TheLiveBigWay® Digest: Graduation Season

Who Pays for College?

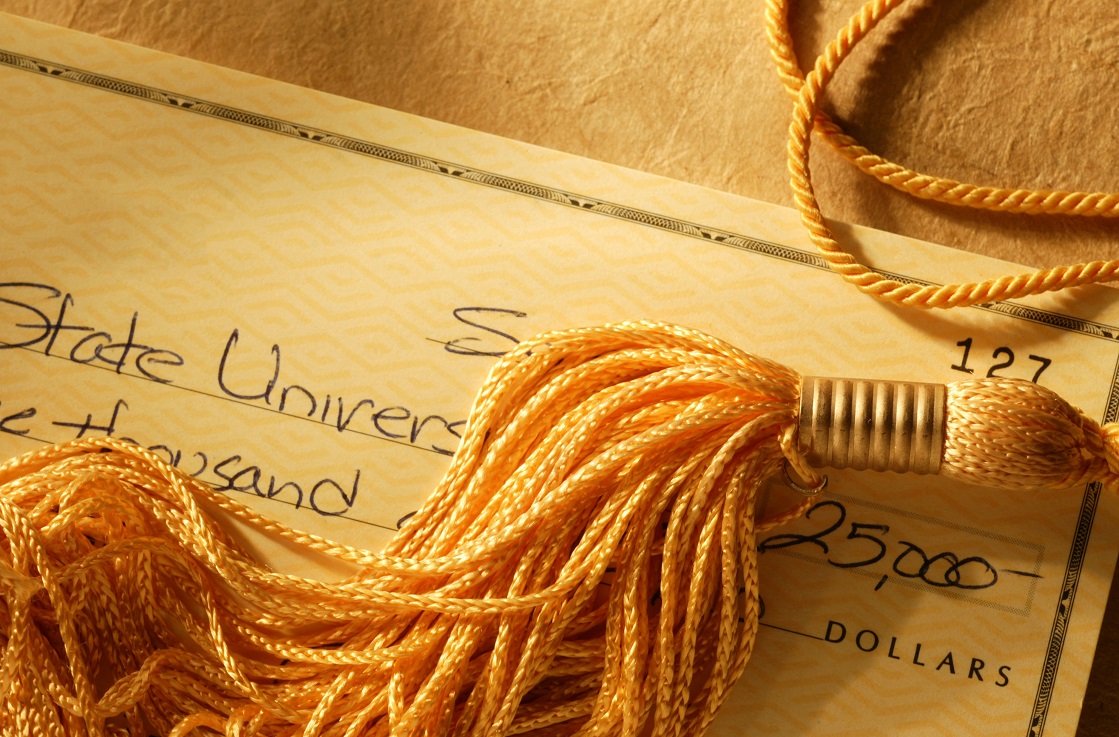

May marks the beginning of an exciting time for students and families – graduation season! And after the ceremonies are over and the graduation hats fly, the next question for high school and college graduates is always… what’s next?! While it can be easy to get caught up in the celebration of graduation festivities, this major life transition also includes several big decisions, such as who will pay for that college degree? In this piece, we dive into a few national studies provided by Sallie Mae and the College Board to explore who and how students and families pay for college.

Generation Earn: Congrats, Grads!

To all high school and college graduates, we’d like to extend a sincere congratulations on accomplishing a major milestone! In addition to being a wonderful time of celebration, graduation is also an opportune time for planning for what lies ahead. To this degree, we’d like to offer two books that we feel make for impactful summer reading for recent graduates. One book helps grads think about the things they want to do, choose to do, and can’t wait to do in their life, and the other is a guide that covers many major financial decisions that grads are likely to encounter. Learn more about each book here and let us know if there is a graduate in your life who would be interested in receiving one of these tools.

Yeske Buie in the Media: A Buck Will Buy Your Identity

For our most recent live webinar, Yeske Buie engaged with cybersecurity expert, Carrie Kerskie, to share with you tips and best practices for keeping your personal information protected. The webinar caught the attention of contributing author for Financial Advisor Magazine, Joyce Blay, who shared a great article summarizing many of Carrie’s recommendations. We’ve listed a few of the recommendations from the article in this piece, and we encourage you watch the entire webinar to ensure you’re doing all you can to protect your cyber identity.

2018 Tax Return Request

The first deadline of the 2019 tax season is officially in the rear-view mirror. For those who did not file for an extension, we’d like to request that you send us a copy of your return. Exactly how we use the information in your return varies from Client to Client but can range from analyzing Roth conversions, to updating retirement capital projections, calculating tax projections, and tracking tax data that can impact investment decisions. It is our preference to receive the entire document, however, having a copy of the 1040 and all Schedules is usually sufficient. To securely send us a return or any other information, please use one of the methods described here.