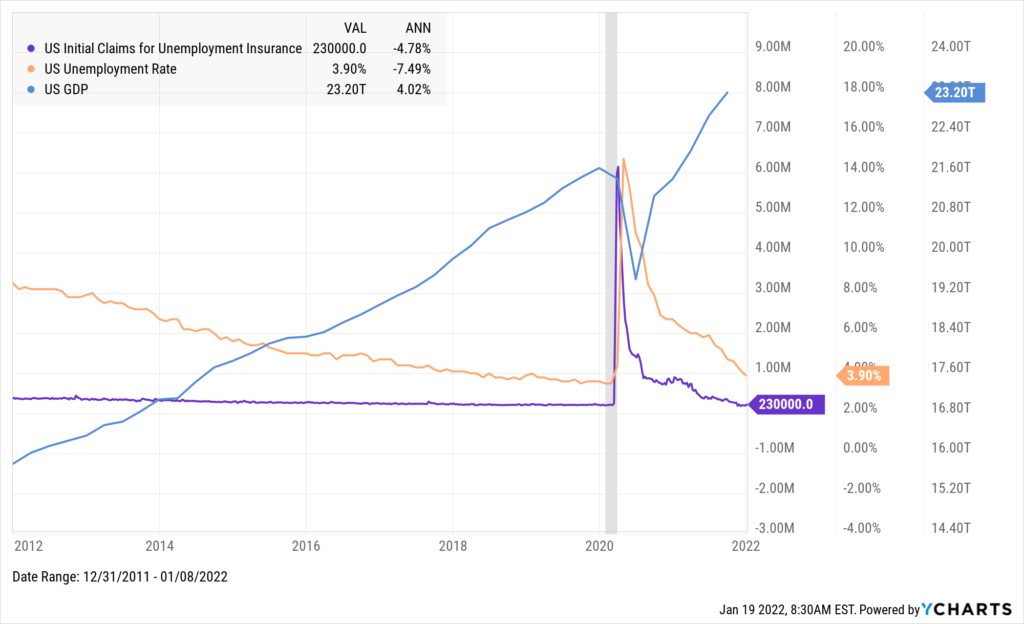

Despite the dramatic shock to the system presented by COVID nearly two years ago, a number of indicators seem to suggest that the economy is back on track in many ways. Unemployment is down to 3.9% (the pre-pandemic figure was 3.5%) and claims for unemployment insurance are lower than they were before COVID. Most importantly, perhaps, is the estimate for GDP (which measures total economic output) – the estimates for the US indicate a growth rate of 4% in 2022, which is on track with the rate at which the economy has been growing for the past 10 years. The two charts below tell the story rather succinctly.

Economic Indicators: Initial Claims for Unemployment Insurance, Unemployment Rate, and GDP (2012-2022)

That’s not to say there aren’t still problems to be solved as we continue to muddle through this pandemic, or that we won’t continue to experience disruptions as we press on. But there are reasons to be optimistic about the path we’re on, and how swiftly we’ve returned to our pre-pandemic trajectory.

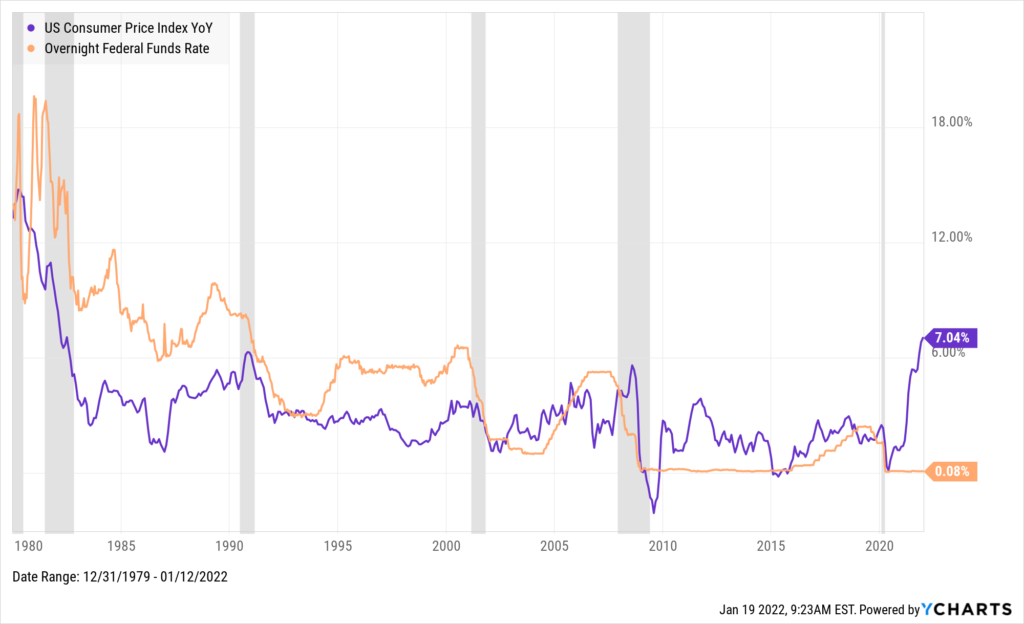

The Fed and Inflation – A 40-Year Dance

The Federal Reserve has a dual mandate – full employment (achieved when unemployment is 4% or less) and maintaining an inflation rate of 2%. That mandate was born in the early 80s under the leadership of Paul Volcker, who sought to “slay the dragon” of inflation (back when it was running at 15%). And the Fed has two main tools that it uses to achieve that mandate – Open Market Operations (the process by which the Fed adds and subtracts dollars from the money supply via the purchase and sale of US government bonds), and manipulating interest rates (by raising and lowering the Federal Funds rate). As the recovery has continued to unfold, the Fed has been tapering its purchases of bonds as the economy strengthens; now that we’ve reached full employment, it has determined it is time to begin using the other tool in its toolkit and begin raising rates to cool the economy (something Chairman Powell has been saying for months). This is a normal progression through the economic cycle.

Volcker leaned heavily on the use of the Federal Funds rate, increasing it to nearly 20% at the outset of his campaign. And in subsequent periods, other leaders of the Fed have done the same. See the chart below, in which the Federal Funds rate is depicted by the orange line and the inflation rate (CPI) is in purple.

Inflation vs. the Federal Funds Rate (since 1980)

We think this illustration provides three main takeaways:

- In every instance in which inflation has started to rise, the Fed raised the baseline interest rate and the inflation rate subsequently decreased. And we should note the rate has hovered around 2% for nearly 30 years.

- The inflation rate rose coming out of every recession over the past 40 years (indicated by the gray bars) except in the early 90s, an indicator that it is normal for prices to rise in the expansionary stage of the economic cycle (and we are in that stage of this current cycle).

- The Fed’s approach has evolved over time; in the 80s and 90s, it was aggressive and raised rates promptly (some would even argue too proactively at times, preempting growth by prioritizing an arbitrarily low inflation rate), whereas in response to the Great Recession the Fed let rates sit near 0% for nearly seven years. And recent guidance from the Fed has indicated that although they’re targeting an inflation rate around 2%, they will let the rate oscillate around its target a bit before taking action so as not to curtail growth prematurely.

Given the Fed’s announcement of four interest hikes in 2022, and its guidance that it won’t make sudden movements unless economic circumstances dictate doing so, we would expect this round of rate hikes to resemble the path we were on leading up to the pandemic, when the Fed raised rates by a quarter point every few months.

A Portfolio With a Value-Tilt Is Well-Suited for this Economic “Season”

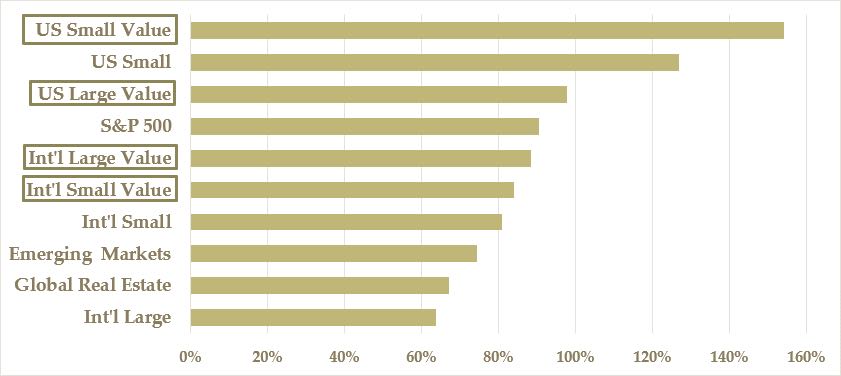

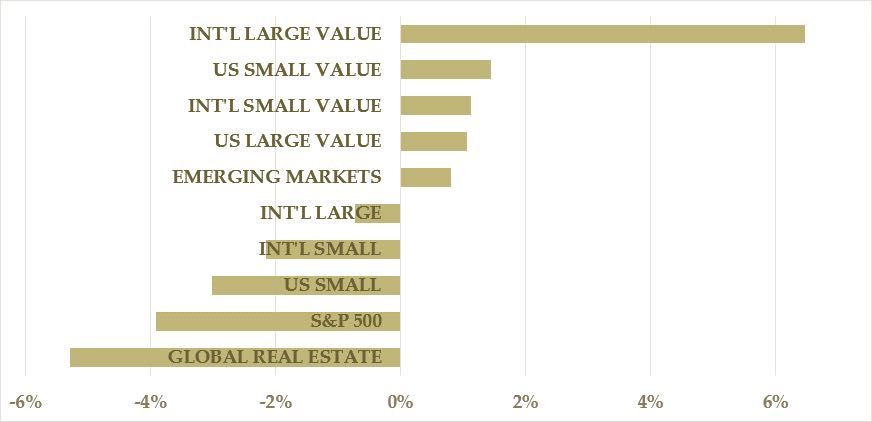

Readers of this digest know our Clients’ portfolios are tilted towards small company and value stocks. That approach has been well-served throughout the recovery (April 1, 2020 through January 19, 2022) – see below:

We think this illustration provides three main takeaways:

- In every instance in which inflation has started to rise, the Fed raised the baseline interest rate and the inflation rate subsequently decreased. And we should note the rate has hovered around 2% for nearly 30 years.

- The inflation rate rose coming out of every recession over the past 40 years (indicated by the gray bars) except in the early 90s, an indicator that it is normal for prices to rise in the expansionary stage of the economic cycle (and we are in that stage of this current cycle).

- The Fed’s approach has evolved over time; in the 80s and 90s, it was aggressive and raised rates promptly (some would even argue too proactively at times, preempting growth by prioritizing an arbitrarily low inflation rate), whereas in response to the Great Recession the Fed let rates sit near 0% for nearly seven years. And recent guidance from the Fed has indicated they’re although they’re targeting an inflation rate around 2%, they will let the rate oscillate around its target a bit before taking action so as not to curtail growth prematurely.

Given the Fed’s announcement of four interest rates in 2022, and its guidance that it won’t make sudden movements unless economic circumstances dictate doing so, we would expect this round of rate hikes to resemble the path we were on in leading up to the pandemic, when the Fed raised rates by a quarter point every few months.

It’s here that we’ll note value stocks are particularly well-suited as an investment in a rising rate environment. Lower interest rates favor “long-duration” growth stocks, whose anticipated earnings are mostly in the distant future. Higher interest rates favor value stocks, whose current and near-term earnings loom larger. The outlook for value stocks is quite positive given current circumstances, and recent returns have backed that up; as choppy as the start of 2022 has been, nothing’s done better than value stocks (year-to-date returns through January 18):

We’ll have more to say on this topic during next week’s webinar (register here), but we wanted to make sure we left you with some light reading ahead of the weekend.

As always, please don’t hesitate to reach out to a member of our Financial Planning Team with questions.

Please click here for performance disclosures related to performance reporting and benchmarks.