Conscious Creep: Budgeting with Balance

The words “lifestyle creep” often conjure negative thoughts and images: someone living paycheck to paycheck even as they earn a six-figure salary, for example. Indeed, lifestyle creep – a gradual increase in spending as your income rises – has been the boogeyman of many personal finance sources out there. It is possible, however, to increase your spending without losing your balance. Let’s explore how, with conscious values-based and policy-based decision making, a little bit of lifestyle creep isn’t necessarily a bad thing.

What Lifestyle Creep Is NOT

Before diving too deep into this discussion, let’s first make space for a few important caveats about what lifestyle creep is not:

- Lifestyle creep is not defined by things out of your control – most notably, inflation. If you’re seeing your cost of living go up each year without making conscious decisions to upgrade your lifestyle, then there is no reason to feel guilty. Inflation is as inevitable as death and taxes. Sometimes you just have to adjust your budget in recognition of the fact that things cost more today than they did a few years ago.

- Lifestyle creep can also be the result of changing life circumstances: getting married, having kids, adopting a pet, moving to a new city or state, etc. While these changes do necessitate increasing your lifestyle spending, they are also conscious decisions that are made to move into a new stage of life. It’s a fact of life that the decisions you make in one stage are going to be different than the decisions you made 5-10 years ago, and that’s okay.

- Lastly, lifestyle creep is not reaching the point where you can finally afford necessities you previously couldn’t. Having the budget for a reliable car or being able to afford better preventative medical or dental care is not a sign that your spending is out of control. Instead, it’s a sign that your financial capabilities to care for yourself have expanded, and your updated lifestyle reflects that.

Keeping Up with the Joneses

We live in a consumerist society, making it incredibly challenging to avoid the trappings of constant, modern advertising and the human tendency to play the comparison game. Phrases such as “the hedonic treadmill” and “keeping up with the Joneses” have even become common vernacular, evidencing just how easy it is to get caught up in purchasing the next new thing.

Even we, as financial planners, can’t claim that we are immune to lifestyle creep. I, myself, have moved three times in the past five years, as my income has afforded me the ability to find more comfortable apartments that better align with my vision for my life.

Note that this is not an indictment of the idea of lifestyle creep. It’s okay to buy the nicer house, own the nicer car, go on the nicer vacation – even spend money on the nicer shampoo! Part of the value in earning a higher income is allowing yourself to enjoy the fruits of your labor. The goal is to do so without being influenced by the decisions of those around you. When you add something new to your life, consider whether it’s actually adding value or just helping you live the life you think you “should.” Make the decision that makes you happy – not the one that you think will impress others.

Moving Forward When It’s Hard to Turn Back

There’s an inspiring article by personal finance writer Katie Gatti Tassin titled, “A Little Lifestyle Creep is OK—but Be Careful, it’s Hard to Go Backward.” In her article, Tassin makes a case that we adapt quickly to big lifestyle changes, making it hard to reverse them, “It’s all relative, but it’s difficult to downsize—lifestyle creep typically only creeps in one direction.”

Given that it is virtually impossible to undo the trend of lifestyle creep, we advise our Clients to do two things:

- Set policies to guide decisions around new income, and

- Make these changes with a conscious understanding of how it relates to your values.

Let’s touch on both of these.

Policy-Based Decision Making

People tend to fall into the trap of lifestyle creep when they see new income and haven’t yet thought about what to do with it. Before you ever find yourself in this situation, we recommend establishing financial planning policies to guide you. A concept pioneered by our Founding Partners, we have written about financial planning policies on several occasions in the past; they are “compact decision rules that make it easier to stick with a consistent course of action in the midst of an ever-changing environment.”

Financial planning policies allow you to establish a plan that, for instance, you will save an additional 10% of any raise you receive, ensuring that the entire increase does not immediately go to brand new purchases. As Tassin notes, “It’s usually wise to take smaller steps than you’d think necessary so you can really wring all the joy and excitement out of each and every incremental inch upward.”

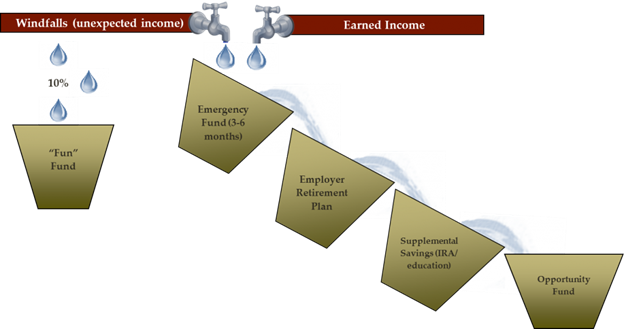

The following is an illustration of a basic set of Cash Flow Policies. Note that no dollar amounts are prescribed here. The sole commitment is that this individual will fill each bucket before moving to the next, regardless of his or her level of income.

Policy-based decision making allows you to establish a framework whereby your savings rate is not left behind as your income and spending increase. As a general rule, as your income and spending increase, your savings rate should be increasing even faster. And that applies to both your retirement savings and your emergency fund, which needs to be able to cover 3-6 months of your (now higher) living expenses. The goal is to ensure that your savings outpace your cost of living in order to maintain that standard of living for the rest of your life.

The less you spend, the less you have to save to replace your lifestyle in retirement. In other words, as Tassin puts it, “It’s not just asking yourself ‘Can I afford this right now?’ It’s, ‘Can I afford this forever?’”

Values-Based Decision Making

How do you know what is “good” lifestyle creep and what isn’t? First, you have to be clear about what money means to you, because it can feel empty if you don’t understand the “why” behind what it is and how it fulfills your goals. In other words, you can’t truly make a grounded decision about what to do with your income until you have truly defined what “wealth” means for you.

Wealth building is a uniquely personal journey, and it’s up to you to determine who and what are most important to you. While some readers may cherish traveling the world and creating memories with family or friends, others may derive no greater joy from meticulously designing the perfect home full of craftsman furniture and designer fixtures.

Calling back to my example about my own lifestyle creep, the decisions that I have made regarding my own living situation have been informed as much by my values and goals as by my finances. I made the conscious decision to change that area of my life as a result of intentional self-reflection and an understanding that I was committing to maintaining my new standard of living indefinitely.

“Spend extravagantly on things you love and cut mercilessly on things you don’t.”

– Ramit Sethi

In order to define what wealth means for you, we recommend spending a little time finding out what you love and going after it aggressively. Taking that a step further, also think about what you don’t love or what external factors may be influencing you.

Transform “Intimidating” into “Empowering”

In conclusion, lifestyle creep can be an intimidating concept because it can sneak up on anyone and lead to the irreversible expansion of your lifestyle beyond your means. However, when implemented with care, lifestyle creep can be transformed into a tool that empowers you to enjoy the fruits of your labor and position yourself to maintain that standard of living for the rest of your life.

Balance is possible, and if you’re looking for someone to help you explore your values system or establish policies to make the decision-making process easier, reach out to us! We’re great people to think with.