Economy and Investing

Hello volatility my old friend…

What is Bitcoin actually worth?

The Coming Bear Market

This is the title of a recent article by economist Robert Shiller in which he discusses current economic and market conditions in the U.S. and compares them to prior times when markets declined. Shiller is notable for having published a book titled “Irrational Exuberance” in…

Video: Yeske Buie Investment Philosophy and Process

The 2017 Trends in Investing Survey

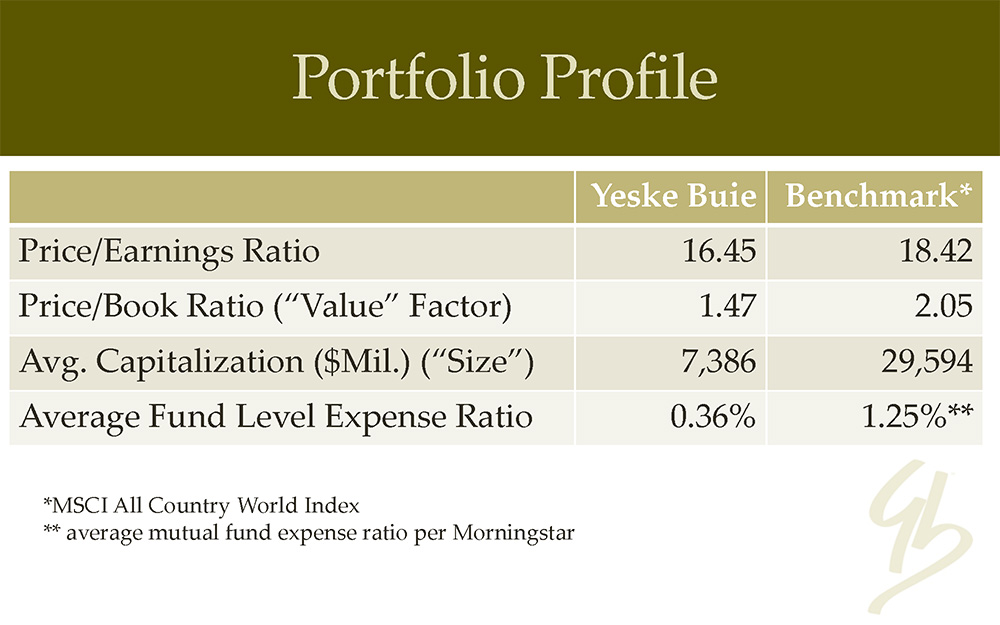

Short Take: Is the Stock Market Expensive?

Ever since the Dow crossed the 20,000 mark, we’ve been hearing from various quarters that the party is, most assuredly, over. As we noted at the time (Market Note: Dow 20,000), that milestone is just a number. And, of course, the Dow represents just 30…

Around the World in 60 Minutes

The world is in a rare state of flux, with a populist, anti-trade president newly installed in the White House, and populist, anti-EU parties on the rise all across the European continent. Economic conditions in the US and abroad, meanwhile, are showing positive trends, but…

Fundamentals of Fixed Income

At Yeske Buie, we use a few bond funds to obtain exposure to fixed income investments for our Clients. While fixed income may not be the most exciting piece of your portfolio, it is a necessary part of a sound investment strategy. The more “exciting”…

Market Note: Dow 20,000

The Dow closed above 20,000 for the first time on Wednesday, repeating the feat the following day. There are headlines any time the Dow crosses a 1,000 mark and that’s especially true of this latest milestone. Here’s our take. First of all, and to state…

Contact Info

Washington, D.C. Metro Area

Vienna, VA 22180

San Francisco Bay Area

San Francisco, CA 94104