The World Is(n’t) Ending – A Walk Down Memory Lane

We’d like to begin this piece by acknowledging that it is scary out there – this year has been challenging for a number of reasons. To paraphrase Michael Stipe, lead singer of R.E.M., it feels like the end of the world as we know it… and yet somehow, when we look forward, we at Yeske Buie feel fine. How is it, you might ask, that we can maintain a positive outlook about the future? The answer lies in the past and what we’ve already survived – our strength lies in our resilience.

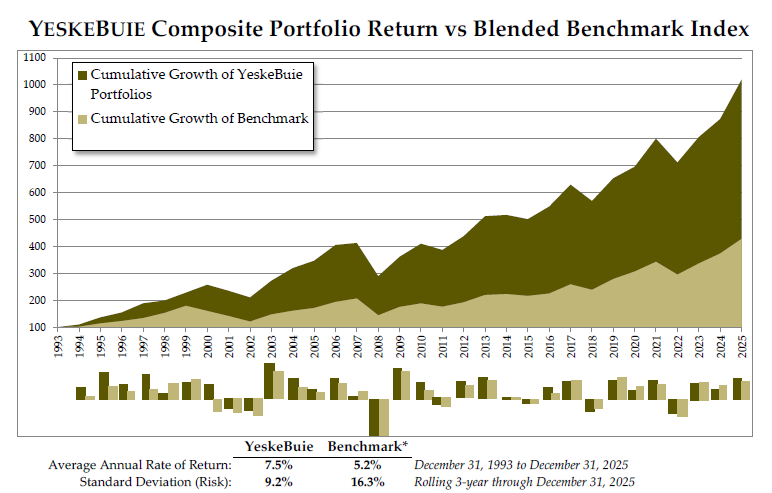

Below is an image readers of this digest will find familiar: a chart illustrating the Yeske Buie portfolio’s performance against its benchmark since the beginning of 1994. Over the past three decades, markets have thrown many a monkey-wrench at investors’ financial lives; and yet, the trend is clear: despite the worries of the day, markets rise over time.

Depending on the year, the “worries of the day” have centered around topics like tariffs, inflation, what the Fed will do with interest rates, sky-high oil prices, supply chain disruptions, the war in Ukraine, the ongoing effects of COVID on the economy – and we could go on. The focus of this piece is to highlight that though the topic of concern varies, we’ve faced similarly significant concerns in years past and yet we’re still standing.

In the space below, we’ve summarized seven (!) downturns that occurred over the past 28 years, making note of how our portfolio performed during each respective downturn and how it rebounded once markets reached their relative bottom each time. We’ve also included links to pieces we wrote during each period, along with a sampling of headlines in case you want to turn this stroll into a deep dive.

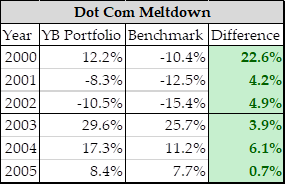

2000 – 2003: Dot Com Meltdown

What Happened:

We’ll begin with the Dot Com Meltdown, which began in earnest after the Y2K scare (when the world was going to end – who else filled their bathtub with drinking water and stashed canned goods in every corner of their home?). US markets declined in value for three years straight. What was happening to drive the decline? Overvalued tech companies were finally facing the music, and investors were being forced to acknowledge that those sky-high valuations had to be reconciled with reality. It was during this time that our portfolio’s globally diversified approach (and inclusion of international stocks), along with our tilts toward small company stocks and value stocks paid dividends – note the outperformance relative to our benchmark (which, like our portfolio, is geographically neutral, but does not reflect the same tilts toward small and value stocks). Furthermore, we think it’s fascinating to observe how dramatically the market rebounded in 2003, with our portfolio returning nearly 30%.

What We Wrote:

This period preceded the merger of our predecessor firms, so we’re unable to link to posts from this time. But Dave has reminded our Financial Planning Team time and again over the past two years that “things were feeling like ’99 all over again.”

Headlines:

- Wall Street Ends a Tough Year – Final session sell-off ends Nasdaq’s worst year, Dow’s first drop since ’90 (emphasis ours, and with intent – note how dramatic the headlines are as we go on)

- Wall Street: From Bad to Worse – US stocks extend slide to second year for first time since 1974

- Investors Say Ta-Ta, 2002 – Stocks fall for third straight year, market’s longest losing streak in 61 years

2008 – 2009: Great Recession

What Happened:

Fast forward a few years, and markets were ripe for another downswing. This time, the bubble that burst wasn’t in the technology sector, but in real estate. Loose underwriting standards led to mortgages being approved for buyers who probably shouldn’t have owned a home (or two or three), and the subsequent defaults on those loans sent a catastrophic tidal wave through the global economy because of the derivative/speculative “investments” (we use the term loosely) built on those debts.

While the downturn actually began in October of 2007 and ended in March of 2009, most of the carnage occurred in 2008. And the strain on markets caused the worst economic downturn since the Great Depression, earning its apt nickname. And yet again, the next year (despite markets continuing to fall for the first two months of 2009), the rebound was swift and pronounced, with our portfolio up nearly 25% in 2009. And while it still felt scary (anyone recall how often they heard the phrase “double-dip recession” in those days?), we were focused on being opportunistic.

What We Wrote:

In response to what was happening in the world throughout those years, what would become TheLiveBigWayDigest was born – in its first form, it was known as The Yeske Buie Weekend Digest. Links to all of our pieces from 2009, when we began posting regularly in this format, can be found here.

Headlines:

- For Stocks, Worst Single-Day Drop in Two Decades

- Wall Street’s Red October – This month was one of the worst-ever for stocks. Down on a wild ride. S&P down 198 points – most ever.

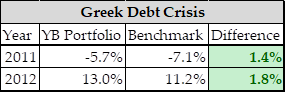

2011 – 2012: Greek Debt Crisis

What Happened:

Two years later, downside volatility was back. This edition focused on the debt crisis in Greece and how it might affect the rest of Europe and the world at large (not to mention concerns over the Fukushima power plant, the US’s downgrade by S&P, and soaring oil prices). Stocks actually had a great first half of the year, but those gains were no match for the slide at the end of 2011. And then came 2012, which is when the world was actually supposed to end (remember?). It didn’t, obviously, and markets recovered nicely despite worries about the Fiscal Cliff in the US that plagued headlines for much of the year.

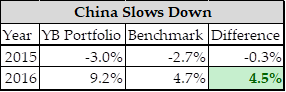

2015 – 2016: China Slows Down

What Happened:

A few short years later, investors were jittery with concerns about oil prices (this time because they were collapsing), China’s slowing growth projections (after years of massive growth), and the first interest rate hike from the Fed since the end of the last recession (sound familiar?). Compared to the other downturns discussed here, this was the mildest. But that doesn’t address how it felt – note the way our two selected posts below began by speaking to the fact that the world wasn’t, in fact, ending. And, of course, it didn’t – our portfolio returned more than 9% in the subsequent year.

What We Wrote:

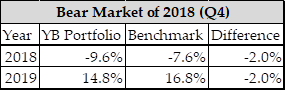

2018 – 2019: Bear Market of 2018

What Happened:

Fears about rising interest rates had investors spooked – anyone recall the fretting over the inverted yield curve? In the US, much of the downside volatility in markets could be traced back to the Tax Cuts and Jobs Act of 2017, which reduced the corporate tax rate by 14%. Many corporations used the savings to buy back their own stocks, artificially inflating their own stock price. When the same cash flow surplus wasn’t made available in the next year, valuations came down as the air was let out of the proverbial balloon and stocks fell for the first time in years. And then they came back in full force in 2019, pushing markets to all-time highs just in time for the next decade to begin…

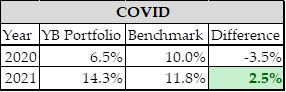

2020 – 2021: COVID

What Happened:

The entire world shut down in response to a deadly virus that continues to affect our lives more than two years later. The stock market cratered in March 2020, with March 9th (Black Monday I), March 12th (Black Thursday), and March 16th (Black Monday II) providing some of the most dramatic one-day declines markets have ever seen. Both Congress and the Fed took swift action, as did governments and central banks around the world, and over the subsequent 21 months markets soared worldwide. What’s fascinating to see in looking at the annual returns is that the downswing isn’t even captured in this table – the fall and recovery occurred so quickly that markets ended in the black after the worst market crash since the Great Depression.

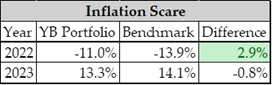

2022 – 2023: Inflation Scare

What Happened:

After watching markets take off and run through the final three quarters of 2020 and nearly all of 2021, our Clients were seeing their portfolios at their highest levels ever coming into 2022. And that was just in time for inflation to reach the highest levels we’d seen in more than 40 years.

The Fed took action, raising rates at the fastest clip since the 1980s, and markets reacted…temperamentally. The first three quarters of 2022 were a near constant downslide, with stocks of the largest companies in the US taking the hardest hit and dragging the rest of the world’s markets down with them. Meanwhile, our Clients’ portfolios benefitted from an allocation that tilts in favor of value stocks, which tend to perform better when interest rates are rising (as they were for most of 2022 and into 2023).

What We Wrote:

- The Good, The Bad, and The Ugly (published a day before markets bottomed out in 2022)

- Picture(s) Worth 1,000(ish) Words

- A Recession Is Coming (Right?)

- Musings of a Money Mad Man – Yeske Buie v. American Stocks

- 2023 – A Year of Ups and Downs (and Ups!)

- Portfolio Review, Part Deux: On Bonds

If you’ve made it this far, we thank you for taking this walk with us, and we hope it did for you what a walk outside can sometimes do for your outlook: provide some refreshing perspective and a respite from the daily news cycle. We also hope that if you take nothing else from this article that you at least remember this: every time it has seemed like the world is coming to an end, it has not. And until it does, we’ll charge forward, grounded and resilient as ever.

And if you’re still needing another reason to be optimistic about what this world can offer, we invite you to take in one of our favorite videos – a classic that only gets better with time: the world’s most beautiful flash mob.

The Yeske Buie Team