Confidently Confront Crisis

In life, crisis is unavoidable. With proper planning and resilience, however, a crisis can be maintained, and even nurtured, to not only minimize devastating effects, but also to inspire growth. This means that having a financial plan built to withstand a crisis, whether due to a change to your lifestyle, a blow to the economy, or a global pandemic, is vital.

Inspired by a seminar featuring Adam Grant and Malcolm Gladwell, two thought leaders in the realm of business and social sciences, our team spent some time deeply thinking about crisis planning, and thought it a great opportunity to highlight some of the answers. So, how are Yeske Buie’s plans built to withstand a crisis? Here’s how.

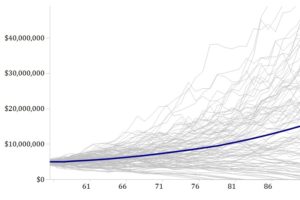

Monte Carlo Analysis

Yeske Buie uses Monte Carlo analysis to model the probability and possibilities of a scenario that is unpredictable. It is improbable that life, and consequently your financial journey, will be linear. By using analytical tools that incorporate the variability of a scenario, we can assess how your financial plan will be affected by a crisis.

Insurance Planning

As we know, life can be unpredictable, and sometimes those unpredictable events cause financial strain. An important aspect of crisis planning is analyzing your needs for insurance. Life Insurance is an important consideration when testing your plan for its sustainability during a crisis. At Yeske Buie, by looking at your current and future income, expenses, and liabilities, we can calculate the level of insurance an individual needs in order to provide for their family in the event of premature death.

Estate Planning

Estate planning is another way we plan for a crisis. By ensuring that you work with an estate attorney that understands your wishes, we assist in guiding you through the steps of making sure your legacy is executed in the way you wish. While this scenario is one that everyone will eventually experience, there is comfort in knowing that you’re a plan is in place.

Two Week Look

A part of our process with the accounts we manage is to perform a two week look. This entails us reviewing every account every two weeks to determine if there are any opportunities to rebalance the portfolio to meet its target allocation. By actively reviewing your accounts, we ensure that your portfolio is properly diversified. During peak volatility, such as March 2020, we change our process from looking every two weeks to looking daily which allowed us to optimize our strategy. It’s important to note that while we look at all accounts every two weeks, that doesn’t mean that we’re making changes every two weeks. Learn more here.

Emergency Funds

Establishing an emergency fund is another important aspect of crisis planning. By having a sufficient amount of cash set aside, you’re protected in the event of home repairs, unexpected medical expenses, or a layoff. To read more about how much you should aim to have in your emergency fund, check out this article.

Policy-Based Financial Planning®

Policy-based financial planning is the process of building a system that withstands life’s unpredictable circumstances. The framework was built by Yeske Buie’s Founders, and is founded on research that establishes resilience in your portfolio. By committing to a policy that is rooted in research, we can approach market crisis knowing that our policy is built to withstand volatility. Learn more about how our policies are designed to withstand an everchanging world.